Transactions without intermediaries supported by smart and transparent contracts, passive earning possibilities, and a wide range of financial inclusion possibilities are some of the many functionalities offered by DeFi apps. In this article, we will review the 10 best DeFi apps to consider in 2025, and why you should consider them within your investment portfolio.

Your capital is at risk.

There are several DeFi platforms to choose from. Each one has different lending and investment facilities. Read through each review below before deciding which option to invest in 2025.

There are a number of crypto trading apps out there but none quite like Dash2Trade. Dash2Trade is an exciting project that was launched in 2022. The project is a crypto trading and analytics platform that aims to provide users with everything that they need to make informed trading decisions.

Dash2Trade offers everything under one roof including trading signals, social trading, analytics, coin listings and educational resources. The platform will also offer exclusive trading competitions through which users can win rewards and earn income from the platform.

The main aim of the Dash2Trade project is to provide real value to users by helping the navigate the ever-changing market and invest with confidence. The platform is supported by the native D2T token, which will provide liquidity to the project and offer users a reward that holds real world value.

D2T has a limited supply of 1 billion and is currently available to purchase on major exchanges such as Gate.io, BitMart, LBank, and Changelly. D2T is used by users to pay for platform subscriptions, unlock advanced trading features and participate in competitions.

Those who receive rewards in D2T will be able to exchange the tokens for other cryptos or hold them as a long-term investment. The token is completely tax-free as the team behind the project believe that value should come from the project and not from users trading the token.

Your capital is at risk.

Impt.io is a brand new DeFi project that will launched in 2023. The project aims to resolve problems that exist in the current carbon credit industry by using blockchain technology to execute carbon credit transactions. Blockchain technology is immutable which will reduce cases of carbon credit fraud and double spending.

As well as acting as an exchange for carbon credits, Impt.io is also a platform through which users can objectively track their sustainable choices and impact on the environment. The platform will reward users who make environmentally friendly choices with IMPT tokens and exclusive NFTs.

The IMPT token will support the entire ecosystem and will act as currency on the platform. The token can be used to purchase NFTs, unlock platform features and participate in the DAO.

Impt.io is set to revolutionize the carbon credit industry, making it one of the best investment apps for eco-conscious investors. The best way to invest in this exciting project is to purchase the token through a DEX or CEX trading app such as Uniswap and LBank.

Your capital is at risk.

In fact, you simply need to connect your favorite wallet to DeFi Swap, choose the tokens you would like to convert, and that’s it – DeFi Swap will do all the work on your behalf and instantly complete the conversion.

As it is backed by an immutable smart contract built on the Binance Smart Chain, the exchange will be able to do this autonomously. It is important to remember that DeFi Swap is not only a platform that allows you to exchange BSC tokens anonymously, but it also provides several ways for you to earn interest on your digital assets through yield farming.

The innovative taxation process of DEFC, DeFi Swap’s native token, also allows token holders to generate passive income streams. For example, when people buy or sell DEFC, a 10% fee is charged, half of which is distributed as a dividend to other holders.

You can access DeFi Swap’s online portal via your web browser, making it quick and easy to take advantage of this platform’s features. In addition, there are over 50 tokens supported by DeFi Swap, including DAI, USDC, USDT, and ANKR.

Your capital is at risk.

Lucky Block was launched in response to the need for users to take part in lotteries without having to leave their homes in many cases. The traditional lottery offices can be very far away or only open at unsuitable hours.

As a gaming platform on a mission to revolutionize the decentralized industry, Lucky Block’s goal is to create a more transparent and fair framework that will provide users with more opportunities to earn money through their online gaming activities.

Lucky Block allows users to participate in more draws, unlike the traditional system. As a way of giving back to its users, the platform offers free daily jackpot prize draws, which allow users to vote on which charities they would like to support financially and receive a stake in the prize regardless of whether they win the jackpot that day.

Your capital is at risk.

One of the best features of MetaMask is aggregating data from different sources, which ensures that when you make a token exchange, you are getting the best price and are not paying any network fees.

It is also possible to buy cryptocurrencies instantly from the wallet’s interface, with added support for the best altcoin apps blockchain like Ethereum, Polygon, BSC, Avalanche, Fantom, and Celo tokens. In addition, there are various options for funding your purchase, including credit cards, debit cards, bank transfers, and Apple Pay and Google Pay.

Furthermore, by not storing your payment information and relinquishing control over your crypto assets, MetaMask ensures that you remain anonymous throughout the process.

Your capital is at risk.

There are over 300 crypto assets supported by the Crypto.com DeFi wallet, including Bitcoin, Ethereum, BNB, Cosmos Atom, Polygon Matic, Doge, USDT, USDC, and many others.

There is also a dedicated NFTs screen in the DeFi Wallet where you can manage your precious pieces of artwork that are stored on the blockchain and send, receive and send them. You can organize all your NFTs on the NFT screen, which works like a gallery. When you visit the NFT section, you can view up to 20 of these NFTs as a slideshow.

Changing funds within the Crypto.com ecosystem is free of charge, but you need to be aware that all transactions take place on-chain. The cost of a single transaction may range from $5 to $50 if Ethereum, for example, is congested.

There might be a difference in transaction fees from one blockchain to another, so you might not know how much the transaction will cost until you make the transaction. However, you can track how much Ethereum fees are at any given time with the Crypto.com DeFi wallet. It is possible to choose times when the network is less congested to make transactions at a lower cost.

Your capital is at risk.

In order to provide a seamless and low-cost experience for its users, UniSwap has launched three versions of its DEX trading platform to streamline its user experience in a way that makes it one of the best DeFi apps available nowadays.

Over $2 billion worth of daily trades are conducted on UniSwap’s V3 platform daily, putting the company in the lead in the DEX market. In addition, substantial gains have also been recorded on the Ethereum-based protocol.

Your capital is at risk.

In 2020, Ave was introduced as a non-custodial liquidity protocol that revolutionized the notion of decentralized finance and took the blockchain industry by storm. The Aave platform allows users to borrow or lend currencies compatible with the ERC-20 protocol through a lending pool.

The users deposit their assets into liquidity pools and receive interest every year on their deposits by way of the liquidity pools. The protocol then lends out tokens from the pool while the pool pays interest on the tokens. This means that the participants in the ecosystem will not have to interact with any other third parties as they don’t need to. Furthermore, through Ethereum smart contracts, Aave creates a peer-to-peer system that enforces peer-to-peer transactions.

Your capital is at risk.

SushiSwap lets users buy and sell digital currency without involving a third-parties. However, SushiSwap also offers a wide range of services that align with the principles of decentralization and the goals of financial technology. Since SushiSwap has surged to success, the company currently has a market capitalization of $280 million due to its popularity.

You can earn a return on your cryptocurrency holdings by investing tokens in liquidity pools, staking, and even making loan agreements to generate a yield.

Additionally, SushiSwap expanded its business model by creating an NFT marketplace, combining the Metaverse as part of its business model. In addition to immersing buyers and sellers in one of the best NFT app trading experience, the SushiSwap network will also enable them to transact in a decentralized fashion through its marketplace, providing a chance for buyers and sellers to transact in a decentralized way.

Your capital is at risk.

Aside from being one of the best DeFi projects, the platform is known for its simplicity when it comes to its processes. Neither Nexo charges origination fees nor requires monthly payments for its credit lines. Loans from this provider are automatically approved.

In terms of loan percentages, Nexo offers a variety of terms and has a base interest rate of 6.9% as a starting point. In addition, over 40 different currencies are available for borrowing, so you will surely find something that suits your needs. Nexo’s minimum loan amount is $50, and its maximum loan amount is $2 million.

All interest will be paid in NEXO tokens and not the cryptocurrency borrowed, which is one of the key features of Nexo. You will have to pay exchange fees if you switch from NEXO to another cryptocurrency later. Unlike other lending platforms, the platform offers several levels of insurance to protect its customers’ funds.

Your capital is at risk.

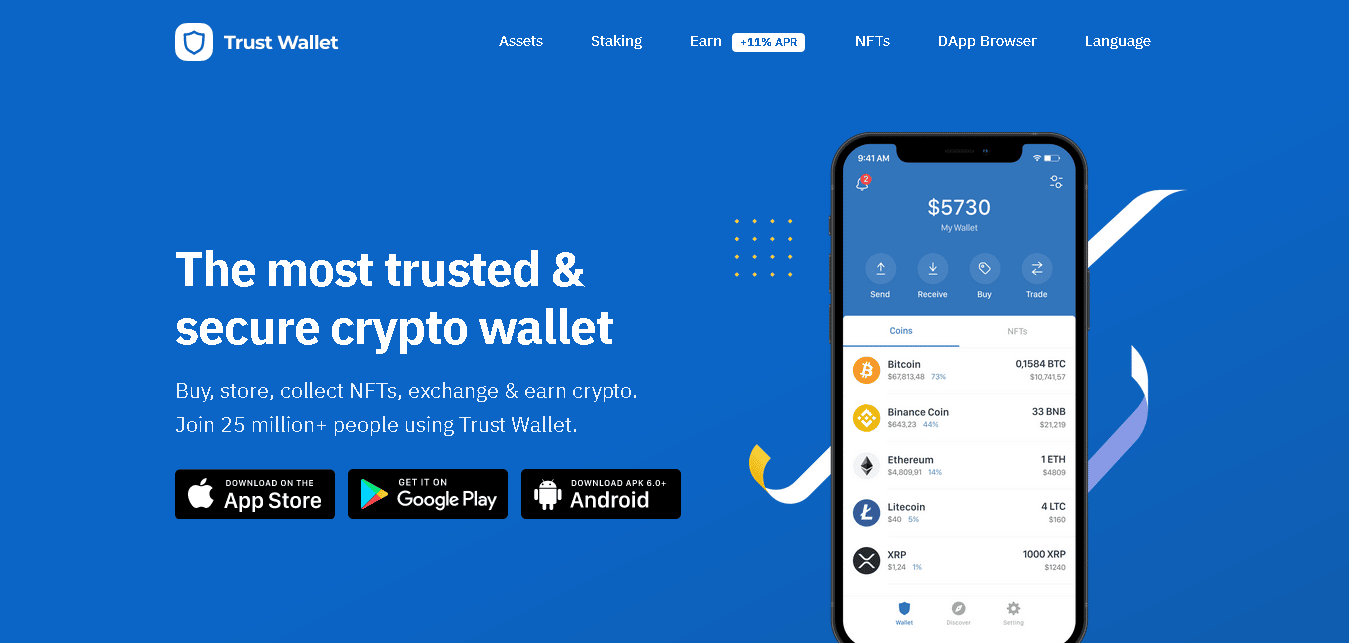

Even though Trust Wallet’s design is quite simple, it is a pioneer in decentralized finance technology, despite its apparent simplicity. More than a dozen coins can be staked through this wallet, and you can earn interest rates up to 11% APY on various coins.

Furthermore, the wallet has an integrated Web3 browser and a marketplace for decentralized applications (dApps), making it one of the best Bitcoin wallet apps in the industry. So you will be able to access your favorite crypto lending platform or decentralized exchange with ease.

Your capital is at risk.

As a result of its methodological approach, the user can save satisfactorily because they can keep their cryptocurrencies when there is a dip in the market and sell them when there is an increase.

In terms of interest rates on lending, Bitcoin and Ethereum lending rates amount to an APY of 4.8% and 5.5%. However, although the rates available elsewhere may be slightly higher, it is important to note that YouHodler accounts come without lock-up periods, allowing you to make the most of your money without worrying about it. Furthermore, this platform does not require you to stake any tokens to use it. YouHodler also offers an APY of 7% on Uniswap and 6.2% on Chainlink, as well as a 4.5% rate on Yearn.finance, among other noteworthy interest rates.

Your capital is at risk.

DeFi (Decentralized Finance) and CeFi (Centralized Finance) are two distinct approaches to financial systems in the cryptocurrency space. While both aim to promote the use of cryptocurrency, they differ in their underlying principles, structures, and features. Here is a comparison table highlighting key differences between DeFi and CeFi:

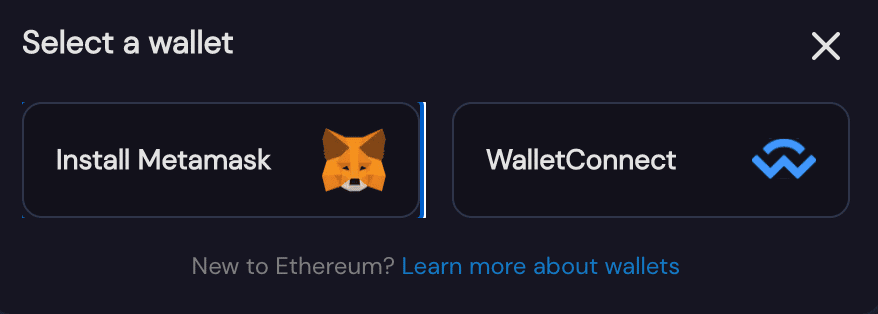

Getting started with DeFi Swap is as easy as clicking on Connect to a Wallet on the platform. However, if you use another wallet apart from MetaMask, you will need to click on ‘Wallet Connect’ and scan the QR code. This will enable you to connect your chosen wallet to DeFi Swap.

With DeFi Swap, you can use a wide variety of crypto wallets such as Tokenary, Infinity Wallet, Wallet 3, SecuX, Ambire, Keyring Pro, Ledger, and KryptoGO, among others.

The next step is to navigate the Farm page on DeFi Swap’s platform once you have purchased your DeFi Coin. Choose the amount of DeFi Coin you want to stake and the lock-in period that you would like.

It will be possible for you to choose from four different lock-up terms – 30, 90, 180, and 365 days.

The longer the lock-up period, the more interest you will earn. When the particular term you have chosen has come to a close, you can withdraw your initial investment into your wallet. Additionally, this is also true when it comes to the interest payments that you have generated.

As soon as you are ready, click on the ‘Stake’ button to stake your DeFi Coin.

Using a top-rated DeFi app such as DeFi Swap, which provides liquidity for traders on the platform, you can also make money by participating in liquidity pools and making money through those. As a result, you will be able to lend tokens.

As soon as you connect your wallet to the DeFI Swap website, you will be able to begin your yield farming journey instantly. Then, it is possible for you to access a wide range of yield farming pools thanks to its protocol residing on top of the Binance Smart Chain.

Consequently, you will obtain a share of any trading fees collected on the respective pair after selecting a pool and transferring your preferred number of tokens. This way, you can earn passive income, as you do not need to do anything after depositing your tokens.

The DeFi Swap decentralized exchange is powered by the underlying crypto token, DeFi Coin, which we discussed earlier in this guide. There are many benefits to using a DEX, such as instant decentralized token swaps and passive incoming possibilities.

If you are looking to buy DeFi Coin, one of the best crypto tokens to watch out for in 2025, then the best place to do so is via the DeFi Swap exchange by the first steps above.

Your capital is at risk.

DeFi apps enable you to access a whole range of decentralized finance services directly from the convenience of your smartphone or desktop. This benefit is that you can achieve all of your DeFi requirements wherever you may be. You can use the service if you have an internet connection.

Those apps are very diverse regarding their services, varying from one to another. For instance, you may be able to earn interest on the investments you make in a cryptocurrency as a result of investing in it.

Moreover, the top DeFi apps in the market provide exchange services. In other words, you don’t need a centralized platform to swap digital tokens.

Instant and decentralized swaps: Several top DeFi apps provide swapping tools. Simply put, one token can be swapped for another. So, you can swap tokens instantly without leaving your wallet interface.

Staking: In most cases, when staking, your tokens need to be locked away for a specified period to earn interest. Interest rates rise as the term lengthens.

Liquidity Pools: Liquidity pools can make money when you use a top-rated DeFi app. The idea is to lend tokens to a decentralized exchange that provides liquidity to traders. Upon collecting trading fees, you will receive a commission. Liquidity pools are usually not subject to lock-up requirements.

Wallet Storage: This feature will store your digital token investments securely. With DeFi apps, you don’t need a third party to hold your private keys; they are non-custodial. On the other hand, using a centralized exchange will protect your tokens since the platform will handle that for you.

Interest Accounts: DeFi apps with the best features will also offer interest accounts. Unlike other accounts in the industry, these have no lock-up terms or caps.

If you prefer not to deal with traditional financial institutions, a DeFi platform can provide several benefits.

Firstly, direct transactions are enabled by DeFi between any two parties. Since there is no intermediary, transaction fees are greatly reduced, and interest rates can be negotiated directly between the parties. As a result, traditional financial institutions typically charge much lower interest rates than DeFi networks.

Anyone can review smart contracts and completed transactions published on a blockchain. Immutability is the key characteristic of blockchains. Featuring the transparency and security of blockchain technology, DeFi’s platform users can execute smart contracts while maintaining their privacy. The publicly available transaction data do not reveal your real-life identity.

Moreover, the best DeFi apps are accessible to anyone with an internet connection, allowing them to open bank accounts or receive loans. DeFi transactions can occur without regard to geography due to its high level of accessibility.

The DeFi Coin (DEFC) is the underlying token that powers the DeFi Swap exchange– which we are convinced has the best DeFi app in this industry and has proven to be the most outstanding platform. The fact that DeFi Coin becomes a part of your portfolio means that you will indirectly be investing in the future success of DeFi Swap.

DeFi Coin, however, is not only designed to allow you to earn above-average capital gains but also to allow you to earn interest passively while you target above-average capital gains.

The fact that the project rewards long-term investors is among the many reasons why DEFC is the most suitable DeFi coin and the best crypto to buy. This is because there is a 10% tax on every order for either a purchase or a sale. Therefore, as long as you remain a DeFi Coin holder, you will be entitled to receive a share of the tax. In addition, as you accumulate more DEFC tokens, you will receive a greater share of the proceeds.

In summary, the most competitive DeFi apps allow you to generate interest on idle tokens and even borrow funds with the help of instant loans available to you. Moreover, you can also exchange crypto assets in a decentralized manner and provide liquidity to earn a good return on investment.

So consider DeFi Swap if you’re looking for the best DeFi app for 2025, and get started immediately. This platform offers many attractive high interests and instant swap options.

Your capital is at risk.

They are cryptocurrencies involved in decentralized finance. By doing so, they are able to offer traditional financial services, such as loans and interest-bearing accounts, using their respective platforms without the need for a third party to participate in the process.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025