Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined…

Decentralized crypto wallets help you retain full control over your assets, as they allow you to own your private keys, eliminating third-party risk. On the other hand, centralized platforms, like exchanges, manage your private keys, which makes your funds more vulnerable to hacks, freezes, or regulatory seizures.

For that reason, choosing the right decentralized wallet is critical. Security, multi-chain support, gas fee controls, and dApp compatibility vary across wallets. And a poor choice can lead to lost funds, high fees, or limited functionality.

Finding the best decentralized wallets may be challenging since many providers claim top-tier security and features but lack audits, true self-custody, or cross-chain support. So, we tested and analyzed over 40 providers to find decentralized wallets that cover all the above criteria. Best Wallet and Zengo topped our list for their privacy-focused features and user-friendliness. Here’s how other wallet providers ranked and what makes them stand out from the competition:

Best Wallet

Overall Best Crypto Wallet

Overall Best Crypto Wallet

Zengo

Safe Wallet with Staking and dApps

Safe Wallet with Staking and dApps

Cypherock X1

Best For Seedless, Hardware-Based Storage

Best For Seedless, Hardware-Based Storage

Ellipal Titan

Cold Wallet with Most Tokens Supported

Cold Wallet with Most Tokens Supported

Ledger

Best Hardware Wallet for Security

Best Hardware Wallet for Security

Here’s an overview of the best decentralized crypto wallets in 2025:

We tested over 40 decentralized crypto wallets to find those that meet our strict criteria, which include security measures, supported assets and networks, ease of use and user experience, backup and recovery options, and smart contract and DeFi integration.

After a deep analysis, we shortlisted the 13 best decentralized crypto wallets for 2025 that stand out for their security, usability, and functionality. In this section, we’ll review each wallet to help you find the one that best suits your needs:

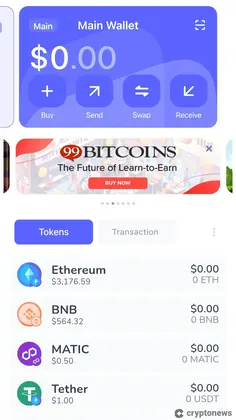

Best Wallet is a non-custodial, multi-chain decentralized crypto wallet that prioritizes anonymity and security. It supports 1,000+ tokens, including Bitcoin and all ERC-20 tokens, and 60+ chains, allowing you to buy, sell, stake, and swap assets within a single app. With no KYC or ID verification, it provides complete financial privacy.

The wallet integrates DEX trading, staking, and portfolio management. However, what makes it stand out from the competition is its native token, $BEST. $BEST holders gain early access to new projects, pay lower transaction fees, and earn higher staking rewards. We also appreciate its support for biometric authentication and encrypted key storage, which further enhances its security.

Why is Best Wallet the best decentralized wallet in 2025?

We rank Best Wallet as the top decentralized wallet of 2025 due to its privacy-first approach, multi-chain functionality, and built-in DEX. It’s an all-in-one crypto solution for traders, stakers, and DeFi users who value control over their assets.

Key Features

Pros

Cons

Zengo is a non-custodial, MPC-based crypto wallet that eliminates seed phrase vulnerabilities. It supports 320+ assets, including Bitcoin, Ethereum, and stablecoins, and 12 blockchains while offering three-factor authentication (3FA) and biometric security. You can buy, sell, and swap assets directly within the app.

Unlike traditional wallets, you can’t extract private keys, which Zengo claims reduces hacking risks. While it lacks DeFi and dApp integration, WalletConnect support enables external Web3 access. However, we should note that it lacks support for some major assets like Ripple and native Solana.

Why is Zengo the best for backup and recovery options?

Zengo earned its spot due to its recovery kit, which allows you to recover your wallet even if you delete the app. The recovery kit consists of two mandatory authentication factors – email authentication and a recovery file stored in one of your cloud backup locations. You can also use the 3D FaceLock option to protect your account further. Keep in mind that you need to create a recovery kit before making a deposit.

Key Features

Pros

Cons

Cypherock X1 is a decentralized hardware wallet that eliminates seed phrase vulnerabilities by splitting private keys across four encrypted NFC-enabled cards and the main device. Using Shamir’s Secret Sharing, it enhances security by ensuring there’s no single point of failure while maintaining full user control.

Unlike traditional wallets, Cypherock decentralizes key storage, reducing the risks of physical theft or hacks. However, its plastic build felt less premium during our tests, and its companion software, cySync, could benefit from more features like built-in swaps.

Why is Cypherock the best for multi-wallet management?

Cypherock X1 allows you to securely manage up to four wallets with separate private keys. Its multi-wallet setup, combined with Shamir backup, ensures seamless portfolio segregation without compromising security.

Key Features

Pros

Cons

The Ellipal Titan 2.0 is a fully air-gapped hardware wallet, keeping your private keys completely offline. It supports 50+ blockchains and 10,000+ assets, including Bitcoin, Ethereum, and Solana. Its 4-inch touchscreen and aluminum alloy body provide durability and ease of use, while QR code transactions ensure complete network isolation.

We tested both the Ellipal Titan and the Ellipal Titan 2.0 models. What we liked about the Titan 2.0 model is its auto shut-down feature that saves battery and its HD IPS display that offers better color consistency and sharpness than Ellipal Titan’s LCD display. However, we weren’t thrilled by its lack of multi-sig support, Xpub access, and full-node compatibility. Unlike Ledger or Trezor, Ellipal Titan 2.0 relies on a mobile app rather than a desktop interface.

Why is Ellipal Titan 2.0 the best air-gapped wallet?

The Ellipal Titan 2.0 is the best air-gapped wallet because it remains completely offline, eliminating risks from WiFi, Bluetooth, or USB-based attacks. It only communicates via QR codes, which keeps your private keys 100% offline. Its CC EAL5+ Secure Element chip and offline firmware updates make the Ellipal Titan 2.0 one of the most secure hardware wallets available.

Key Features

Pros

Cons

Ledger offers hardware wallets that store private keys offline, protecting against online threats. Models include the Nano S Plus ($79), Nano X ($149), Flex ($249), and Stax ($399), each with varying security, screen size, and connectivity features. The Ledger Live app enables portfolio management, staking, and secure transactions.

Ledger wallets support 5,500+ cryptocurrencies but require manual app installations for different assets. But while we liked its Bluetooth connectivity (Nano X, Flex, Stax), which enhances usability, the high costs and complex setup may deter beginners. In addition, Ledger Recover ($9.99 a month, optional) has raised concerns over privacy and security.

Why is Ledger the best for long-term storage?

Ledger is ideal for long-term storage because it offers cold storage, a Secure Element chip, PIN protection, and recovery options. Its offline security ensures resistance to phishing, malware, and exchange failures. In addition, its frequent firmware updates make it a future-proof solution.

Key Features

Pros

Cons

The Trezor Safe 5 is a hardware wallet designed for maximum security and ease of use. It features an EAL 6+ Secure Element chip, a 1.54-inch color touchscreen, and haptic feedback for intuitive navigation. This means you’ll feel subtle vibrations when you approve or reject transactions or enter your PIN codes. We also liked its scratch-resistant Gorilla® Glass 3 screen, which highlights its robust construction.

The Trezor Safe 5 supports 1,000+ cryptocurrencies, and you can integrate it with Trezor Suite to manage your transactions. Its $169 price tag makes it a premium option for both novice and advanced crypto traders. Unlike Ledger, it lacks Bluetooth connectivity but compensates with Shamir Backup, an advanced wallet recovery system. However, it doesn’t support air-gapped transactions like the Ellipal Titan 2.0.

Why is Trezor Safe 5 the best open-source wallet?

As an open-source wallet, the Trezor Safe 5 offers unmatched transparency. The community can audit, improve, and verify its security features, ensuring constant updates and protection. Unlike closed-source competitors like Ledger, Trezor’s code is fully accessible, reducing the risk of hidden vulnerabilities.

Key Features

Pros

Cons

The Blockstream Jade is a Bitcoin-only hardware wallet that also supports the Liquid Network for L-BTC and Liquid assets. It offers air-gapped security, QR code transactions, and multi-sig support, making it ideal for self-custody. Unlike traditional wallets, Jade uses server-enforced PIN protection instead of a Secure Element chip. This means that your recovery phrase will be directly encrypted on your device and ensures that the wallet will remain fully open-source.

Jade’s open-source design allows for full transparency, but its lack of native iOS support and small screen may frustrate some users. Navigation relies on a scroll wheel and a single button, which isn’t as intuitive as touchscreens. Plus, it’s heavily focused on Bitcoin, so we don’t recommend it for altcoin holders. However, its affordability ($64.99) makes it an excellent entry-level cold wallet.

Why is Blockstream Jade the best for Bitcoin HODLers?

Jade is our top recommendation for BTC holders due to its air-gapped transactions, QR-based security, and multi-sig support, all of which make it one of the safest self-custody solutions. Its SeedQR and duress PIN features further enhance protection against physical theft or coercion.

Key Features

Pros

Cons

The Ngrave Zero is a premium hardware wallet designed for maximum security. It features an EAL7 certification, the highest security standard in the financial industry. With a completely air-gapped design, it operates without USB, WiFi, or Bluetooth, significantly reducing attack surfaces. Its 4-inch touchscreen and fingerprint scanner enhance usability while maintaining strict security protocols.

The Ngrave Zero supports 15 blockchains, including Bitcoin, Ethereum, and Solana, as well as all ERC-20 and ESDT tokens, plus NFTs on the Ethereum network. While great for security-focused users, those needing broader multi-chain support might prefer alternatives like Ledger Nano X or Trezor Safe 5. The Ngrave Graphene backup system, made of stainless steel, provides fire, water, and tamper resistance for your recovery key.

Why is Ngrave Zero the best for advanced security?

With EAL7 security, an air-gapped architecture, and tamper-proof hardware, Ngrave Zero is the best choice for advanced security. It eliminates risks from online connections, protects against physical attacks, and ensures your private keys remain completely offline, making it one of the most secure wallets available.

Key Features

Pros

Cons

The SecuX hardware wallet offers a secure, cross-platform solution for managing cryptocurrencies and NFTs. You can view and manage your NFTs directly from the wallet using its large touchscreen. It will also allow you to send, receive, and share NFTs and check their latest prices on popular DeFi marketplaces like Magic Eden and OpenSea. Plus, you can set any of your NFTs as your profile picture.

You can buy four SecuX wallet models – SecuX V20 & W20, SecuX W10, SecuX Nifty, and Shield BIO. SecuX Nifty is specially designed for NFT enthusiasts. You can connect it to the SecuX Wallet App, which is available for Android and iOS devices. All four wallets support 10,000+ crypto assets, 300+ chains, and NFTs on Ethereum. However, SecuX Nifty is the only wallet that supports NFTs on Polygon, BNB Smart Chain, and Solana.

Why is SecuX the best for NFT management?

SecuX Nifty is the first hardware wallet specifically designed for NFT collectors. It supports NFTs on Ethereum, Polygon, BNB Smart Chain, and Solana. The wallet comes with a 2.8-inch color touch screen, which will enable you to see your NFT collections in full, and a dynamic keyboard for entering your PIN. You’ll also be able to manage your NFTs through its mobile app, which features a personalized NFT gallery.

Key Features

Pros

Cons

SafePal S1 is a fully air-gapped hardware wallet designed for maximum security. It stores your private keys offline, eliminating exposure to online threats. We also loved its support for over 30,000 cryptocurrencies and the self-destruct mechanism that wipes data upon tampering, which provides a strong balance of security and usability.

While its EAL 5+ secure element ensures top-tier protection, the lack of Bluetooth, WiFi, or USB means all transactions rely on QR codes. Some users may find this inconvenient, and beginners might struggle with the setup process. However, its compact design and Binance-backed reliability make it a solid choice.

Why is SafePal S1 the best value-for-money wallet?

For just $49.99, SafePal S1 offers high-end security at a budget-friendly price. Unlike competitors like Ledger, which charges significantly more, it provides air-gapped security, multi-chain support, and DeFi/NFT integration at a fraction of the cost.

Key Features

Pros

Cons

Trust Wallet is a non-custodial software wallet that supports millions of crypto assets and NFTs across 100+ blockchains. Designed for convenience, it offers in-wallet staking, seamless token swaps, and direct crypto purchases. As a hot wallet, it connects to the internet, making it more accessible but less secure than hardware wallets.

Despite its user-friendly interface, we should note that its lack of two-factor authentication (2FA) is a potential security concern. Additionally, its vast support for assets includes some questionable crypto projects, requiring you to research before investing. However, Trust Wallet remains a strong choice for those seeking a multi-chain, all-in-one wallet.

Why is Trust Wallet the best for dApp browsing?

We rate Trust Wallet as one of the best wallets for dApp browsing thanks to its seamless integration with DeFi platforms, NFT marketplaces, and Web3 applications. Its built-in dApp browser enables you to explore decentralized finance, swap tokens, and access blockchain-based services without leaving the app.

Key Features

Pros

Cons

MetaMask is a non-custodial software wallet primarily designed for Ethereum (ETH) and ERC-20 tokens. It also supports networks like Binance Smart Chain and Polygon. Available as a browser extension and mobile app, it allows seamless interaction with dApps. You can swap tokens, manage multiple accounts, and connect to Web3 platforms easily.

However, we can’t recommend MetaMask to complete beginners. Setting up custom networks, managing gas fees, and handling private keys requires technical knowledge. The interface can be overwhelming, and errors like failed transactions or incorrect gas limits can result in frustrating user experiences and unnecessary costs. Security risks, such as phishing attacks, also demand extra caution.

Why is MetaMask the best for Ethereum and ERC-20 tokens?

MetaMask is one of the best Ethereum wallets due to its deep integration with Ethereum-based dApps, decentralized exchanges, and NFT marketplaces. It has customizable gas fees, multi-chain support, and compatibility with hardware wallets for added security.

Key Features

Pros

Cons

Phantom is a non-custodial software wallet designed primarily for Solana (SOL) and SPL tokens, with added support for Ethereum and Polygon. Available as a browser extension and mobile app, it provides a streamlined way to store, swap, and stake crypto while also offering NFT management and DeFi access.

As one of the best Solana wallets, Phantom is secure and easy to use. However, it only supports Solana staking, and we found the built-in swap feature’s 0.85% fee high, especially since it comes on top of the network fees. While security features like phishing protection and scam detection are strong, self-custody means lost seed phrases can’t be recovered.

Why is Phantom the best for Solana and SPL tokens?

Phantom is the best for Solana meme coins and other SPL tokens because of its seamless staking, fast transactions, and strong ecosystem integration. It offers swaps, built-in NFT tools, and scam protection, making it the go-to wallet for Solana users.

Key Features

Pros

Cons

Selecting the best decentralized wallets requires a rigorous evaluation of key factors that impact security, usability, and functionality. We prioritize security and private key control, ensuring you retain full custody of your assets.

We also assess multi-chain support, as broader compatibility enhances flexibility for trading, staking, and DeFi. Ease of use and UX play a crucial role, while backup and recovery options ensure funds aren’t lost. Finally, smart contracts and DeFi integration determine a wallet’s effectiveness in Web3 interactions. Here’s how we ranked them:

Security and private key control determine whether you truly own your crypto. A decentralized wallet should be non-custodial, meaning only you hold the private keys. If a wallet manages your keys (like centralized exchanges), you don’t truly own your assets — you trust a third party.

We assess security by checking open-source code, audit history, and encryption standards. Open-source wallets like MetaMask allow public scrutiny, audits from firms like CertiK boost trust, and strong encryption and seed phrase backups are critical.

Multi-signature support and hardware wallet integration reduce attack risks. If a wallet lacks these, it’s not truly secure. Never use wallets without a verified audit or recovery options.

A wallet’s supported cryptocurrencies and networks determine what assets you can store, trade, and interact with. A good decentralized wallet supports multiple blockchains, such as Ethereum (ERC-20), Bitcoin, Solana (SPL), and BSC (BEP-20).

To assess this, we check native asset support, custom token imports, and cross-chain functionality. For instance, MetaMask supports ERC-20 tokens but lacks Bitcoin, while Best Wallet supports multi-chain assets and various Web3 integrations.

Multi-chain support matters for DeFi, NFTs, and staking. If a wallet doesn’t support Layer 2 networks like Arbitrum and Optimism or custom RPCs, you’ll face higher fees and limited dApp access. A flexible, multi-network wallet ensures better usability and asset management.

Ease of use and UX impact how efficiently you manage crypto. A good wallet should be intuitive, responsive, and error-resistant. We evaluate UX by testing transaction flows, gas fee customization, and multi-platform syncing.

Gas control matters; some wallets let you adjust fees manually, while others offer fewer options. Poor fee settings can lead to failed or costly transactions. Multi-platform syncing ensures seamless access across devices — think browser extensions, desktop, and mobile apps.

A clunky UI or missing sync features make Web3 interactions frustrating. We look for clear signing prompts, minimal approval clicks, and smooth dApp connections. A wallet that confuses users increases risks — one wrong click can drain funds. Simplicity and control are essential.

Backup and recovery options ensure you don’t lose access to your crypto if your device is lost, stolen, or compromised. Without proper recovery, your funds are gone forever. We examine this by checking seed phrase security, encrypted backups, and alternative recovery methods. A strong wallet provides a 12-24 word seed phrase and local encrypted backups.

You should avoid wallets that store keys on centralized servers as they could expose you to hacks. Multi-device support also matters — Ledger Live syncs securely, while MetaMask requires manual imports, for example. Essentially, a good wallet lets you restore quickly and securely. If recovery is complex or poorly implemented, you risk losing everything.

Smart contract and DeFi integration determine how efficiently you interact with dApps, DEXs, and staking platforms. A wallet should enable secure, seamless Web3 connections without exposing private keys.

We analyze dApp compatibility, transaction previews, and contract risk analysis. If a wallet lacks multi-chain support or staking features, DeFi usability is limited. A good DeFi wallet ensures secure, efficient, and flexible Web3 interactions.

A decentralized wallet is a non-custodial wallet that enables you to manage your digital assets without relying on third parties. Decentralized wallets give you full control over your private keys, which means that only you will be able to access your funds

That’s in contrast to centralized wallets, which are often provided by cryptocurrency exchanges or brokers. Centralized wallets don’t provide you with your private keys, which means you need to trust the centralized provider to keep your funds safe.

Decentralized wallets give you full control of your crypto investments. Unlike centralized wallets, only you have access to your private keys.

Importantly, when setting up a decentralized wallet, private keys are usually provided in a simplified form. This is often a 12-word passphrase that needs to be entered in the correct order. Nonetheless, the decentralized wallet provider will never have access to the private keys.

This means users are responsible for safeguarding their wallets. If the wallet is compromised or the private keys are misplaced, the provider cannot help recover the funds.

The responsibility of ‘custodianship’ is how DeFi and centralized wallets are differentiated. Centralized wallet providers are tasked with keeping your cryptocurrencies safe. Conversely, DeFi wallets give you full control – meaning you’re responsible for looking after their private keys.

DeFi and centralized wallets both enable you to store your cryptocurrency. The key difference is who is responsible for safeguarding the wallet’s private keys.

In the case of centralized wallets, private keys are secured by the provider. This is often a crypto exchange or broker. As such, you don’t have access to your private keys. In turn, if the custodian is hacked or goes bankrupt (like FTX), your crypto funds are at risk.

Decentralized crypto wallets, on the other hand, give you full control of your funds and private keys. This means that there’s no reliance on a third-party custodian. You can send and receive funds at any time without needing approval from another person or entity.

However, there’s nowhere to turn if the decentralized wallet is hacked or you lose your private keys. Therefore, while DeFi wallets give you control of your wealth, you should take the appropriate security measures.

This means keeping the private keys offline at all times, preferably written down on a sheet of paper. In doing so, you can recover your wallet if you forget your password or the device is lost or stolen.

Some of the core benefits decentralized wallets offer include sole custody of the private keys, access to dApps, and faster transaction times.

Still not sure if a decentralized wallet is the best option? Here are some of the benefits of using a decentralized wallet for storing cryptocurrencies:

The main attraction of decentralized wallets is that you control your funds. That’s because only you can authorize outgoing transactions, and there’s no third party that could block them.

Moreover, entities — whether that’s the wallet provider or the government — cannot access your crypto funds. This allows you to store wealth outside of the conventional financial system. In other words, you don’t need to trust decentralized wallet providers as you do with centralized exchanges.

When using a centralized wallet, the number of supported tokens is often limited, as you can only store tokens that the exchange supports. In comparison, the best DeFi wallets support thousands, sometimes millions, of cryptocurrencies.

Take Trust Wallet as an example. It’s compatible with over 70 blockchain networks and 4.5 million cryptocurrencies and NFTs. This enables investors to store all of their digital assets in one safe place.

The best decentralized crypto wallets provide seamless access to Web 3.0 dApps. Some of the most commonly supported dApps include:

But there are hundreds more. Crucially, these dApps offer access to decentralized finance tools, such as token swaps, staking, yield farming, and dual investments.

Another popular feature of decentralized crypto wallets is anonymity. This means you can create a wallet without providing any personal information or contact details. All you need to access your wallet is the respective password or private keys.

Decentralized wallets use a non-custodial approach. This means that you’ll be in possession of your private keys and not third parties (like crypto exchanges) that are susceptible to hacking. However, decentralized wallets will always be at risk from remote hacking attempts and theft. As such, you must ensure that you follow sensible security practices to keep your crypto funds safe.

For example, those using a mobile wallet should ensure that PIN or biometric protection is enabled. This should be in addition to a smartphone’s lock screen password. If someone is able to bypass these security measures, they’ll have access to the wallet.

This is also the case for desktop and browser extension wallets. Another way for hackers to access a decentralized wallet is through links. For example, a scammer might impersonate the wallet’s support team and send a link for you to click.

Unwittingly, the link might install a virus or keylogger, enabling the scammer to access the wallet remotely. The safeguard here is to never click links from unknown sources, whether on social media or in emails.

The safest option is to keep the crypto wallet offline at all times. For example, consider installing the wallet on a cheap smartphone that you never connect to the internet.

Hardware wallets are more secure than software wallets because they store your private keys offline. However, this doesn’t make them impenetrable. For example, on Dec. 14, 2023, Ledger detected an exploit using the Ledger Connect Kit. Fortunately, this exploit was quickly spotted and resolved.

This is why you should always use reputable wallet providers that implement robust security measures, such as providing regular firmware updates and security audits. Moreover, you should never share your private keys or recovery phrases.

Ultimately, decentralized wallets are safe, but you must also take responsibility. You need to consider that increased convenience often leads to reduced security.

To properly store and protect your private keys, you need to create a seed phrase. This is a sequence of 12,18, or 24-phrase words, which, when entered in the correct order, give you access to the crypto wallet and all the tokens.

To ensure you don’t misplace your seed phrases, we recommend getting a seed phrase storage device such as Cryptotag. This device is made of aerospace-grade titanium and is water and heat-resistant. The Cryptotag device is compatible with Ledger, Trezor, MetaMask, and other popular crypto wallets.

Now that we’ve established the difference between centralized and DeFi wallets, we can explore the different types available.

Most crypto investors opt for a software-based decentralized wallet. Software wallets are often referred to as ‘hot storage’. This is because the funds remain online at all times, increasing both convenience and risk.

Software wallets come in many forms, but mobile apps are particularly popular. Decentralized wallets like Best Wallet and Trust Wallet both offer iOS and Android apps. This enables you to secure your crypto funds with a PIN or fingerprint ID.

Mobile wallets are very convenient for actively managing crypto portfolios. At the click of a button, you can send, receive, and trade crypto right from your smartphone.

Software wallets also come with browser extensions. For example, MetaMask offers an extension for Chrome, Edge, Brave, and Firefox browsers, so you can access the crypto markets whenever you’re on your PC.

Some decentralized wallets come as desktop software, but this is less common. One of the most popular desktop wallets is Ledger, which safely stores Bitcoin on Windows, Mac, and Linux.

Hardware wallets allow you to store your private keys on a physical device, which keeps them offline at all times. To transfer crypto to another wallet, you must enter a PIN on the hardware device, which offers an ultra-secure way to store large amounts of crypto.

However, hardware wallets are far from convenient for active crypto traders. That’s because making last-minute trades is cumbersome, considering access to the hardware device is needed.

The leading hardware wallet providers are Trezor and Ledger. Both are decentralized, as neither provider has access to the device’s private keys.

However, keep in mind that you’ll need to provide some personal and financial information when buying a hardware wallet online.

Before wrapping up this guide, let’s go over the steps to download and start using a decentralized crypto wallet. Our recommended choice is Best Wallet, a user-friendly, free mobile app available on iOS and Android.

Follow these simple steps to set up Best Wallet and begin managing your crypto today:

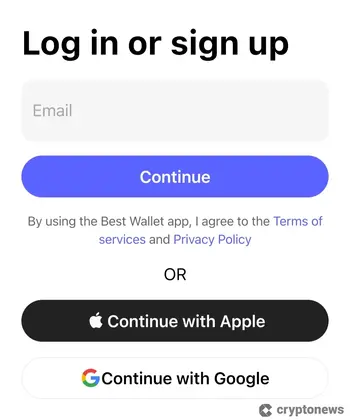

Head to the Google Play Store or Apple App Store, search for Best Wallet, and download the app. The installation is quick and completely free.

Open the app and enter a username and password to set up your account. This step is essential for securely accessing your wallet.

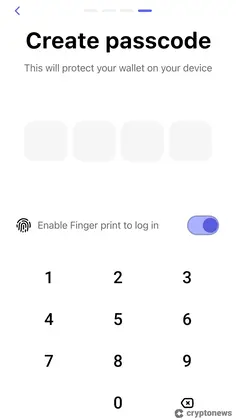

The app will prompt you to back up your mnemonic phrase (12 words). This phrase is crucial for restoring your account, so store it securely and never share it. It’ll also require you to select a passcode and set up 2FA and/or biometric authentication (fingerprint login) for added security.

Once set up, you can now send, receive, and manage your crypto assets directly from the Best Wallet app.

Choosing the right decentralized wallet is essential for maintaining full control over your crypto assets. Unlike centralized options, decentralized wallets give you sole ownership of your private keys, eliminating third-party risks like exchange hacks, regulatory seizures, and account freezes.

However, each wallet offers different security measures, blockchain support, and user experiences, making research crucial before selecting one. Security, backup options, and ease of use should be top priorities when selecting a wallet. Based on those factors, we recommend Best Wallet as the top decentralized wallet due to its non-custodial build, integrated DEX, and advanced security features.

However, regardless of the wallet you choose, you should always follow best security practices, including safely storing your seed phrase and avoiding phishing attacks. Crypto security is ultimately your responsibility when utilizing DeFi wallets — choosing a secure wallet is only the first step.

Decentralized wallets include Best Wallet, MetaMask, Trust Wallet, Phantom, Ledger, Trezor, SafePal, and Blockstream Jade. These wallets give you full control over private keys, eliminating third-party risks. They also support various blockchains, DeFi apps, and NFT storage.

The safest decentralized crypto wallet is Ngrave Zero due to its EAL7-certified security (highest in the industry), fully air-gapped design (no USB, WiFi, or Bluetooth), biometric authentication, and tamper-proof hardware. It ensures private keys never touch online devices, minimizing attack risks.

Coinbase Wallet is decentralized because it’s a non-custodial wallet, meaning you control your private keys. Unlike Coinbase Exchange, it doesn’t store funds or keys on centralized servers, giving users full control over their crypto assets and transactions.

Trust Wallet is decentralized, as it allows you to control your private keys. It doesn’t store user data or funds on its servers, allowing full self-custody and direct interaction with DeFi apps, DEXes, and multiple blockchains.

Decentralized wallets don’t charge platform fees, but you must pay network fees (gas fees) for transactions. These fees vary by blockchain (e.g., Ethereum gas fees). Some wallets add a small swap fee for token exchanges, but basic usage remains free.

Decentralized crypto wallets are highly secure if you follow best practices. They offer self-custody, private key control, and offline storage options in the case of hardware wallets. However, security depends on user precautions — weak passwords, phishing scams, and lost seed phrases can compromise funds.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

The information on this website is for educational purposes only, and investing carries risks. Always do your research before investing, and be prepared for potential losses.

18+ and Gambling: Online gambling rules vary by country; please follow them. This website provides entertainment content, and using it means you accept out terms. We may include partnership links, but they don’t affect our ratings or recommendations.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and are not intended for UK consumers.