Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined…

Ines is a Senior Web3 Writer at Cryptonews. She writes research-driven, value-packed guides and reviews covering cryptocurrencies, exchanges, and other Web3 topics. Ines is constantly on the lookout…

Crypto wallets with large balances of crypto tokens capture the attention of other traders. These “whale” wallets make waves as they come and go, often earning a healthy profit from their trades. A crypto whale tracker lets you follow the moves of these whales and analyze their holdings for possible opportunities.

In this guide, we review the top apps and tools to find the best crypto whale tracker. Each excels in its own way, making some a better fit than others depending on how you trade and which blockchains you use. Which crypto whale activity watcher fits your crypto trading strategy best? Let’s discover what’s out there and compare.

While the crypto whale definition varies by context, they have one thing in common: crypto whales can move markets, either collectively or individually. A crypto whale tracker is a tool to help you identify the movements of crypto whales and possibly plan trades around these whale movements. Crypto whale wallet trackers analyze publicly available blockchain data to make sense of the data, eliminating countless hours of error-prone manual tracking.

These tools come in different forms. Some provide simple alerts when larger amounts of crypto move from one wallet to another or to or from exchanges. Others provide detailed analyses of token holders, clusters (meaning a user’s crypto asset portfolio holdings may be split between several wallets), and the holdings of individual wallets.

We reviewed the best crypto whale trackers. Although features often overlap, each serves a niche.

We tested the best crypto whale trackers, finding some more powerful than others but each well-suited to a specific use case. Depending on your research needs, you may choose to use more than one. Many also offer basic or even full-featured functionality for free.

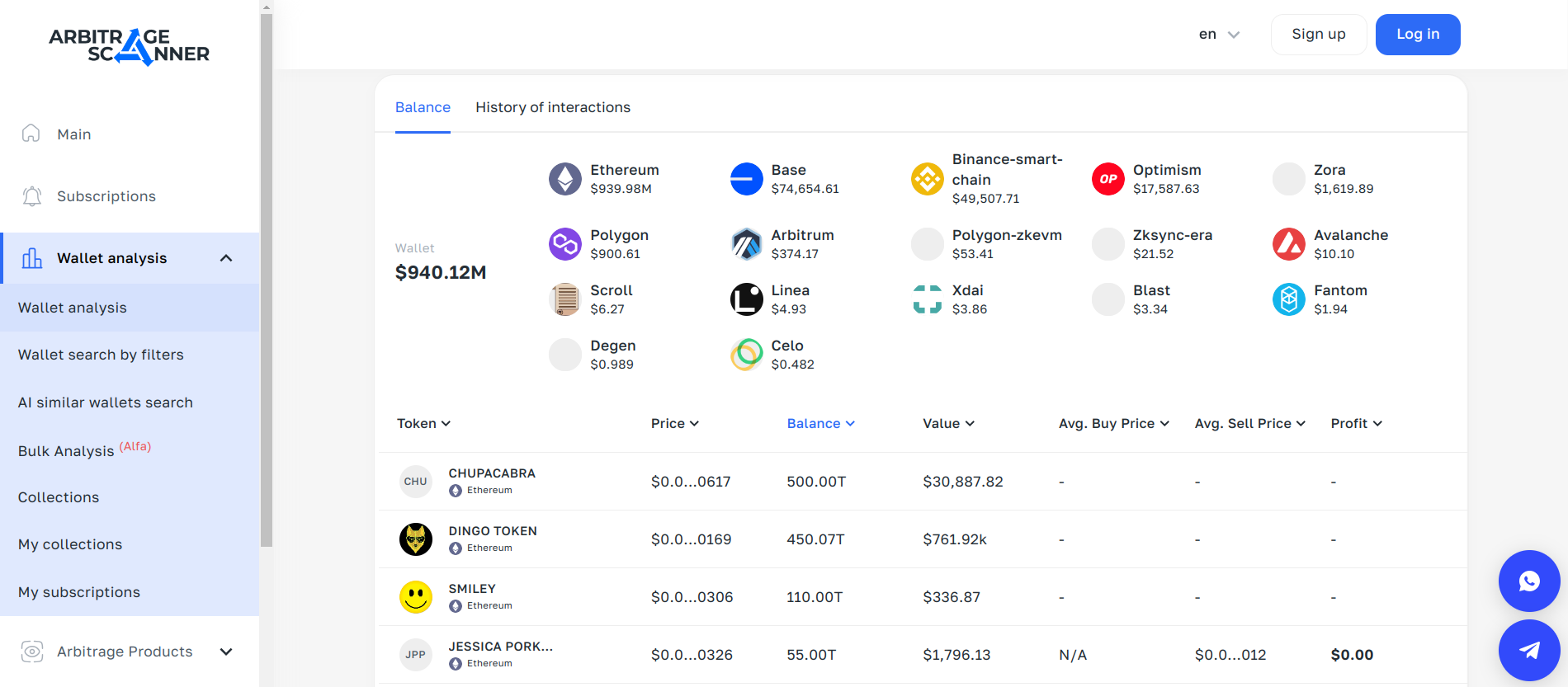

Although arbitrage opportunities are abundant in crypto, they can be challenging to find without tools and tricky to trade if you need to move funds before the window closes. As its name suggests, Arbitrage Scanner focuses on finding these market inefficiencies so you can move quickly.

However, the platform also provides robust wallet analysis. Check the holdings of any wallet on five EVM-compatible chains. Looking for similar investors or possible clusters? Arbitrage Scanner does the detective work for you, looking for similar traits or holdings so you can dig deeper. You can even estimate the P&L for holders of a specific token using filters.

More of a research tool than a screener for whale wallets, Arbitrage Scanner caters to a trading audience, offering plans based around access to exchange arbitrage tools. If you’re an active arbitrage trader who also needs research tools for specific wallets and tokens, Arbitrage Scanner offers the best of both worlds.

Paid plans start at $60 monthly, but you can get a 1 day free trial exclusively through Cryptonews. Arbitrage Scanner also offers a featureful Telegram application for active traders.

Start 1 Day Free Trial ![]()

Nansen has earned a reputation as the most comprehensive crypto whale tracker for Ethereum Virtual Machine (EVM) chains. However, the platform goes far beyond simple wallet tracking. Upon login, you’re greeted with Nansen Spotlight, featuring volume-based signals as well as an overview of top tokens by inflows. You already know where the smart money is placing bets without looking at a single wallet. As of this writing, Lido Staked ETH (stETH) is the leading asset for inflows on Ethereum.

Need the details on more tokens? Switch to the token tab to view inflows (bullish) and outflows (bearish) for the most popular tokens and many newer crypto assets. You can use crypto trading indicators to measure similar metrics and identify entry or exit points. Nansen highlights the assets to research first.

From NFT market analysis to in-depth portfolio analysis, Nansen lets you explore nearly every aspect of the crypto market. However, the platform is best known for its labels. Create watchlists and labels to make data easy to find and group helpful information in one place.

Although Nansen offers a scaled-down experience for free, a step-level plan at $99 monthly offers an affordable way for investors to zero in on the next opportunity based on whale activity and broad market data.

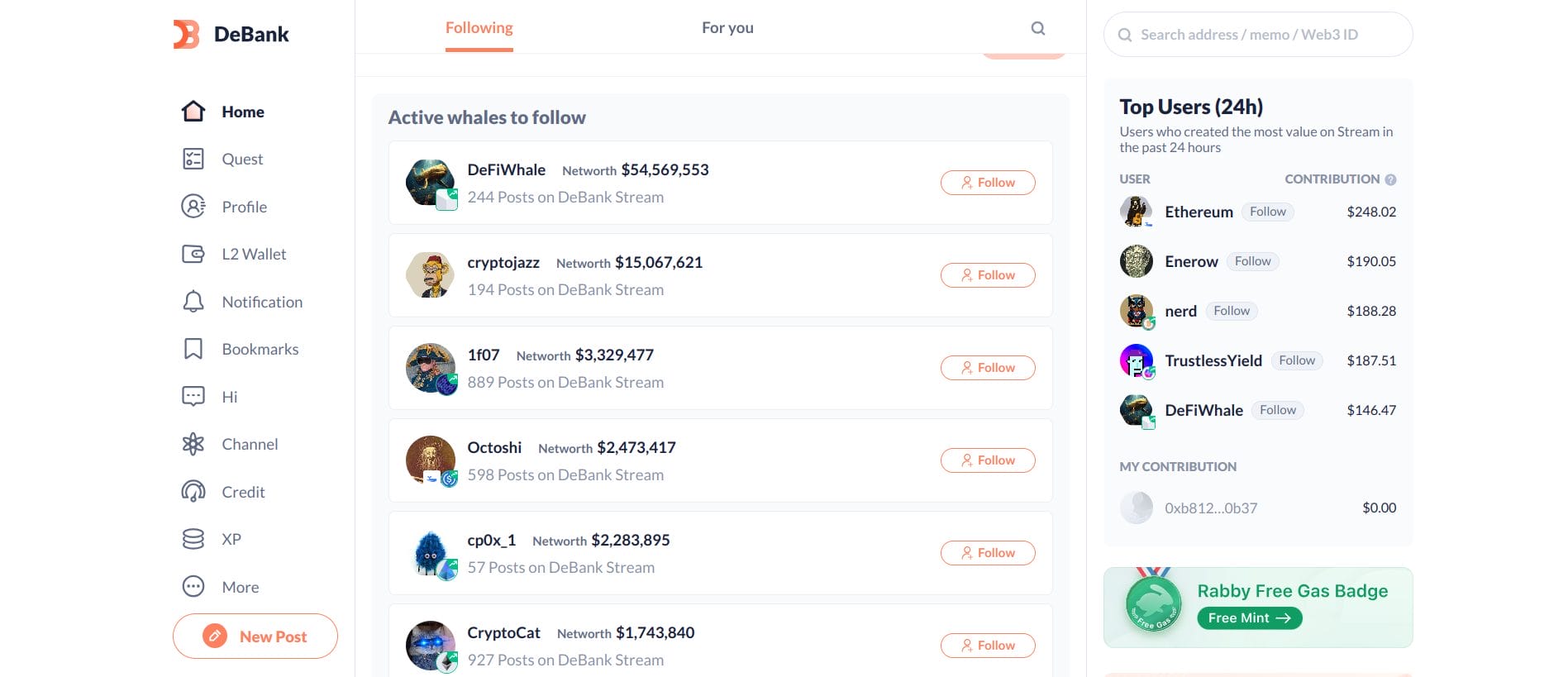

Traders worldwide use Debank as a personal portfolio tracker due to its wide support for EVM chains and fast addition of new tokens and protocols. Debank also makes the popular Rabby crypto wallet, a fast-growing alternative to MetaMask.

Debank’s real power lies in its ability to provide a detailed overview of any Ethereum-compatible crypto wallet address. Instantly see holdings, including funds invested in protocols, ranked by value. Tap a link to see additional wallets invested in the same asset or protocol. Identify the biggest crypto transactions and crypto whales instantly and track their transaction history in an easy-to-read format.

Many also enjoy the social feed on Debank. Follow the musings (and activity) of million-dollar-plus portfolio owners, with ownership verified by minting a Web3 ID NFT ($96). Stop guessing what whales will do next. Many on Debank will tell you and provide a detailed explanation for their decision.

Need a crypto whale tracker that’s free? Join the 2.4 million accounts that follow Whale Alert on X. Whale Alert highlights the big wallet movements in the crypto space. However, X posts may be delayed and could miss critical information you need to plan your trade.

If you need more data and you need it fast, consider a paid plan. For about $30 per month, you can get instant alerts using Whale Alert’s Websocket API. Trading desks, high-value traders, and developers may want to upgrade to higher plans that are well-suited to building automated trades and AI models.

Whale Alert covers more than ten chains and the hottest tokens, helping you filter the noise to focus on the real money flow.![]()

DexCheck unlocks valuable trading data for decentralized exchange (DEX) protocols like Uniswap. This powerful web app stands out in this roundup for its ability to show the biggest trades on DEX platforms in real-time. Discover the latest tokens and see buys and sells as they happen.

You can also view any wallet’s profit and loss, trading history, and win rate. However, real-time trades from the wallet’s activity analyzer require a Pro account. DexCheck supports two premium levels, which you can access by staking or burning DCK tokens. Staking locks the tokens in a smart contract, whereas burning sends them to an unrecoverable wallet address. Both methods reduce the supply available for trading.

DexCheck also offers a variety of Telegram bots, allowing you to act quickly on the information you gather from the app or track your own portfolio. The Wallet Tracker bot compliments the full-featured app, allowing you to track any wallet address on the go with instant alerts.

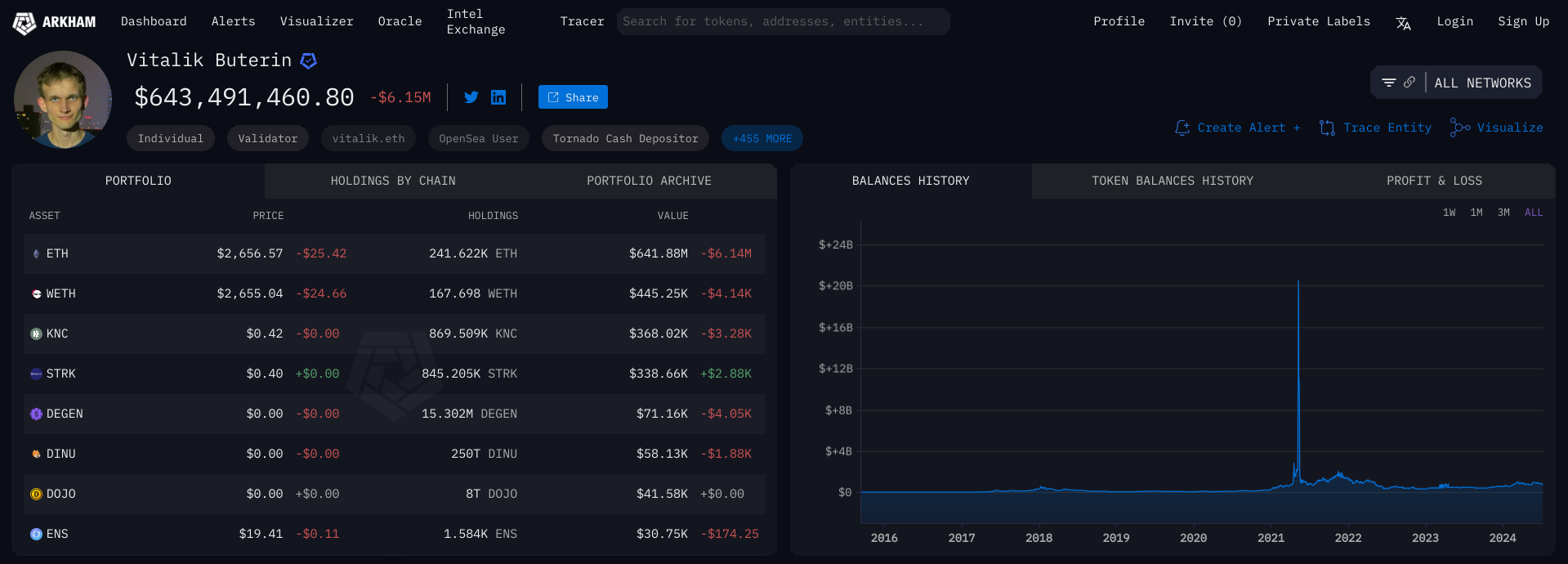

While pages can be a bit slow to load, Arkham Intelligence proves to be well worth the wait. View detailed holdings for any wallet address as well as centralized exchange deposits and withdrawals. Sort holding by chain and explore transaction history. As a caveat, many newer meme coins and newly launched tokens are not shown in balances, a common problem for crypto whale trackers.

Arkham Intelligence’s Dashboard provides a quick market overview and links to user-created dashboards featuring snapshots on chains, tokens, CeFi, DeFi, and more. Create your own to get the info you need at a glance.

Need the Alpha Intel? Arkham Intelligence offers a marketplace powered by the platform’s own ARKM token. The Intel Exchange offers an interesting way to fundraise, earn rewards, or buy intel on hackers, scammers, and more.

Alerts or free on Arkham Intelligence. Add a pre-made alert or customize your own to track market movements on any wallet or multiple wallets. You can also track trading firm movements or large ETH and BTC transactions.

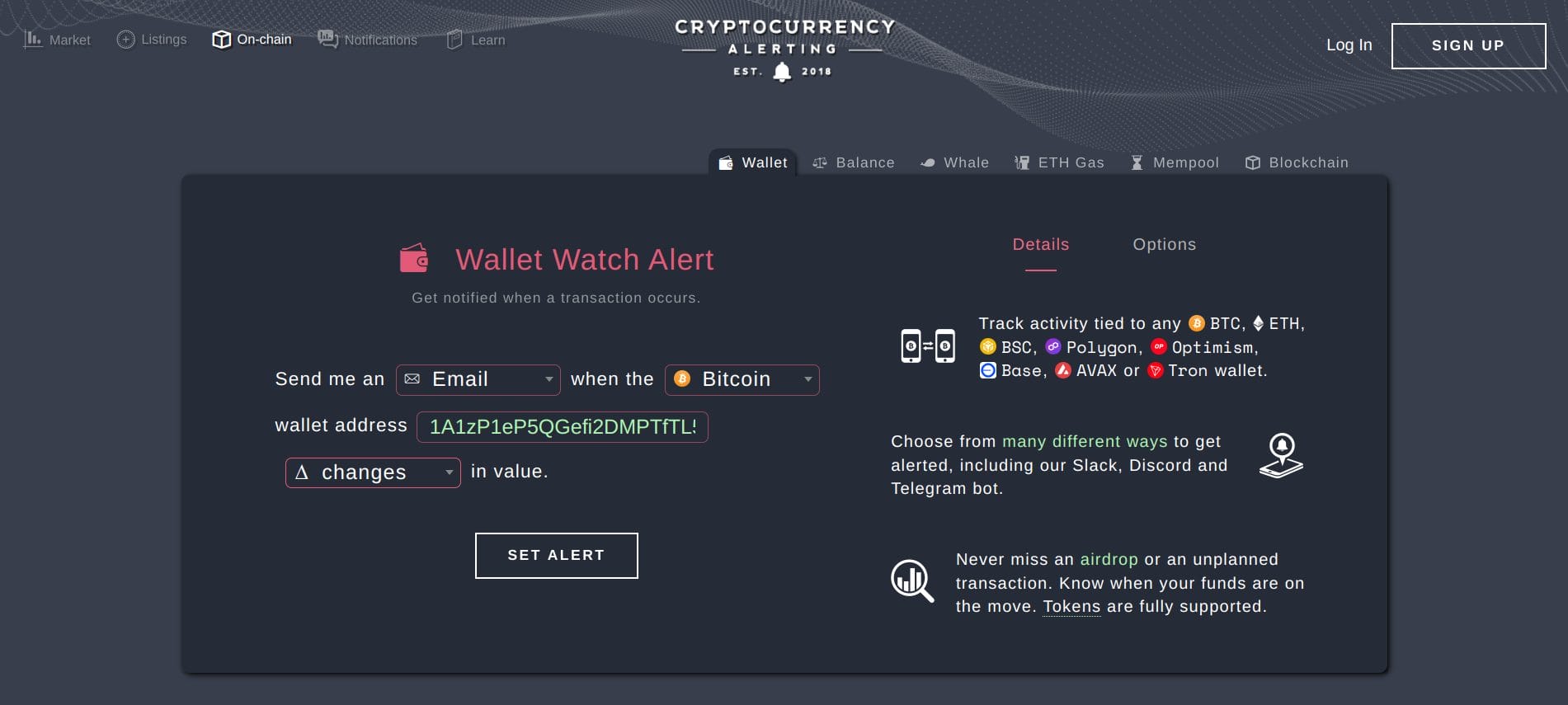

Crypto whale alerts are just a small part of what’s on tap with Cryptocurrency Alerting. What appears to be a simple app offers more functionality than first meets the eye. Whale alerts are in beta, and only two chains are supported (BSC and Ethereum). However, you can track individual wallets on eight networks, including Bitcoin, Ethereum, and Base.

However, active traders will appreciate additional features, such as new coin listings. Get an instant alert when a new coin or token launches on a specific exchange — or any exchange. Choose from SMS alerts, Telegram, Discord, and several other notifications. Cryptocurrency Alerting continuously scans 48 exchanges for new listings so you can take a position before the crowd arrives.

Cryptocurrency Alerting also offers funding rate alerts for perpetual futures traders, volume-based alerts, stock alerts, and more, making it one of the most complete market alerts available.

So, how do you track whales? The steps are often similar across platforms. First, you’ll need to identify a whale to track. Some platforms do this automatically, although sometimes with less useful information. For example, you might get a list of whale activities, big wallets and their large transactions. However, you’ll also want the ability to drill down into their other holdings to find potential opportunities.

Let’s look at the steps to track a whale using Arkham Intelligence. Visit Arkham Intelligence and open the app by tapping the Launch Platform button.

Let’s say we want to target ETH whales to start. ETH whales likely hold several other tokens and likely some NFTs as well. In this example, we’re interested in the other tokens to see if there are other opportunities.

Use the search bar to find ETH transactions. You can also use this search to find other tokens or wallet addresses.![]()

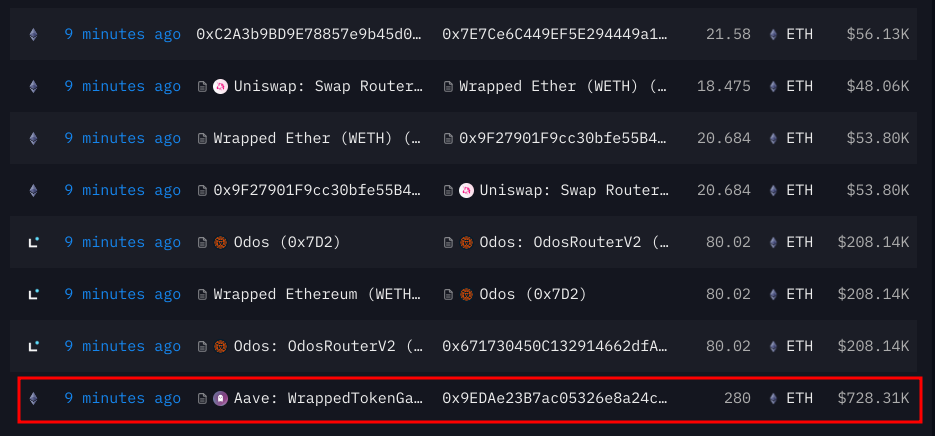

The initial list shows all recent transactions. We need large whale-worthy transactions.

Set the VALUE to 5 ETH or a similar high number to eliminate smaller transactions.

Examine the filtered list to find a likely whale. In the example below, we found a wallet that withdrew 280 ETH from Aave, a leading decentralized lending protocol.

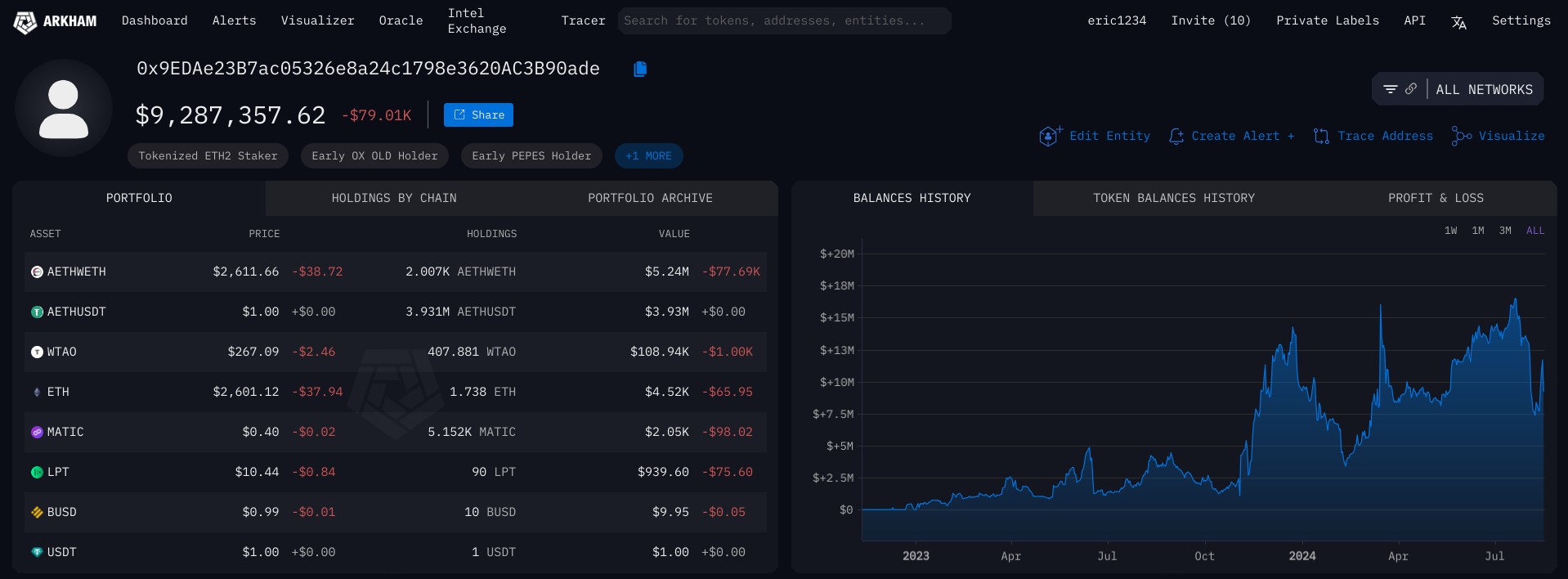

Open the link for the receiving wallet in a new tab.

In the new tab, we can see our crypto whale has more than $9 million in crypto in this wallet.

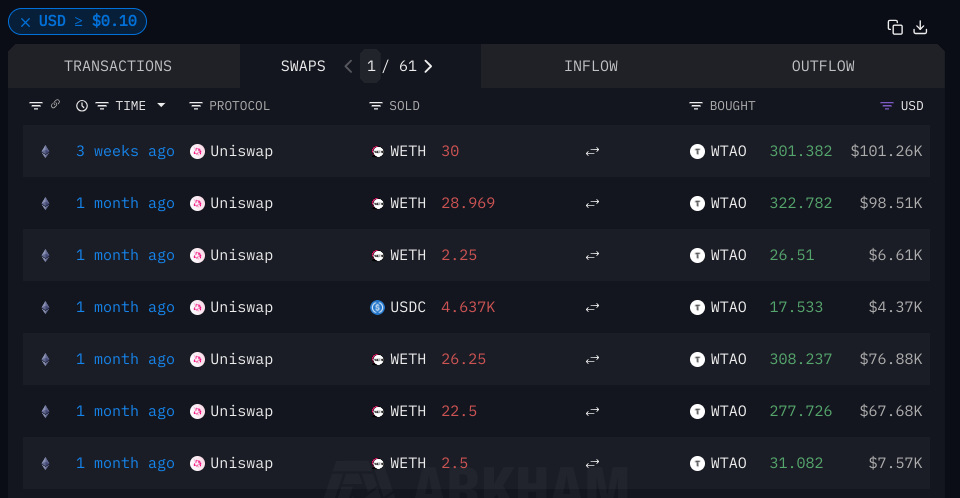

Further down, Arkham also lists recent transactions, with additional tabs to filter by swaps, inflows, and outflows. The last of these options may point to other wallets owned by the same whale. Swaps may uncover some leads on hot tokens. This wallet has been buying WTAO.

Arkham also offers a chart for WTAO, as well as a transaction list that you can filter for large transactions to identify additional whales. You can also “visualize” the token to find patterns and clusters, which may indicate multiple wallets owned by the same entity.

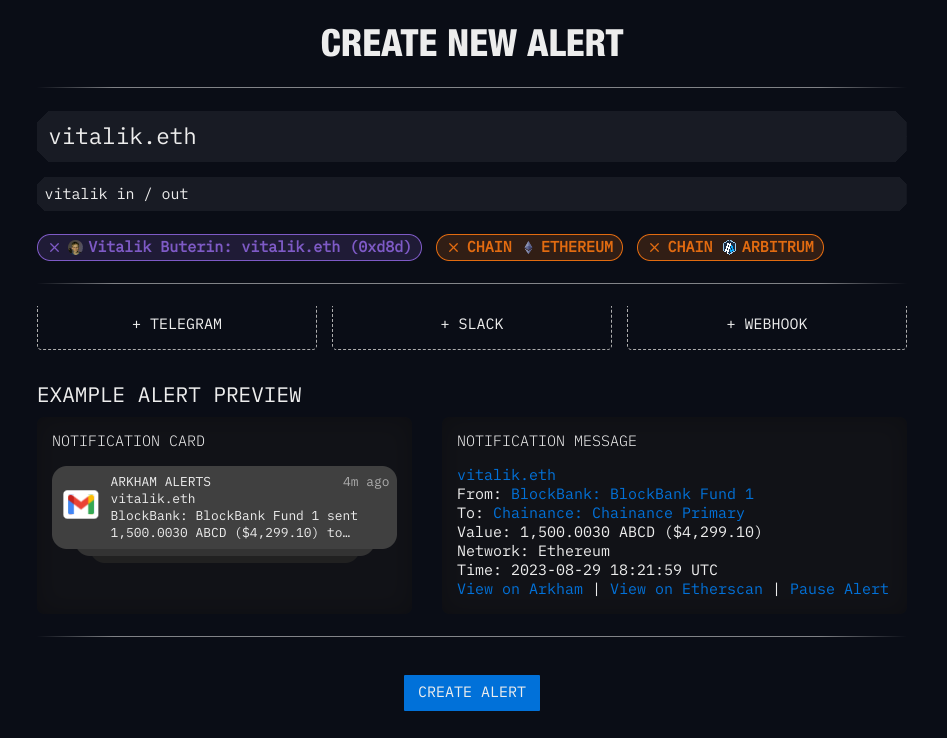

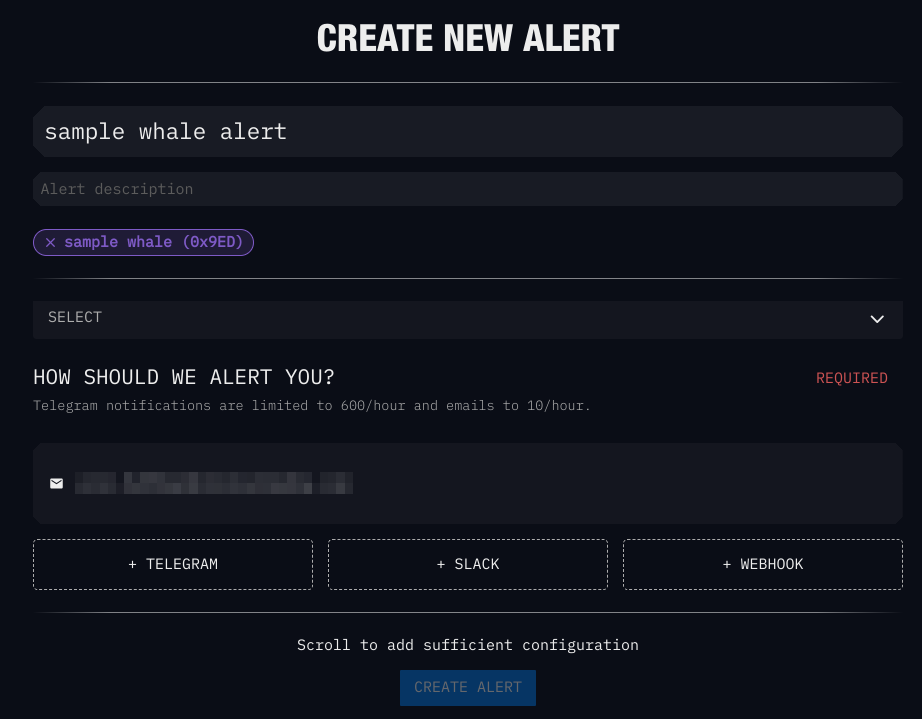

You may want to name the wallet. If so, tap on Edit Entity. Next, let’s set an alert.

Choose Create Alert near the top of the page. Because we started from a wallet overview page, the alert automatically defaults to just the target wallet.

Set your alert details. For example, you might want to limit your alert to large transactions or a specific token. When the criteria are met, you’ll get an alert. Arkham supports email, Slack, and Telegram notifications.

You’ve set your first alert. You can also add other alerts for additional wallets that look interesting. Have fun, but be careful. In a later section, we’ll discuss why you may not want to follow every whale you find.

A crypto whale tracker simplifies the process of tracking whales. Blockchain explorers contain all the same information but leave the detective work up to the user. For example, every Ethereum transaction is detailed on etherscan.io. Similarly, blockchain.com chronicles all the transactions on the Bitcoin blockchain. However, finding whale transactions using these tools can be challenging.

Crypto whale trackers analyze the data and create results you can filter according to your needs. Make data-based decisions rather than guessing. Get instant alerts based on your settings. With frequent use, you’ll also see patterns you can use in your future trades. Whale trackers offer a way to learn and hone your instincts in addition to providing actionable insights.

According to one oft-cited and sobering study, 97% of traders lose money. The study measured performance over 300 days of trading. This high failure rate number suggests a series of ill-chosen trades, perhaps worsened by unfortunate market timing. In simple terms, traders often guess rather than make trading decisions based on hard data.

Crypto whale tracker apps and in-depth market analysis tools remove the guesswork from decision-making. Instead, you can see where the money flow is moving and identify shifts in sentiment. Whale-watching can even help you find the next big thing much earlier, securing an entry before the broad market comes in droves.

The crypto market can change on a dime. Time is money in many trades, and real-time alerts can help ensure timely entries and exits that maximize gains and reduce risk. Nearly every whale watcher app provides whale alerts for crypto markets.

You don’t have to trade to learn from whale wallets. Consider setting up a spreadsheet to track “paper trades.” Use the whale wallets you identify to enter hypothetical trades on the spreadsheet and check your performance over time. This process lets you learn the easy way without losing money. Over time, you’ll discover which information is helpful and how to find it quickly.

We’ve all seen a dog chase a squirrel. The squirrel is usually a bit more agile and a few steps ahead, but what happens when the dog sees a second squirrel moving in another direction? Chances are good that all the squirrels will get away. Crypto whale trackers can provide too much information, not unlike having more than one squirrel to chase.

In addition to information overload, the data can sometimes be difficult to interpret, possibly leading to costly trading mistakes. In the worst-case scenario, whales may be setting a trap, knowing the transactions of larger wallets garner plenty of attention.

Successful scammers often have large crypto wallets. We once tracked $10 and $20 contributions to marketing wallets for small meme coin CTOs (community takeovers) to a whale wallet with over $170 million in assets that was receiving ETH all day long. This scam, and likely several others, was happening at an industrial scale. Should you follow this whale wallet? Probably not.

Scammers and groups that run honeypot scams also often have large wallets. A honeypot token uses code to whitelist specific wallet addresses and automatically blacklist others. Blacklisted wallets may not be able to sell the token. Following a whitelisted whale wallet into a honeypot means they can buy and sell while you can only buy. In the end, you’ll have worthless tokens after the whitelisted wallets drain all the value from the token (or the liquidity pool is pulled).

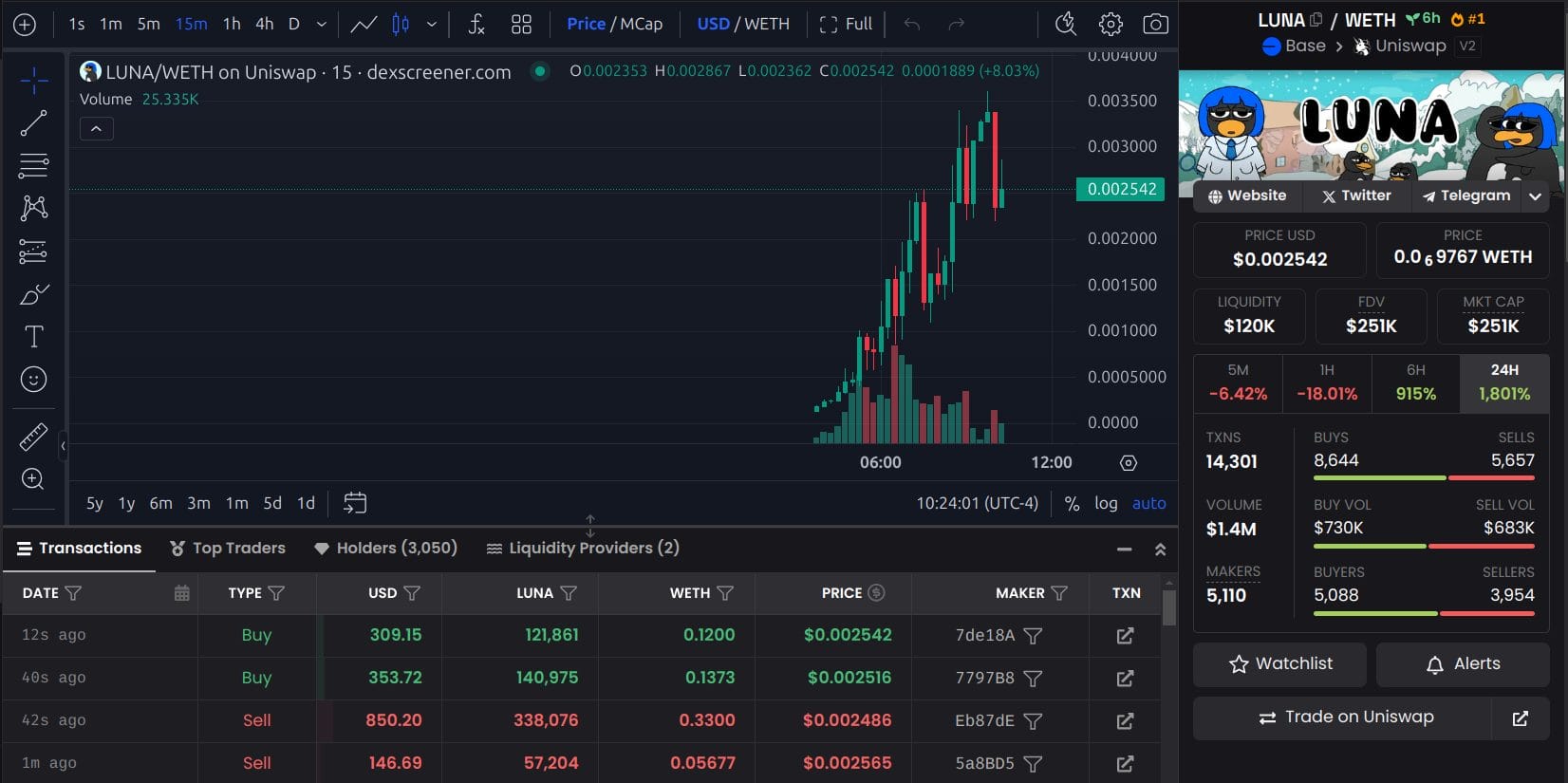

In the example below, currently trending at number one on Dexscreener, Honeypot.is flagged the token as a honeypot token. Buyers may not be able to sell. However, the whitelisted wallets or the wallets they ultimately send funds to are likely whale wallets.

Whales may also own additional wallets, masking how much of the supply they own. For example, if you follow a whale into a trade and they buy 0.5% of the supply, that may seem like a minimal risk if they sell. However, it’s possible that they have more than one wallet and hold a much more substantial position.

Spend some time learning the platform you choose. Many trackers offer granular detail with no explanation of what it all means. Experience will help, as will examining the profit an loss for target wallets. Is this wallet owner a trading genius, or do they just have a lot of money? It’s an important question to answer before you choose to follow their moves.

Movements from Wallet A to Wallet B might be meaningless. Learn how to filter the results to be more relevant to the way you trade. If needed, make some paper trades first to learn which data is useful before you commit real money to following whales.

Remember the dog chasing squirrels? That can easily happen with crypto whale trackers. We found ourselves with 20+ open tabs and pages of notes. You can’t catch all the squirrels. Find a a few to focus on first and examine their profit and loss to narrow the list.

Although crypto whale trackers come with some usability challenges, they also bring opportunities. You can use whale trackers to find new tokens before they reach the masses and discover new protocols before they reach wider adoption. Let’s look at some situations where whale alerts and trackers can be useful.

Crypto whale trackers offer powerful tools to help you stay ahead of the market. You can use alerts to get an early warning if whales are moving crypto to exchanges, signaling a potential selloff. You can also use trackers to find new tokens and protocols. However, you’ll want to exercise caution in using these tools because data can be overwhelming. In the worst-case scenario, the whales’ movements may even be bait for a trap. Invest some time in observing and making paper trades before you invest real money based on the movements of whale wallets. With time and experience, you’ll learn to filter the signal from the noise and start using these tools more effectively.

Visit Arbitrage Scanner

Arkham Intelligence offers the most tool in a free app. However, you can also consider free trackers like Debank, a platform that lets you examine holding and follow the social feed for whale wallet holders.

Crypto whale alerts are notifications that let you know when large transactions occur. For example, you can set an alert for Bitcoin transactions over $100,000 or customize an alert based on a specific token or wallet address.

Following whales can be profitable but you should research a wallet’s transaction history carefully before following their movements. Crypto whales aren’t always great traders and in some cases may be setting a trap.

Nansen.ai has earned a reputation for being the most advanced whale tracker and has become particularly popular for NFT traders. Other full featured trackers include Arkham Intelligence.

Yes. With free options like Arkham Intelligence and Debank available, you can experiment with crypto wallet trackers at no cost. If you need addtional features, paid option like Nansen.ai offer expanded functionality.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

The information on this website is for educational purposes only, and investing carries risks. Always do your research before investing, and be prepared for potential losses.

18+ and Gambling: Online gambling rules vary by country; please follow them. This website provides entertainment content, and using it means you accept out terms. We may include partnership links, but they don’t affect our ratings or recommendations.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and are not intended for UK consumers.