Close search

By Anthony Clarke

Last Updated: Apr 16, 2025

Co-author

By Shraddha

Looking for the best crypto exchange in Canada? Yeah… it’s kind of a jungle out there. Every platform’s shouting about being “the cheapest,” “the fastest,” or “the one with a gazillion coins,” but let’s be real, you’re not here for empty hype. You want one of the Canadian crypto exchanges that actually works for you. That means rock-solid security, smooth CAD deposits and withdrawals, and an interface that doesn’t make you feel like you need a PhD to place a trade.

Luckily, Canadian crypto exchanges are finally shedding that clunky, early-2010s feel and stepping into the modern fintech era.

Whether you’re just dipping your toes into crypto or you’ve been chart-watching since Bitcoin was $100, this guide’s here to cut through the noise. We’ll break down the best Canadian crypto exchange picks based on stuff that actually matters: fees, safety, ease of use, and available features. So whether you’re after the most secure crypto exchanges in Canada or trying to find the best Bitcoin exchange in Canada, we’ve done the digging so you don’t have to.

Here are our top picks for the best crypto exchanges in Canada, based on features and benefits for users:

In this guide, we’re diving into the top crypto exchange landscape from a Canadian perspective, no jargon, no fluff, just what you actually need to know. Whether you’re finally ready to grab your first slice of Bitcoin or you’re already juggling altcoin trades like it’s your side hustle, we’ve got you covered.

The best Canadian crypto exchanges are doing more than just listing coins; they’re building trust, reliability, and access for users at every level. However, Canadian crypto exchanges vary widely in terms of fees, features, and coin availability, so knowing your needs upfront is important

We’ll walk through each platform’s standout features, fee setups, and who they’re best suited for. Bitbuy has that hometown advantage with full regulatory backing. Kraken and Coinbase bring in the big guns when it comes to global access and trading firepower. Meanwhile, Shakepay and Best Wallet keep it casual for folks who want crypto without the complication.

No matter your skill level or goals, there’s an exchange here that’ll click with how you want to use crypto. Whether you’re buying your first satoshi or looking for advanced order books, Canadian crypto exchanges have platforms to match every style.

Canada’s crypto scene is maturing fast, and with more platforms than ever to choose from, finding the right one can feel like scrolling through Netflix with commitment issues. But don’t worry, we’ve done the homework so you don’t have to.

Whether you’re making your very first Bitcoin purchase or juggling multiple wallets like a pro, this lineup covers a bit of everything. From no-frills simplicity to feature-packed powerhouses, these are the 7 Canadian exchanges worth knowing about right now.

Let’s dig into the details and figure out which one actually fits your trading style.

Best Wallet is a non-custodial, mobile-first Web3 wallet built for people who want their crypto to work fast, privately, and without friction. It supports more than 60 blockchains, including Ethereum, BNB Chain, and Polygon.

And yes, it’s fully usable in Canada, so managing a multi-chain portfolio from one app is actually doable.

What makes it stand out? Everything’s where you’d expect it to be. You can swap tokens, check out dApps, and get alerts about airdrops without needing five different tabs open. For Canadian users, the ability to buy crypto in-app with Apple Pay, credit/debit cards, or local fiat rails is a nice touch, and it’s handled by providers like MoonPay and Banxa, so you’re not dealing with sketchy pop-ups.

With the rise of self-custody, even some Canadian crypto exchanges are adding web3 features to stay ahead of the curve. For example, Best Wallet has a built-in decentralized exchange (DEX) aggregator and its native $BEST token unlocks early access to the best crypto presales, lower fees, and voting rights.

As for security, your private keys don’t leave your phone. Additionally, it’s among the best non-KYC crypto exchanges, and you can lock things down further with Face ID or a passcode. It’s built to give you access without surrendering control, something most centralized platforms still haven’t figured out.

Pros:

Cons:

Best Wallet does a solid job of combining core crypto features without overcomplicating things. It’s not flashy, but it covers the essentials for users who care about privacy, control, and ease of use without needing to be glued to a desktop. Want the full scoop on this wallet? Head over to our Best Wallet Review.

Visit Best Wallet

Bitbuy is a Canadian cryptocurrency exchange that takes a no-nonsense approach to trading. It’s regulated, secure, and built with the kind of clarity most platforms could learn from.

It’s been around in some form since 2013 (originally called Instabit), got rebranded in 2016, and now runs out of Toronto with full regulatory backing from FINTRAC and the OSC. Translation: it’s one of the few crypto platforms in Canada that actually checks all the legal boxes.

Unlike offshore platforms, Canadian crypto exchanges must comply with FINTRAC and OSC rules, giving you an extra layer of trust. Luckily some Canadian crypto exchanges like Coinsquare are fully registered and audited, which is a big deal in a mostly unregulated market. You won’t find a massive list of obscure altcoins here, Bitbuy sticks to around 25 popular cryptocurrencies like Bitcoin, Ethereum, Solana, and Cardano. That might sound limited, but it’s kind of the point. The focus is on keeping things clean, safe, and straightforward. There’s Express Trade for people who just want to buy and go and Pro Trade for those who like candlestick charts and order books.

Depositing and withdrawing CAD is simple, fast, and familiar, Interac e-Transfers, wire transfers, you name it. Most deposits land within hours, and withdrawals don’t take long either. Bitbuy stores most of its user funds in cold storage runs third-party audits and claims 1:1 asset backing things you’d expect from a platform trying to keep trust front and center.

It’s not trying to be everything for everyone. Instead, Bitbuy has carved out a space for Canadian users who want something that just works, and is accountable.

Pros:

Cons:

Bitbuy sticks to the basics and does them well. If you’re in Canada and want a crypto platform that keeps things clear, regulated, and functional without unnecessary bells and whistles, it gets the job done. Canadian crypto exchanges are starting to nail that sweet spot between regulation and usability, something some global platforms still struggle with.

We’ve got a separate Bitbuy Review if you want a deeper look at its perks.

Kraken has been around since 2011, which in crypto years makes it basically ancient. But unlike many of its early peers, it didn’t crash, get hacked, or disappear with people’s funds. Instead, it quietly built a name for itself as one of the more stable and secure places to trade digital assets.

It supports over 200 cryptocurrencies, including major names like Bitcoin, Ethereum, Solana, Cardano, and Polkadot. You’ll find spot trading, margin trading, and staking built in, whether you’re a casual buyer or someone who stares at candlestick charts for fun.

For Canadians, Kraken fits nicely into the local scene. You can deposit CAD using Interac e-Transfer, wire transfer, or SWIFT, so you don’t have to deal with currency conversions just to get started. Withdrawals are pretty smooth too. Not all Canadian crypto exchanges are created equal; some are built for pro traders, while others cater to casual users who just want to buy Bitcoin.

The platform divides its tools into two lanes: a clean, simple interface for beginners and Kraken Pro for people who want depth, precision, and more control over their trades. If you’re into staking, payouts on select assets are twice a week, which is a nice touch. Regulation aside, what separates the top Canadian crypto exchanges is how well they handle security, support, and the overall user experience. Security-wise, Kraken tends to lead with its track record.

It’s one of the few exchanges that hasn’t been hacked. Most of its crypto is kept offline in cold storage, and it goes out of its way to show it actually has the assets it claims to. In a space full of smoke and mirrors, that counts for a lot.

Pros:

Cons:

Kraken isn’t trying to be flashy or cutting-edge for the sake of it. It does the core things right: security, variety, and serious tools for serious users. If you’re based in Canada and want a platform that’s more about stability than hype, Kraken’s worth checking out. Our full Kraken Review has everything you need to know.

Visit Kraken

Coinsquare has been doing the crypto thing in Canada since 2014, which means it’s seen some stuff. It’s one of the older names in the space, and unlike some exchanges that exploded onto the scene and flamed out, Coinsquare has kept things relatively stable.

It’s fully registered with CIRO (formerly IIROC), which gives it that regulatory stamp of approval that some users care about, especially when it comes to managing CAD.

It supports around 40 cryptocurrencies, think Bitcoin, Ethereum, Litecoin, and Avalanche. So no, you won’t find every meme coin under the sun, but it covers the big names and keeps things manageable. The platform also splits itself into three tiers: Quick Trade for the basics, Pro Trade for more control and live order books, and Wealth Services for the big spenders and institutions.

Most of the crypto is locked away in cold storage (95%, to be exact), and they claim full 1:1 asset backing. Fiat in and out is smooth, with Interac e-Transfer and wire support, which is convenient if you’re tired of jumping through hoops just to cash out.

One of the nice perks for Canadians is how it handles tax reporting. There’s no hunting through transaction histories—everything’s formatted to make filing a little less painful. According to the Canada Revenue Agency, “cryptoasset” is recognized in the Excise Tax Act.

“If any transactions occur on a crypto-asset exchange, you should keep exchange records including trade ledgers (buy, sell and swaps), transfer ledgers (deposit and withdrawals of crypto-assets and fiat) and records supporting any other types of transactions that took place on the exchange,” the Canadian government agency states.

Pros:

Cons:

While Coinsquare isn’t a global crypto giant, it’s leaning toward being a solid, Canada-focused exchange that sticks to the basics. If you’re looking for a no-frills platform that prioritizes security and regulation and you’re okay with a few limitations, it gets the job done.

Shakepay keeps things simple, maybe a little too simple for some, but that’s kind of the point. Based in Canada and around since 2015, it’s aimed squarely at people who want to dip their toes into crypto without dealing with dozens of coins, confusing interfaces, or fees that sneak up on you.

It’s registered with FINTRAC and follows Canadian rules, so you’re not using some sketchy offshore site to buy your Bitcoin. One of the advantages of using Canadian crypto exchanges is the peace of mind that comes with local compliance and legal accountability.

If you’re new to the space, Canadian crypto exchanges like Shakepay keep it simple by only offering major coins and zero trading fees. Also, most top-tier Canadian crypto exchanges are now mobile-friendly, so you can trade, stake, or withdraw CAD right from your phone.

The coin list is short: just Bitcoin (BTC) and Ethereum (ETH). If you’re looking to buy up-and-coming altcoins, this isn’t your spot. But if you’re just trying to stack sats or pick up a bit of ETH without overthinking it, Shakepay works. Deposits and withdrawals in CAD are fast—usually within minutes via Interac e-Transfer, and free.

Shakepay is also one of the few platforms that actually tries to make crypto fun. There’s a “shake your phone to earn Bitcoin” feature, daily rewards for using the app, and a cashback Visa card that gives you BTC when you spend your CAD. It’s not life-changing money, but hey, it adds up.

Security is solid: cold storage, insurance via third-party custodians, and multi-step approvals for moving funds. And while it doesn’t offer limit orders, charts, or advanced trading tools, that’s not really its crowd.

Pros:

Cons:

Shakepay isn’t trying to impress pro traders. It’s for Canadians who want an easy way to buy and hold Bitcoin or Ethereum, maybe earn a few satoshis while they’re at it, and not overthink it. If you’re okay with the limited coin selection and don’t need all the bells and whistles, it does the job just fine.

Coinbase is, without a doubt, now one of the most recognizable names in crypto, especially for people just getting started. Founded in June 2012, Coinbase is clean and heavily regulated, and it doesn’t try to overwhelm you with features out of the gate. Think of it as the training wheels of crypto, except they actually work.

Things have improved recently for Canadians. You can now use Interac e-Transfer to fund your account and cash out, which saves a lot of time and removes the need to mess around with wire transfers or jump through hoops with third-party platforms. It’s not groundbreaking, but it’s a big quality-of-life upgrade.

Coinbase supports over 250 coins, ranging from the usual suspects (Bitcoin and Ethereum) to lesser-known altcoins you might stumble across online. The main app is all about simplicity, tap to buy, tap to sell. But if you want more control, Coinbase Advanced lets you access live order books, charts, and slightly better fees.

Security is one of the things it’s known for. Most of your crypto sits in cold storage, two-factor authentication is standard, and it’s regulated in the U.S., which—like it or not—adds a level of accountability.

Pros:

Cons:

If you’re based in Canada and want a crypto platform that’s easy to understand, reasonably secure, and doesn’t throw 500 tokens and trading pairs at you on day one, Coinbase is a solid place to start. Just keep an eye on the fees and don’t expect high-level tools unless you go looking for them. You can check out our Coinbase Review for a full rundown of its features.

Visit Coinbase

Crypto.com feels like the Swiss Army knife of crypto platforms. It does a bit of everything. Trading, staking, payments, NFTs, DeFi, a Visa card, you name it. With over 400 cryptocurrencies available, it’s built to handle both casual buying and more involved crypto strategies, depending on how far down the rabbit hole you want to go.

For Canadians, the local perks are solid. You can fund your account with CAD via Interac e-Transfer (no hoops, no conversion fees), and their Visa card actually works in Canada. Spend your money and get cashback in CRO tokens, with extra perks like Netflix, Spotify, and even airport lounge access, if you stake enough CRO, that is.

The main app is surprisingly easy to use, considering its extensive offerings. It’s built more for everyday use than deep-dive technical analysis. If you want more control or non-custodial access, you can always hop over to their Exchange or DeFi Wallet for things like yield farming.

Security-wise, Crypto.com is serious. Most funds are held offline, they use multiple layers of protection, and they’ve got insurance coverage just in case. They’re also registered with FINTRAC in Canada, so the regulatory boxes are checked.

Pros:

Cons:

Crypto.com tries to cover all bases and mostly succeeds. If you’re in Canada and want a one-stop shop for trading, staking, and spending your crypto, it’s worth exploring. Just be ready to take your time getting familiar with everything it offers. For the nitty-gritty on Crypto.com’s wallet, swing by our Crypto.com DeFi Wallet Review.

Picking a crypto exchange isn’t just about who has the most coins or the flashiest app—it’s about finding something that actually works for your needs. So, instead of just listing the biggest names, we broke things down into categories that matter, especially if you’re living in Canada and want a platform that plays nice with CAD.

This approach gave us a clear way to compare apples to apples—so whether you’re here for long-term HODLing, day trading, or just collecting airdrops, you’ll find an exchange that matches your priorities.

The best Canadian crypto exchanges combine regulation, ease of use, and solid asset coverage. In addition, while international platforms often offer more coins, Canadian crypto exchanges give you local support and CAD-friendly funding.

Looking for the best Canadian crypto exchange? Here’s a quick side-by-side breakdown to help you compare fees, security, CAD support, and overall features, without the fluff.

Whether you’re here to stack sats or explore DeFi, choosing the right platform starts with knowing what each one offers, this comparison gives you that head start.

Let’s break it down: a crypto exchange is basically the digital middleman that helps you swap your dollars (or any other currency) for crypto like Bitcoin, Ethereum, or that altcoin you heard about once on Twitter and still don’t fully understand.

It connects people who want to buy with people who want to sell—and makes the whole thing as smooth (or clunky) as the platform allows.

There are two main types of exchanges out there:

So how does trading on a crypto exchange actually work?

Getting into crypto in Canada is honestly way easier than it used to be. No more shady wire transfers or weird browser extensions. And if you’re using Best Wallet, you can buy Bitcoin in under five minutes—all from your phone.

Step 1: Download Best Wallet

Find it in the App Store or Google Play. Once downloaded, tap “Get Started.”

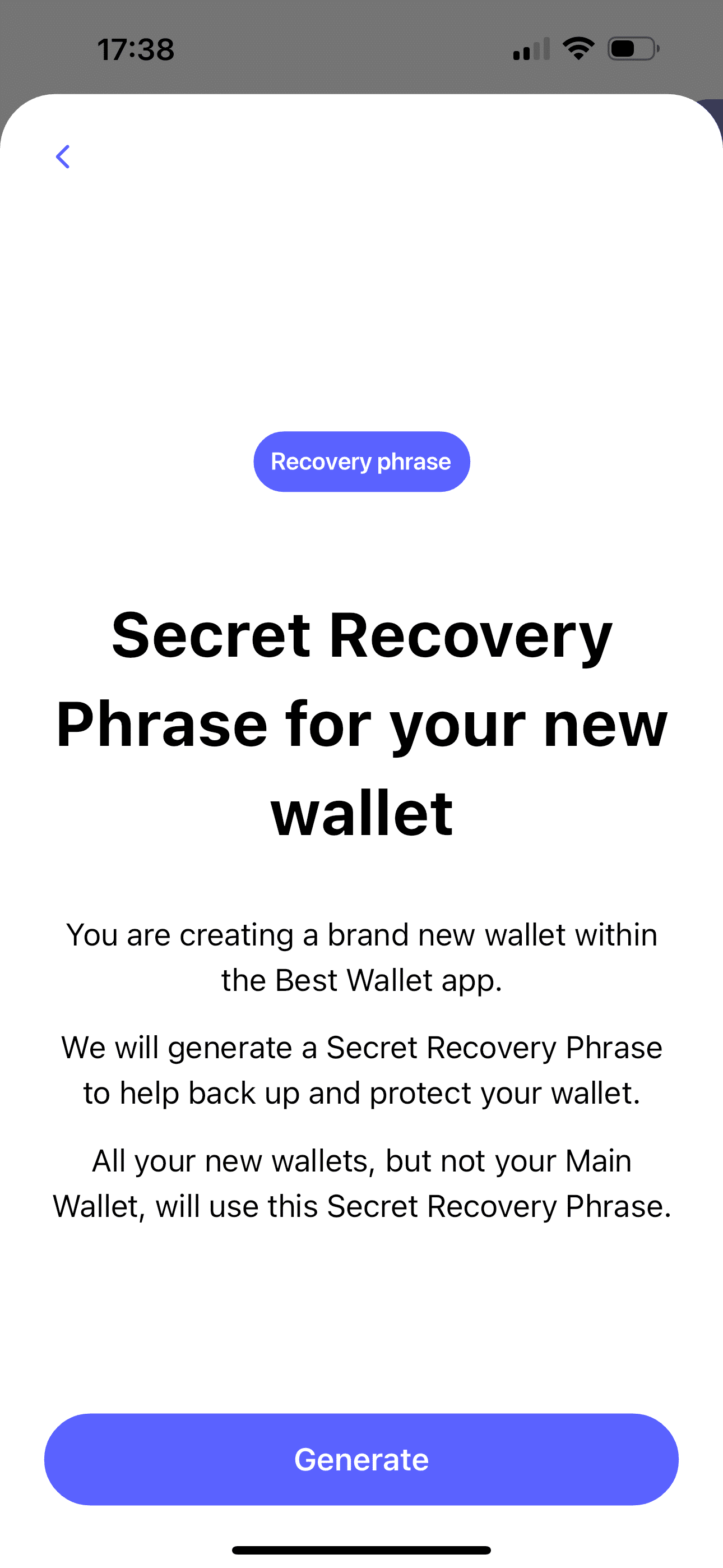

Step 2: Back Up Your Wallet

This is a non-custodial wallet, which means you hold the keys to your crypto. Write down your recovery phrase and back it up. No shortcuts here—lose it, and there’s no customer service to save you.

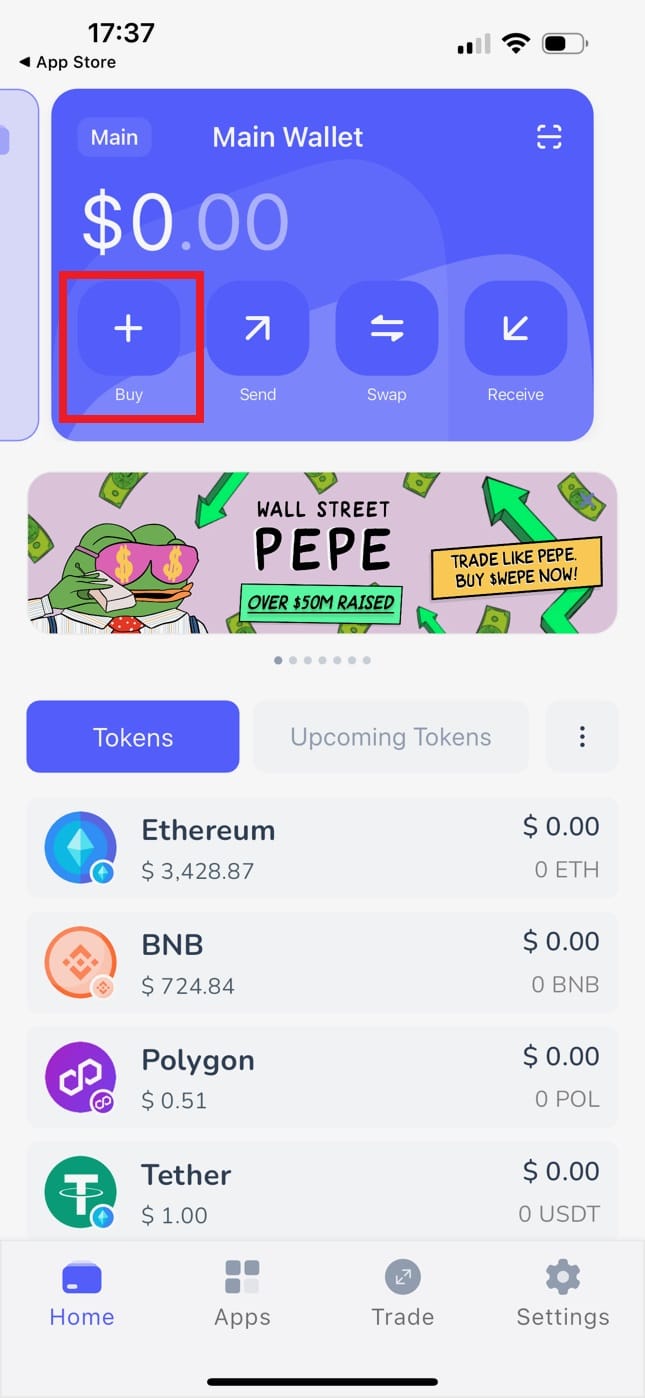

Step 3: Tap “Buy”

You’ll see a “Buy” button right on your main wallet screen. Go ahead and tap it.

Step 4: Pick Your Crypto

Scroll through or search for the coin you want. Bitcoin’s usually at the top, but there are other options too.

Step 5: Enter an Amount

Tell the app how much you want to spend. It’ll show you what gets you in crypto—no math required.

Step 6: Choose How to Pay

Best Wallet accepts credit cards, debit cards, Apple Pay, Google Pay, and bank transfers. Pick what’s easiest for you.

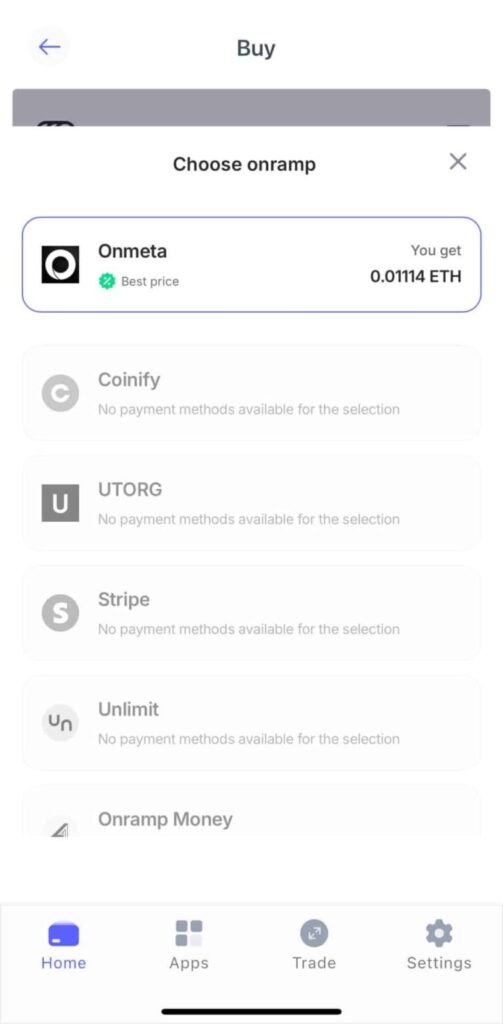

Step 7: Compare Providers

Best Wallet shows you a list of fiat on-ramps (like Onmeta or Coinify) with fees, limits, and ID requirements. You can go with the recommended one or shop around.

Step 8: Confirm Your Purchase

Tap “Buy” again, and you’ll jump to the provider’s site or in-app page to finalize your payment.

Step 9: Wait for the transaction to complete

After payment clears, your crypto gets sent straight to your wallet. No extra steps, no detours.

Step 10: Check Your History

Open the “Trade” tab, then tap “History” to see the receipt and make sure everything landed where it should.

Done. You just bought crypto like a local—with full control over your assets and no drama.

Canadian crypto users aren’t short on choices when it comes to picking an exchange, but not all platforms play by the same rules. While the big names get all the press, some of the most user-friendly platforms are actually Canadian crypto exchanges flying under the radar.

Whether you value privacy or prefer a fully regulated system, it helps to understand how each type of exchange works before you move money around.

FINTRAC-Approved Exchanges

Offshore Exchanges (No KYC)

P2P Exchanges

Decentralized Exchanges (DEXs)

Crypto Wallets

Understanding the pros and cons of each platform type helps you avoid surprises and pick the setup that fits your style. Whether you want total control or full compliance, there’s an option for you—it just depends on what you’re comfortable with. For anyone looking to avoid the risks of sketchy offshore platforms, regulated Canadian crypto exchanges are the smarter bet.

Cryptocurrencies like Bitcoin, Ethereum, and Solana are fully legal in Canada. And by extension, so are cryptocurrency exchanges. However, like any financial service, there are specific rules in place to ensure consumer protection and platform accountability.

That said, Canada’s regulatory reach has limits beyond its borders. While Canadian law encourages the use of regulated platforms, many offshore exchanges still accept Canadian clients without local licensing. Some may even display warnings or limit access when detecting a Canadian IP.

It’s common for users to simply check a box confirming they’re not from Canada or, worse, use a VPN service to access international exchanges. But this approach carries risks. The safest route is to choose a FINTRAC-registered platform that meets national and provincial standards. This way, your assets and information are better protected, even if you pay slightly higher fees for that peace of mind.

Whether you’re casually stacking sats or juggling altcoins like it’s your side hustle, staying safe on a crypto exchange isn’t optional. It’s essential. The risks are real, but with a few simple habits, you can dramatically lower your chances of getting wrecked.

Seriously, don’t skip this one. 2FA is your first real line of defense. It means that logging in (or withdrawing) isn’t just about knowing your password—you’ll also need a time-sensitive code from something like Google Authenticator or Authy. That way, even if someone grabs your password, they’re locked out unless they also have your 2FA device. Think of it as the deadbolt to your front door.

Heads-up: Skip SMS-based 2FA if you can. SIM swaps are more common than you’d think.

If your password could double as a license plate, it’s time to level up. Hackers love reused passwords—don’t give them the satisfaction.

Try this instead: A jumble of letters, numbers, and symbols like v8Xp!q2%Rne_4F is way better than Crypto2023.

Password managers (like Bitwarden or 1Password) make life easier. They store and generate strong passwords so you don’t have to rely on memory (or sticky notes).

It’s easy to get complacent. Don’t. Check-in on your account every so often. Look for unfamiliar logins, new withdrawal addresses, or weird API activity. Sometimes hackers don’t go for the jackpot right away—they test the waters first.

Example: You log in and see a new device accessed your account from a random country. That’s not good. Time to reset passwords, lock down the account, and contact support before it escalates.

If your exchange offers login alerts or withdrawal notifications, enable them. Every extra layer helps.

Some of the most damaging hacks don’t involve brute force—they involve tricking you into doing the work.

Fake login pages, spoofed emails, even bogus X (formerly Twitter) support accounts—it’s all out there.

Scenario: You get an email that looks legit, asking you to verify your account “before it’s suspended.” The link looks normal. You click, log in… and just handed over your credentials to a scammer.

In a real-life example, Claude Lauzon, a Canadian crypto trader from Edmonton, Alberta, opened up about how a simple click on a Facebook ad in 2021 turned into one of the most painful experiences of his life. It started innocently enough—he saw an ad, filled out some info, and got a call promising easy money through crypto investing. At first, he put in small amounts, but things escalated fast.

“They told me, ‘We need to make sure you don’t get charged with money laundering, so you need to give us $200,000 right away.’ So, I cashed in my RRSPs to do that,” said Lauzon. By the time it all came crashing down, he said he’d lost $500,000—his entire life savings.

“It pretty much ruined my life. The night I realized it was all a big scam was devastating for me,” he said.

It’s a sobering reminder that crypto scams don’t always look like scams at first—and that even the savviest among us can get caught in something that seems too good to be true.

How to dodge it:

If it’s not something you plan to trade in the near future, take it off the exchange. Really.

Exchanges aren’t banks. They get hacked, frozen, or straight-up vanish.

Proof?

These weren’t fly-by-night platforms. That’s what makes it worse. Rule of thumb: only keep what you’re actively using on an exchange.

For everything else, consider a non-custodial wallet (you hold the keys), or even better, a hardware wallet (you hold the keys and they’re offline). Crypto’s exciting. But it’s also unforgiving. Take a few extra steps now so you’re not scrambling later. A little effort goes a long way when it comes to keeping your coins where they belong: with you.

Canada’s crypto asset trading space has come a long way in recent years. What used to be a bit of an intricate process is now way more accessible, even if you’re just dipping your toes into Bitcoin transactions for the first time. Whether you’re totally new or one of those advanced users who live for advanced order types, there’s something out there for you.

Some Canadian crypto exchanges, like Best Wallet, are also diving into Web3 functionality, bridging DeFi and centralized finance for Canadian users. As the crypto space continues to grow, expect Canadian crypto exchanges to keep improving their offerings, from new assets to better Bitcoin staking and tax tools.

You’ve also got options like Bitbuy Express or Coinsquare that focus more on regulation and offer a solid, robust mobile app. They come with low fees and robust security measures and make it easy to handle crypto transactions without jumping through a million hoops.

If you’re into more complex stuff like futures trading or trading across different bitcoin pairs, something like Kraken might be more your speed. On the flip side, if you just want to buy some Bitcoin fast, Shakepay keeps it simple; just a couple more steps, and you’re in. Platforms like Crypto.com and Coinbase are solid for people who want a wider selection of cryptocurrencies and tools that support global financial transactions.

The truth is, there’s no one-size-fits-all when it comes to the best crypto exchange in Canada. It all depends on what matters most to you. Maybe it’s low fees, maybe it’s access to educational resources, or maybe you’re just trying to avoid falling into the next cryptocurrency bug. Either way, do your due diligence. Check if the platform is registered with FINTRAC, Canada’s Financial Transactions and Reports Analysis Centre, and make sure it fits your goals: whether that’s crypto exchanges with the lowest fees, solid support, or strong security.

From beginner-friendly apps to pro-level tools, Canadian crypto exchanges are finally offering something for everyone—without sacrificing trust.

Crypto asset trading doesn’t have to feel overwhelming. The crypto industry might still be wild at times, but with the right tools, and a little patience, you can figure it out without getting lost in the weeds. If you’re unsure where to start, here’s a simple guide on How to Buy Bitcoin in Canada.

See Also: Best Crypto Exchanges UK in [cur-month] 2025

Which Canadian crypto exchange has the lowest fees?

Can I use international crypto exchanges in Canada?

Are there specific crypto regulations in Canada I should be aware of?

Which regulatory body oversees crypto exchanges in Canada?

Can I buy Bitcoin with CAD on Canadian exchanges?

What are the best crypto exchanges in Canada?

Is crypto legal in Canada?

Is Coinbase legit in Canada?

Is it legal to buy Bitcoin in Canada?

If you’re fee-sensitive (and let’s be real, who isn’t?), Best Wallet is the best option since you only pay the network fees due to its built-in decentralized exchange. Deposits are free, and so are withdrawals. No sneaky spreads or surprise charges, just straightforward pricing.

Technically, yes. Plenty of Canadians use platforms based outside the country. But just because you can doesn’t always mean you should. If the exchange isn’t registered in Canada or doesn’t support CAD, you could face extra fees, slow funding, or worse, limited support if something goes wrong.

Yup. Any exchange operating in Canada has to play by some serious rules. That means registering with securities regulators, verifying user identities (KYC), and following anti-money laundering (AML) policies. It’s all designed to protect you, but it also means fewer privacy perks than offshore platforms.

Crypto doesn’t fall under just one umbrella in Canada; it’s a joint effort. The Canadian Securities Administrators (CSA) handles the national standards, while provincial regulators like the Ontario Securities Commission (OSC) add their own local oversight. Think of it as double-layer protection.

Absolutely. Exchanges like Bitbuy and NDAX let you buy Bitcoin directly with Canadian dollars. That means no currency conversion fees or juggling multiple wallets; just fund your account and buy. If you’re serious about keeping things local, Canadian crypto exchanges make it way easier to buy, sell, and withdraw without extra hoops.

“Best” depends on your priorities. Best Wallet is great for beginners and is easy to use (and its mobile app is smooth). Each one brings something different to the table, so it’s worth figuring out what features matter most to you.

Yes, crypto is completely legal to buy, sell, and trade. That said, don’t confuse it with legal tender—you can’t pay your taxes with Bitcoin (yet). But owning and investing in crypto? Totally allowed.

It is. Coinbase is officially recognized as a Restricted Dealer under Canadian securities law. So yes, Canadians can use it legally, and it’s regulated like any other major platform operating in the country.

Yep, 100% legal. Individuals and businesses alike can buy, sell, and use Bitcoin. Just make sure you’re using a registered exchange and reporting any gains on your taxes like you would with any other investment.

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

Monthly readers

Expert contributors

Crypto Projects Reviewed

Anthony Clarke’s crypto journey began in 2017, sparked by a discovery on Quora. After purchasing Bitcoin and Verge as his first cryptocurrencies, he developed a deep interest in the emerging world of blockchain technology. This led him to begin writing… Read More

Maximize Your Trading With Margex’s 20% Deposit Bonus

Hottest Meme Coins to Buy in April? Retail Target Latest Crypto For Mega Gains

AR.IO Brings The Permanent Cloud to AI Storage Crisis

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

4 Days Left For Early Investors in World’s First Meme Coin Index: Meme Coin Mcap Hits $56Bn

Best Crypto Exchanges in Hong Kong for 2025

Best Fiat-to-Crypto Exchanges 2025

Best Crypto Exchanges in Japan for 2025

Best Canadian Crypto Exchange in April 2025

CoinEx Review 2025: Earn More from 1,400+ Altcoins

7 Best No-Fee Crypto Exchanges in April 2025

Let’s get social

© 2025 99bitcoins LTD, All rights reserved

Stay ahead with the latest updates, exclusive offers, and expert insights! Sign up for our newsletter today and never miss a beat.