Close search

By Alexander Reed

Last Updated: Apr 16, 2025

Co-author

By Shraddha

Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

Making consistent gains from online investing is no easy feat; especially if you only have limited experience. This is where copy trading can help. In a nutshell, you’ll automatically ‘copy’ a seasoned investor, with positions replicated wherever they trade.

However, choosing the right platform is crucial. This guide reveals the best copy trading platforms for 2025. My methodology covers everything from fees, trader pools, and available markets to safety, account minimums, and payments.

According to my research findings, these are the best copy trading platforms in the market:

Investors should choose carefully when exploring copy trading brokers. The leading platforms support thousands of verified traders, offer low fees, and provide access to many asset classes.

Read on to learn more about my top picks.

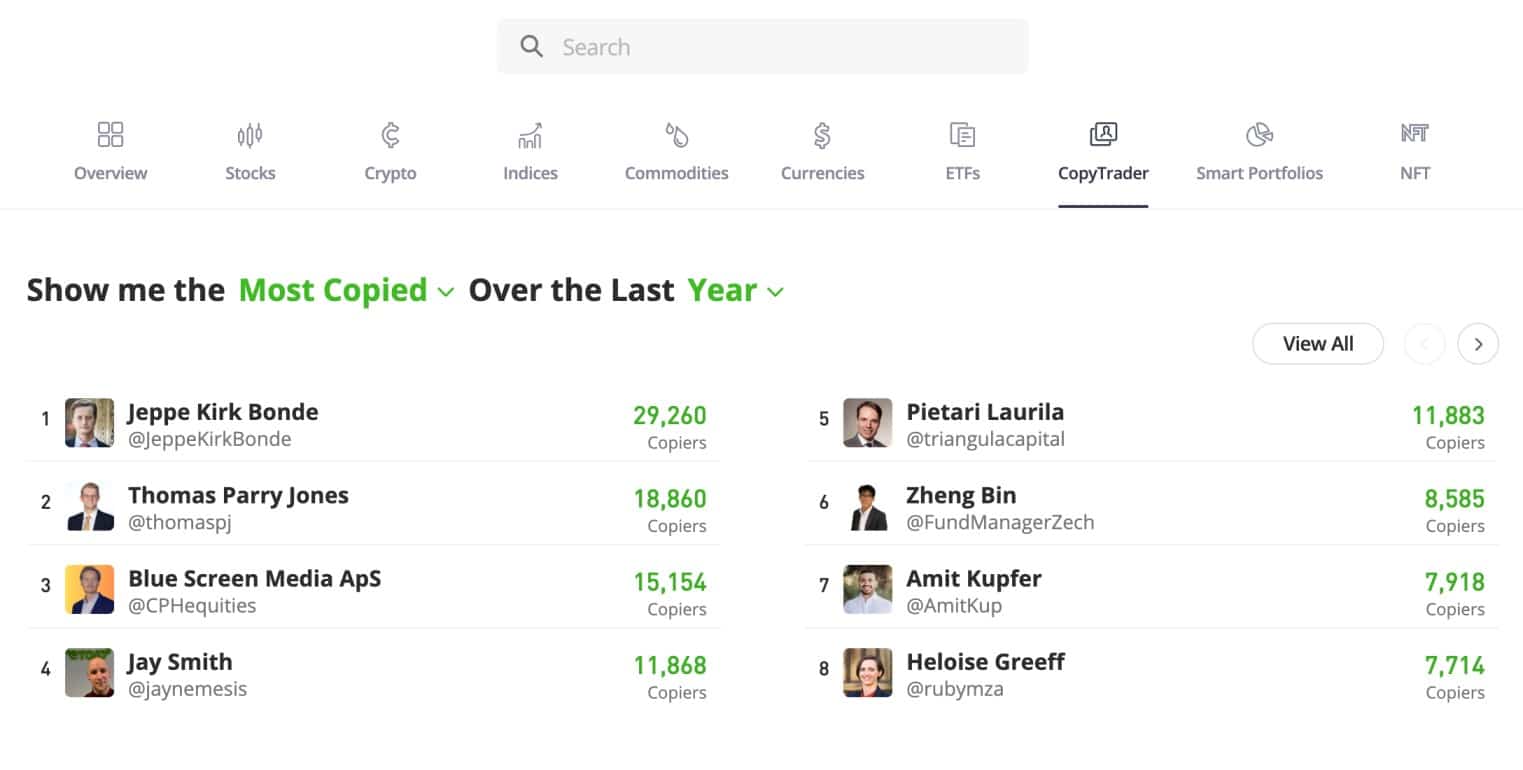

Launched in 2007, eToro is considered the de facto copy trading platform. You can choose from thousands of verified traders, each requiring a minimum investment of $200. Supported asset classes, including stocks, ETFs, and crypto. Available strategies cover scalping, day trading, swing trading, long-term investing, and more.

eToro doesn’t charge additional fees when copy trading. You just need to pay the standard trading commission. That’s 1% on crypto. Other assets can be traded on a spread-only basis. eToro is simple to use; getting started takes minutes, and you can deposit funds with a debit card or e-wallet.

Deposits made in USD, GBP, and EUR are processed fee-free. Another passive investing feature is smart portfolios. These are built and managed by eToro and popular categories including green energy, Big Tech, and eCommerce. In terms of safety, eToro has regulatory approval in multiple locations, including the US, the UK, Australia, and Europe.

Pros

Cons

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

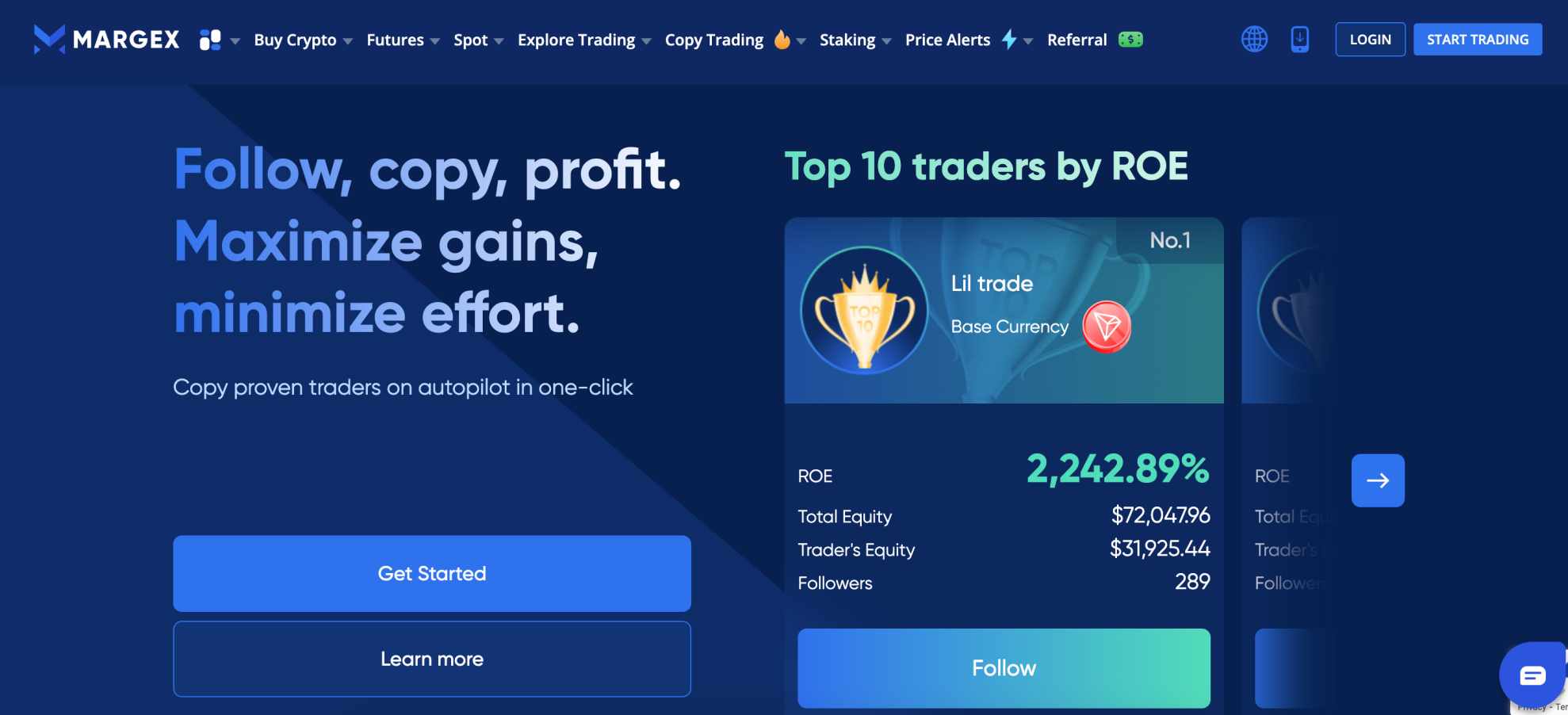

Margex is a crypto trading platform that specializes in perpetual futures. It’s a great option for copying seasoned crypto traders, especially those with expertise in derivative products. Margex supports about 50 futures markets, including Bitcoin and the best altcoins, such as XRP, Dogecoin, and Solana.

Margex’s copy trading service comes with a profit share. The percentage is selected by the trader. You also need to cover standard commissions. These amount to 0.019% or 0.06% per slide, depending on whether limit or market orders are placed. Margex also offers leverage facilities.

The largest-cap futures offer 100x, while less popular markets range between 25x and 50x. Accounts can be opened without providing personal information or a government-issued ID. Users can deposit funds with a debit/credit card. Multiple currencies are supported, including USD, EUR, GBP, and AUD.

Pros

Cons

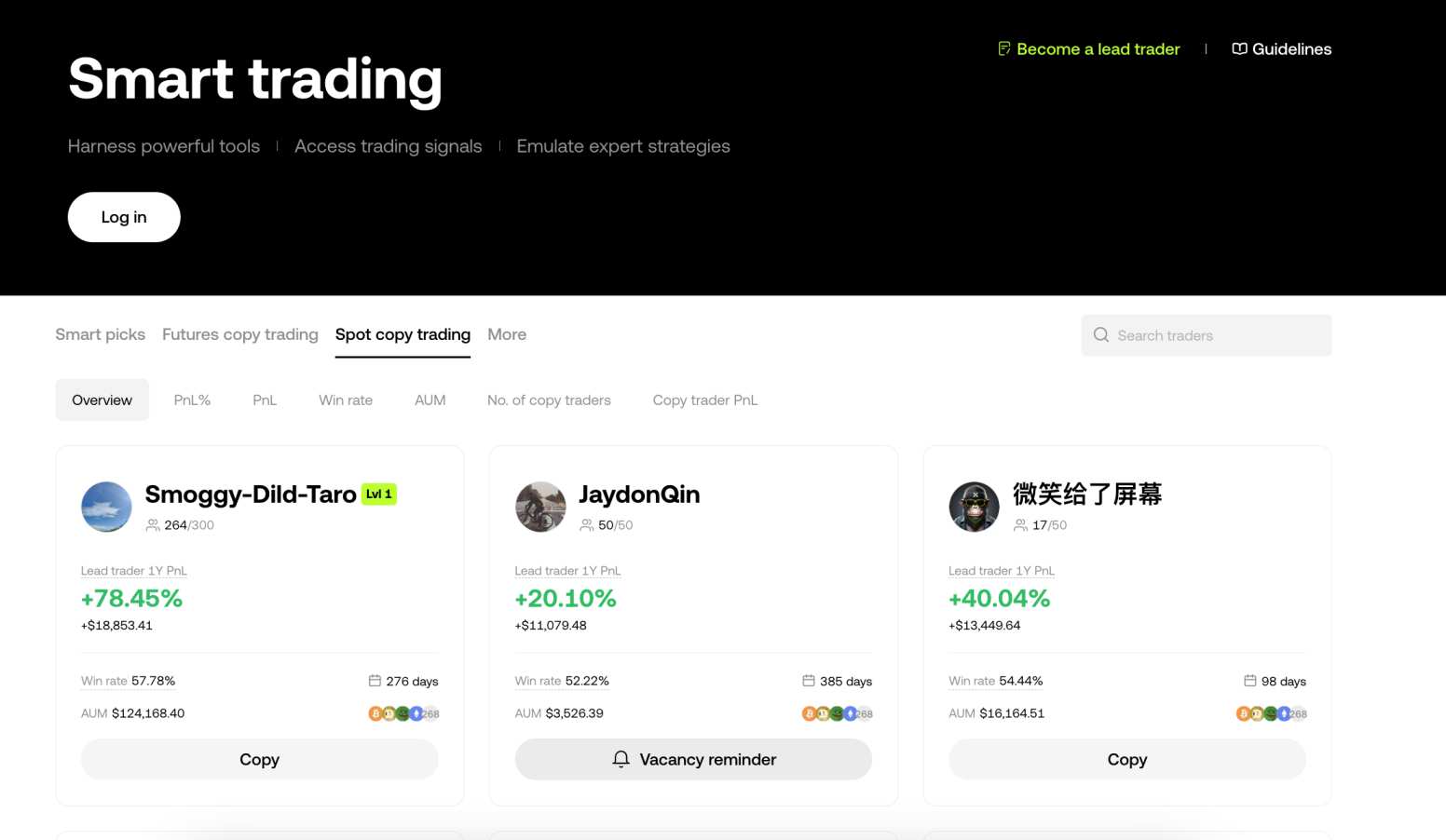

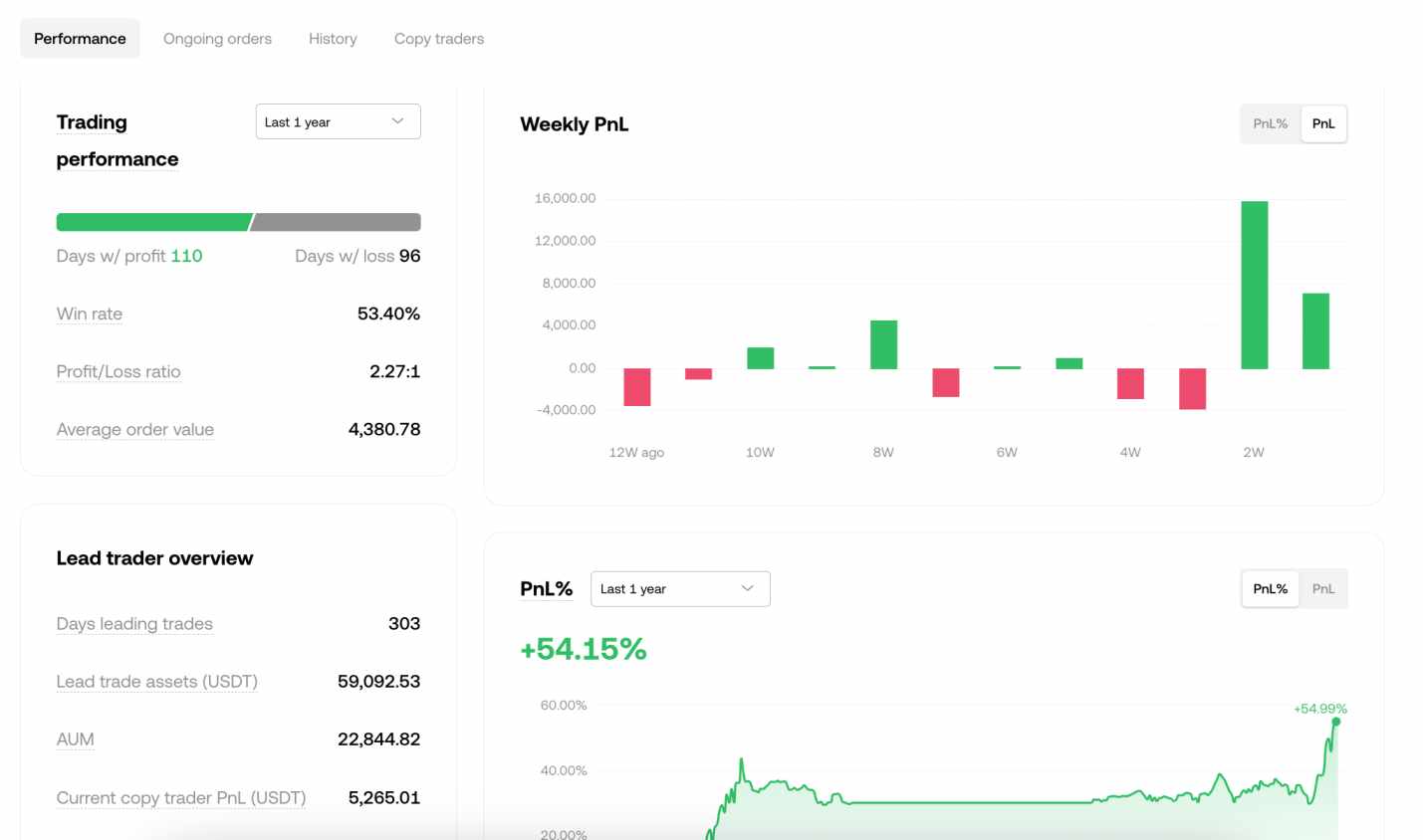

OKX is another good option for copying seasoned crypto traders. It’s a tier-one crypto exchange with millions of active traders. What’s more, OKX has a great reputation for safety and security. The platform supports hundreds of crypto assets, covering everything from Dogecoin, Shiba Inu, and Sui to Bitcoin, Cardano, and Pepe.

Copy trading tools are offered in-house, so you won’t need to use a third-party platform. Moreover, no additional fees apply. You only need to cover the standard commission, which never exceeds 0.1% per slide. Finding a trader is seamless, with key metrics including the win rate, profit and loss, and assets under management.

In addition to copy trading, OKX also offers automated bots. These also offer a passive experience, although you’re copying an algorithm rather than a human trader. What’s more, OKX is also popular for crypto derivatives. It supports options, delivery futures, and perpetual contracts. 100x leverage is offered on the largest markets.

Pros

Cons

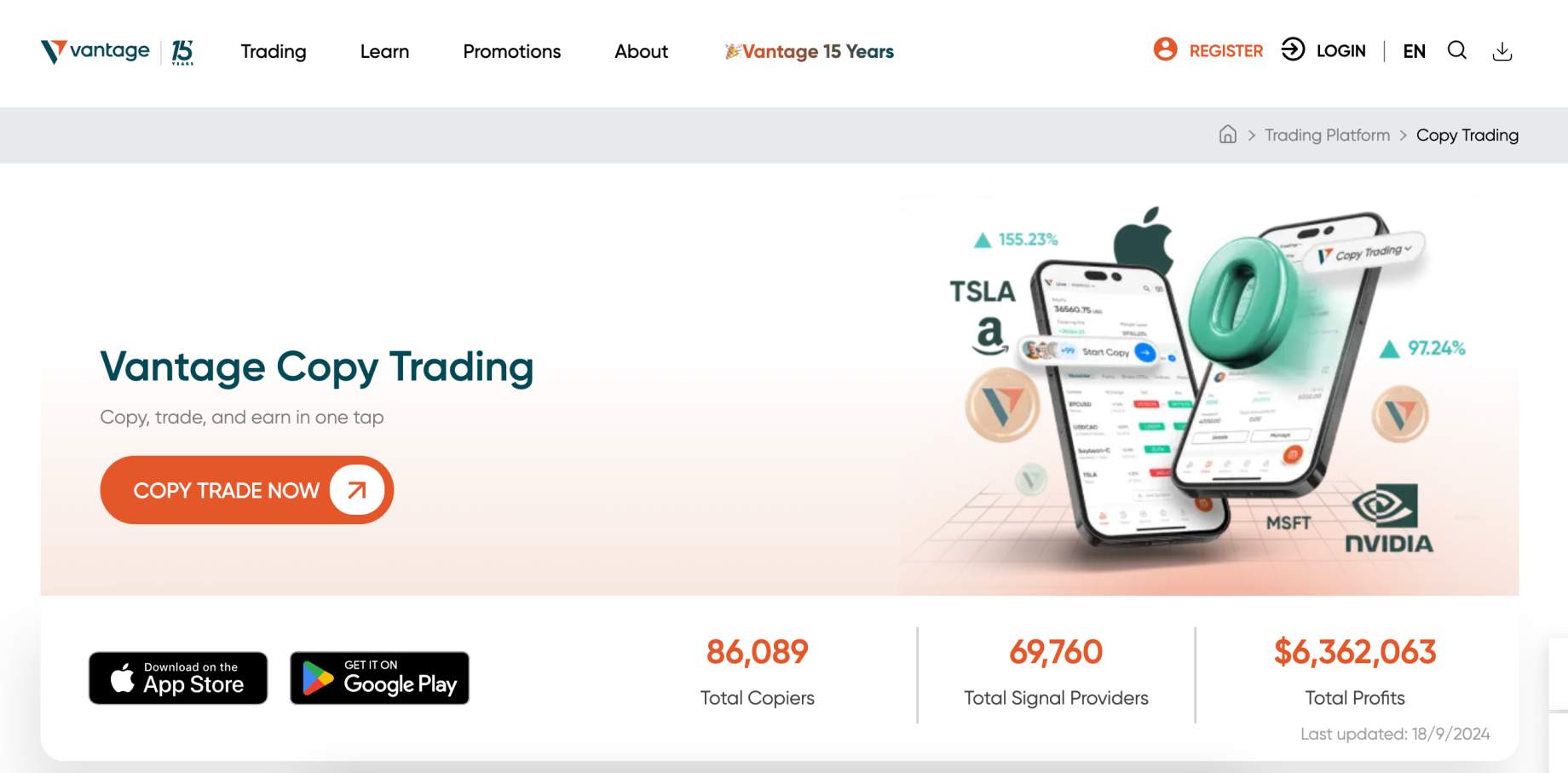

Vantage Markets is a regulated broker offering copy trading apps for iOS and Android. It supports over 69,000 verified traders, covering a wide range of strategies. Investors can easily find a suitable trader without leaving the app. Performance metrics include profit and loss, risk score, and maximum drawdown.

Vantage Markets has a minimum copy trading investment of just $50. This makes diversification affordable for most budgets. Supported markets cover commodities, indices, stocks, and forex. The latter includes majors, minors, and exotics. One of the main drawbacks is the profit share, which can be as high as 50%.

This is determined by the respective trader. That said, standard trading fees are super competitive. For example, traders can avoid commissions when opening a standard account. Alternatively, raw ECN accounts offer spreads from 0.0 pips, with a small commission per slide.

Pros

Cons

AvaTrade is a regulated CFD broker supporting over 1,000 financial markets. It’s licensed in nine different countries, ensuring a safe and secure environment. Asset classes include forex, commodities, crypto, stocks, indices, options, ETFs, and bonds. The copy trading service is offered via AvaSocial, which connects to the same AvaTrade account.

AvaSocial is available as a free mobile app for iOS and Android. The minimum deposit requirement is just $100. Deposits can be made via e-wallets, debit/credit cards, and bank transfers. AvaSocial also offers social trading features, allowing users to chat and follow like-minded investors.

No additional fees apply when copy trading. Moreover, all AvaTrade markets are offered at 0% commission. Investors simply need to cover the market spread. AvaTrade offers leverage of up to 1:400, but limits will be limited in certain regions (e.g. the EU and Australia). It also offers educational resources and a free demo account.

Pros

Cons

Pepperstone is a CFD and spread betting platform with multiple regulatory licenses. It offers a safe and low-cost trading environment across the most popular asset classes. This includes everything from ETFs and crypto to stocks and forex. Global indices are supported too, including the FTSE 100 and Dow Jones

Pepperstone’s copy trading service is offered via MT4 or cTrader. This adds an extra step when getting started. Nonetheless, these trading platforms are used by seasoned traders, especially those deploying short-term strategies. This includes scalping, day trading, and trend trading.

Pepperstone offers commission-free and low-spread accounts, and there’s no minimum deposit required. However, fees are required when copying a trader. MT4 traders charge a monthly subscription averaging $30. Conversely, cTrader has a profit share, plus management and volume fees.

Pros

Cons

Trade Nation is a popular trading platform that’s regulated in five countries. It offers a copy trading app for iOS and Android, although a connection to MT4 is needed. Nonetheless, the app is user-friendly – especially when finding a suitable trader. A wide range of performance metrics is available, including strategy, return on investment, and risk.

You can also choose traders based on their preferred market; Trade Nation supports forex, crypto, commodities, stocks, and indices. You can also choose how position sizes are calculated. Options include balance, equity, or lot size. Trade Nation also offers social trading tools.

These are ideal for discovering insights and broader sentiment from like-minded traders. I like that Trade Nation doesn’t have a minimum deposit requirement. Instant payment methods include debit/credit cards, Skrill, and Neteller. It also accepts the best cryptocurrencies to buy, such as Bitcoin, XRP, and Tether.

Pros

Cons

With a minimum investment requirement of $2,000, DupliTrade will appeal to investors with a large bankroll. This is a third-party platform that must be connected with a partnered broker. DupliTrade has a stringent verification process, meaning all its traders have been pre-vetted. This ensures you’re copying experienced traders with a proven track record.

Most traders focus on major and minor forex pairs, although crypto, stocks, indices, commodities, and ETFs are also covered. In addition to high minimums, DupliTrade traders charge a profit share of up to 30%. These fees are in addition to any trading commissions the connected broker charges.

Pros

Cons

NAGA is a licensed broker with direct copy trading facilities. It’s one of the best options for building a diversified portfolio. Over 4,000 markets are supported, including popular stocks like Apple, Amazon, and IBM. Not to mention indices, crypto, commodities, forex, and ETFs. NAGA is also one of the few copy trading platforms to offer options.

The minimum investment requirement is $250. Traders charge a reasonable profit share, capped at 15%. That said, each trading position costs $0.99. This can convert to a high percentage fee when trading with small amounts. NAGA accepts a wide selection of payment types, including Visa, MasterCard, Maestro, Neteller, and Skrill.

Pros

Cons

cTrader is one of the best copy trading platforms for replicating algorithmic strategies. This means you’ll be in the market 24/7, with orders placed autonomously based on the underlying code. cTrader is a third-party trading suite that connects to selected brokers. Comprehensive filters are available, allowing you to choose a strategy that aligns with your goals.

For example, you can rank algorithmic strategies by the return on investment, performance fee, asset class, daily drawdown, average trade duration, and equity. Do note that the minimum investment varies depending on the trade. Some require just $100 while others specify thousands of dollars. A profit share of up to 30% is charged, plus volume and management fees.

Pros

Cons

ZuluTrade is a good option for beginners seeking a user-friendly dashboard. Available on desktop browsers and a mobile app, ZuluTrade must be connected to a brokerage account. It supports multiple assets, including indices, stocks, forex, and crypto. Commodities like gold and silver are available too.

ZuluTrade – which is used by over 30 million people, provides access to more than 2 million traders. It doesn’t charge fees, so you only need to cover the commissions/spreads implemented by the respective broker. ZuluTrade is also a good option for social trading. You can connect with like-minded traders, ‘like’ posts, and discover investment insights.

Pros

Cons

IG is an established broker with regulatory approval in multiple countries, including the US and the UK. It’s one of the best options for copying seasoned forex traders via MT4. Dozens of pairs are supported, including majors, minors, and exotics. What’s more, forex is traded on a commission-free basis, with spreads starting from just 0.6 pips.

That said, you will need to pay a monthly subscription with the chosen MT4 trader. Nevertheless, IG supports thousands of other markets, ranging from options, indices, and stocks to ETFs, crypto, and interest rates. Deposits made with Visa or MasterCard require $50 or more. The minimum can be avoided when making a bank transfer.

Pros

Cons

There’s a lot to consider when choosing a copy trading platform. For instance, some investors prioritize low fees and account minimums, while others want access to specific markets. I created a diverse research methodology to ensure all trading requirements are catered for.

The key criteria are explained below:

Using the above criteria will ensure you choose the right copy trading platform for your requirements.

These are the key takeaways to know about copy trading:

Ultimately, you can mirror an experienced pro when copy trading, whether that’s for stocks, commodities, indices, or crypto. However, the risks should also be considered; you’ll lose money if the trader being copied doesn’t perform well.

The best way to understand copy trading is with a relatable example.

In terms of getting started, the process depends on the platform. For example, some copy trading platforms are also brokers, meaning they execute trades directly. This avoids the need to use third-party providers.

Conversely, some platforms only offer a copy trading interface, so they don’t work without being connected to a broker. This includes cTrader, DupliTrade, and ZuluTrade.

Fees should also be considered. Some platforms have a profit share, where a percentage of gains are kept by the trade. In other cases, such as AvaTrade and eToro, no additional fees apply.

You can copy trade just about any asset, but the specific markets offered vary depending on the platform and/or broker. What’s more, the chosen trader will likely specialize in a specific asset, so this also needs to be considered.

At a minimum, most copy trading platforms support the following:

It’s also important to understand whether you’re trading real assets or derivatives. For example, eToro copy trading supports real stocks, ETFs, and crypto. AvaTrade only offers CFDs, which aren’t available in some countries (including the US).

These are the key reasons why copy trading is increasingly becoming popular when investing:

Copy trading is an investment tool, so the primary objective is to make consistent gains. However, this isn’t guaranteed. You’re merely replicating the trader’s positions, which could make or lose money.

For example:

The key takeaway is that copy trading can make you money, but not all traders are successful. Once again, diversifying across several traders is a smart move. This is in addition to sensible stop-losses.

Diversification is simple in practice. You simply need to spread the investment funds across multiple traders. However, knowing which traders to replicate can be challenging.

I’d suggest considering the following factors:

The best copy trading platforms support the above metrics and more. This makes it seamless to find a suitable trader.

These are the pros and cons of copy trading in 2025:

Pros

Cons

Investigating fees is crucial when choosing a copy trading platform.

Ensure you check the following charges:

Copy trading will be legal in your home country, as long as the respective assets being traded are permitted. For example, suppose you’re based in the US. You can legally copy traders involved in forex and stocks.

However, you can’t copy trade CFDs. This is because CFDs are banned in the US. Another consideration is the platform’s regulatory status. They must accept clients from your country of residence. Otherwise, your account will be closed.

Ultimately, the specific legalities vary from one jurisdiction to the next. Independent research is advised to ensure regulatory compliance.

These tips will ensure your copy trading experience is a positive one:

If you’re new to copy trading, the following steps explain how to get started with eToro. It offers a safe platform with thousands of verified traders, and the minimum investment is an affordable $200.

Choosing the right copy trading provider is crucial. Key considerations include fees, available traders, and account minimums. eToro is a beginner-friendly option with thousands of traders.

It supports stocks, commodities, ETFs, crypto, and more. Getting started takes minutes and the minimum copy trade is $200. No copy trading fees apply, other than the standard commission and spread.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

How do you copy trade?

The easiest way to copy trade is to choose a broker offering a direct service. For instance, eToro and AvaTrade offer copy trading without requiring third-party integration.

What is an example of copy trading?

You invest $10,000 into a crypto trader who risks 5% of their portfolio on Bitcoin. You automatically buy $500 (5% of $10,000) worth of Bitcoin

Does copy trading really work?

Yes, copy trading allows you to replicate a trader’s success. However, if the trader loses money, these losses will be reflected in your account too

Is copy trading legal in the US?

Yes, copy trading is legal in the US but ensure you’re using a regulated platform. Note that US traders can’t copy prohibited assets, such as CFDs.

Is forex copy trading profitable?

Profits and losses are mirrored like-for-like when forex copy trading. For example, if the trader loses 4 %, you will lose 4% of the original investment.

What is the difference between social trading and copy trading?

Social trading allows investors to share and discover insights in a public setting. Copy trading allows investors to mirror their favorite traders.

Can copy trading be automated?

Yes, it’s possible to automate investments by copying an algorithmic bot. For example, OKX offers crypto copy trading bots that trade 24/7.

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

Monthly readers

Expert contributors

Crypto Projects Reviewed

Having delved into futures trading in the past, my intrigue in financial, economic, and political affairs eventually led me to a striking realization: the current debt-based fiat system is fundamentally flawed. This revelation prompted me to explore alternative avenues, including… Read More

Maximize Your Trading With Margex’s 20% Deposit Bonus

‘Buy in May, Get Paid in June?’ – $300K Bitcoin Calls Heat Up, BTC Bull Token Is Locked In

AR.IO Brings The Permanent Cloud to AI Storage Crisis

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

BingX Launches $10 Risk-Free Copy Trading Voucher for New Users in Exclusive Event

Best Crypto Exchanges in Australia for 2025

Best Crypto Derivatives Exchanges in May 2025

Best Crypto Exchanges in Hong Kong for 2025

Best Fiat-to-Crypto Exchanges 2025

Best Crypto Exchanges in Japan for 2025

Best Canadian Crypto Exchange in May 2025

Let’s get social

© 2025 99bitcoins LTD, All rights reserved

Stay ahead with the latest updates, exclusive offers, and expert insights! Sign up for our newsletter today and never miss a beat.

Best Copy Trading Platforms in May 2025 – 99Bitcoins