Close search

By Jose Aquino

Last Updated: Apr 21, 2025

Co-author

By Caroline

Japan is a huge market for digital assets like Bitcoin and Ethereum. Over 19 million Japanese users are predicted to trade crypto in 2025, largely driven by the country’s progressive regulatory framework. But what is the best crypto exchange in Japan?

This guide ranks and reviews the top exchanges for Japanese traders, factoring in fees, supported markets, safety, accepted payment methods, and other key metrics. We also discuss best practices when using crypto exchanges and how beginners can avoid common mistakes.

Here are the 10 best crypto exchanges in Japan for 2025:

The top Japanese crypto exchanges will now be reviewed. Read on to learn about platform fees, security, markets, and more.

➕ What We Like: A decentralized and secure crypto exchange aggregator that doubles as a non-custodial wallet.

➖ What to Consider: Currently only available as a mobile app.

Exchange Overview

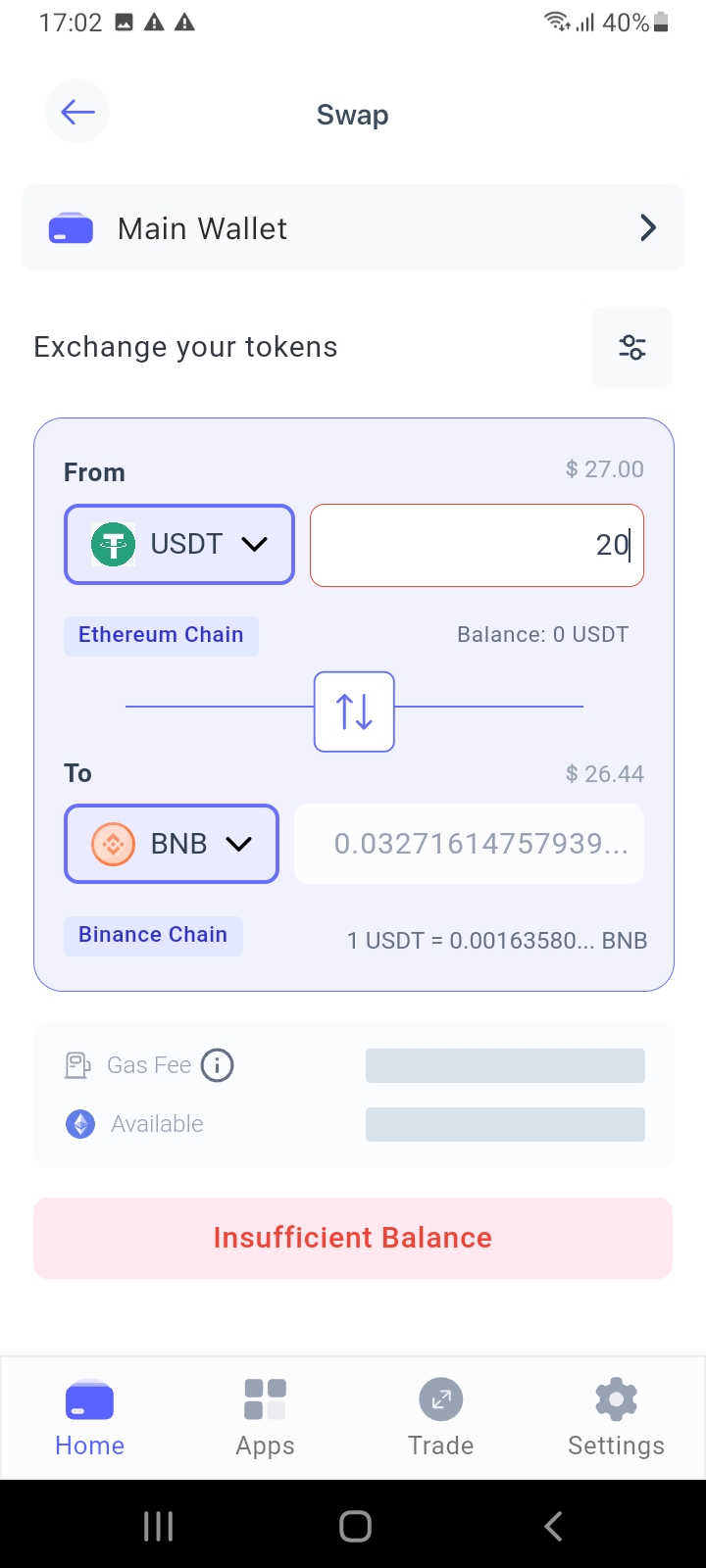

Best Wallet is a decentralized crypto wallet and exchange rolled into one — Japanese users can trade and store digital assets in one safe place. The exchange offers an aggregator service, which means it extracts the best market prices from hundreds of liquidity pools. Users can instantly trade millions of tokens from over 60 networks, including Ethereum, Solana, BNB Chain, Polygon, Base, and Arbitrum. The exchange automatically adds traded tokens to the wallet balance for added convenience.

Best Wallet supports fiat payments (e.g., Visa, MasterCard, PayPal), which allows users to buy and sell cryptocurrencies with JPY. Traders can also access pre-listing tokens via the Best Wallet Launchpad — a great option to find the next 100x crypto. Best Wallet is available as a free mobile app for iOS and Android. The team plans to launch a desktop browser later in 2025.

Best Wallet supports all cryptocurrencies from 60+ network standards — this includes ERC20, BEP20, and SPL. Traders can swap tokens from different networks, such as Shiba Inu (Ethereum) for BNB (BNB Chain) or dogwifhat (Solana). With such a wide segment of the market covered, Best Wallet is particularly popular with active crypto traders.

Best Wallet builds fees into the exchange rate when users swap cryptocurrencies, so there’s no fixed commission or published markup. The platform extracts crypto prices from hundreds of decentralized exchanges, which ensures users get the most cost-effective swaps. Users are advised to manually verify exchange rates before confirming any trades.

The standout feature is Best Wallet’s non-custodial framework — users can buy, sell, and store cryptocurrencies in one safe place without relying on centralized intermediaries. Mobile devices store encrypted private keys, giving users full control of their digital assets. By extension, Best Wallet users can access crypto markets anonymously — even when using JPY.

Robust security features include encrypted private keys, biometrics, two-factor authentication, and real-time alerts when suspicious tokens are received in the wallet. Data breach risks are avoided, as users don’t need to provide government-issued ID documents (e.g., passports or driver’s licenses).

The team built Best Wallet from the ground up to ensure a beginner-friendly experience. It takes less than five minutes to get everything set up — even for new crypto traders. All wallet functions, including trades and transactions, are easily accessible through clear icons and tabs.

➕ What We Like: Offers a huge trading marketplace with over 4,000 cryptocurrencies.

➖ What to Consider: The platform operates without a license.

Exchange Overview

MEXC is one of the biggest crypto exchanges globally. The platform has over 36 million users and daily trading volumes are often several billion dollars. It provides institutional-grade liquidity, which means market-leading spreads and low slippage risks.

MEXC is also a great choice for diversification. The exchange lists over 4,000 cryptocurrencies — many are recently launched projects, so users can trade undervalued tokens before they blow up. Traders can access spot trading markets and crypto derivatives with leverage of up to 400x.

As an offshore exchange, MEXC is more flexible with KYC requirements. It allows withdrawals of up to 10 BTC daily without requiring personal information or a government-issued ID, which is approximately 121 million JPY.

MEXC is one of the best crypto exchanges in Japan for supported markets — over 4,000 cryptocurrencies are available, with new assets added almost daily. Traders can buy and sell the best meme coins like Dogecoin, Pepe, Popcat, OFFICIAL TRUMP, and Fartcoin.

Alongside spot markets, the platform offers perpetual futures with minimum margin requirements of just 0.25%. This low margin environment equates to $40,000 worth of market exposure with an account balance of just $100.

MEXC is one of the cheapest crypto exchanges in the Japanese market. Market makers and takers pay spot trading fees of 0% and 0.05%, respectively. Fees on perpetual futures are 0.01% and 0.04%. The platform offers 0% commissions on selected pairs, although note that MEXC frequently amends its fee structure, so users should assess charges regularly.

MEXC offers pre-market trading on selected projects, allowing users to access new cryptocurrencies before any exchange listings. Pre-market prices are influenced by market forces, which can be significantly higher or lower than the eventual exchange listing price. Over 33,000 participants use this MEXC feature, so liquidity levels are usually sufficient.

MEXC keeps the vast majority of client-owned cryptocurrencies in cold storage wallets with multisig security. The platform publishes “Proof of Reserves”, a critical safeguard that ensures actual assets back user balances.

Multiple account security features are also available, including two-factor authentication, address whitelisting, email notifications, and anti-phishing controls. MEXC has never been hacked since its 2018 inception, but users should remember that the platform is unregulated.

MEXC offers an extensive range of crypto trading products and features — many are aimed at experienced crypto traders. Beginners might find its advanced charting tools, technical indicators, and complex derivative contracts intimidating, so those without the necessary experience may consider other options.

3. Pionex

Exchange Overview

MEXC is one of the biggest crypto exchanges globally. The platform has over 36 million users and daily trading volumes are often several billion dollars. It provides institutional-grade liquidity, which means market-leading spreads and low slippage risks.

MEXC is also a great choice for diversification. The exchange lists over 4,000 cryptocurrencies — many are recently launched projects, so users can trade undervalued tokens before they blow up. Traders can access spot trading markets and crypto derivatives with leverage of up to 400x.

As an offshore exchange, MEXC is more flexible with KYC requirements. It allows withdrawals of up to 10 BTC daily without requiring personal information or a government-issued ID, which is approximately 121 million JPY.

MEXC is one of the best crypto exchanges in Japan for supported markets — over 4,000 cryptocurrencies are available, with new assets added almost daily. Traders can buy and sell the best meme coins like Dogecoin, Pepe, Popcat, OFFICIAL TRUMP, and Fartcoin.

Alongside spot markets, the platform offers perpetual futures with minimum margin requirements of just 0.25%. This low margin environment equates to $40,000 worth of market exposure with an account balance of just $100.

MEXC is one of the cheapest crypto exchanges in the Japanese market. Market makers and takers pay spot trading fees of 0% and 0.05%, respectively. Fees on perpetual futures are 0.01% and 0.04%. The platform offers 0% commissions on selected pairs, although note that MEXC frequently amends its fee structure, so users should assess charges regularly.

MEXC offers pre-market trading on selected projects, allowing users to access new cryptocurrencies before any exchange listings. Pre-market prices are influenced by market forces, which can be significantly higher or lower than the eventual exchange listing price. Over 33,000 participants use this MEXC feature, so liquidity levels are usually sufficient.

MEXC keeps the vast majority of client-owned cryptocurrencies in cold storage wallets with multisig security. The platform publishes “Proof of Reserves”, a critical safeguard that ensures actual assets back user balances.

Multiple account security features are also available, including two-factor authentication, address whitelisting, email notifications, and anti-phishing controls. MEXC has never been hacked since its 2018 inception, but users should remember that the platform is unregulated.

MEXC offers an extensive range of crypto trading products and features — many are aimed at experienced crypto traders. Beginners might find its advanced charting tools, technical indicators, and complex derivative contracts intimidating, so those without the necessary experience may consider other options.

➕ What We Like: The best Bitcoin exchange in Japan for automated trading bots with plug-and-play features.

➖ What to Consider: Not the best option for buy-and-hold investors with long-term goals

Exchange Overview

Launched in 2019, Pionex is an established and regulated crypto exchange with over 5 million users. It facilitates over 10 million trades daily and about $60 billion in monthly volume.

Pionex is best known for its automated trading bots — they’re suitable for beginners without prior experience, as most offer plug-and-play solutions. Users can choose from multiple bot strategies, including grid, DCA martingale, rebalancing, and smart trade. Bots can trade bullish, bearish, and even sideways crypto markets automatically.

The platform accepts popular payment methods for seamless deposits, including Visa, MasterCard, and bank wires.

Pionex lists over 400 cryptocurrencies. Markets are categorized by niche, such as DeFi, AI, meme coins, layer-2, and proof-of-work. Users can access spot trading and futures markets, with most pairs priced in USDT. A small selection of crypto-cross pairs is available, such as RUNE/BTC and EOS/BTC. Only USDC Coin can be purchased when using fiat money.

Spot trading commissions are 0.05% per slide for both makers and takers. Futures commissions are 0.02% and 0.05%, respectively. There are no discounts when trading large volumes, unlike other Japanese crypto exchanges. Withdrawing cryptocurrencies from Pionex incurs flat fees — Bitcoin transfers cost 0.000007 BTC.

The platform’s standout feature is its automated crypto bots. Each is unique to the exchange, and no technical skills are required to get involved. Pionex bots are plug-and-play, so users only need to select a suitable strategy and risk tolerance. Bots are best-suited to traders who prefer short-term speculation rather than long-term holding. Pionex provides a free demo platform, which is ideal for testing automated strategies without risking money.

Pionex is a licensed trading platform with a strong security framework. Its audited Proof of Reserves covers user balances by over 100%, so it has sufficient funds to cover all client withdrawals. Two-factor authentication and address whitelists keep accounts safe while AI technology actively scans the ecosystem for potential threats.

Despite offering complex bot strategies and derivative products, Pionex’s target market is beginners. The platform offers a smooth user experience on both web browsers and iOS/Android apps.

4. Margex

Exchange Overview

Launched in 2019, Pionex is an established and regulated crypto exchange with over 5 million users. It facilitates over 10 million trades daily and about $60 billion in monthly volume.

Pionex is best known for its automated trading bots — they’re suitable for beginners without prior experience, as most offer plug-and-play solutions. Users can choose from multiple bot strategies, including grid, DCA martingale, rebalancing, and smart trade. Bots can trade bullish, bearish, and even sideways crypto markets automatically.

The platform accepts popular payment methods for seamless deposits, including Visa, MasterCard, and bank wires.

Pionex lists over 400 cryptocurrencies. Markets are categorized by niche, such as DeFi, AI, meme coins, layer-2, and proof-of-work. Users can access spot trading and futures markets, with most pairs priced in USDT. A small selection of crypto-cross pairs is available, such as RUNE/BTC and EOS/BTC. Only USDC Coin can be purchased when using fiat money.

Spot trading commissions are 0.05% per slide for both makers and takers. Futures commissions are 0.02% and 0.05%, respectively. There are no discounts when trading large volumes, unlike other Japanese crypto exchanges. Withdrawing cryptocurrencies from Pionex incurs flat fees — Bitcoin transfers cost 0.000007 BTC.

The platform’s standout feature is its automated crypto bots. Each is unique to the exchange, and no technical skills are required to get involved. Pionex bots are plug-and-play, so users only need to select a suitable strategy and risk tolerance. Bots are best-suited to traders who prefer short-term speculation rather than long-term holding. Pionex provides a free demo platform, which is ideal for testing automated strategies without risking money.

Pionex is a licensed trading platform with a strong security framework. Its audited Proof of Reserves covers user balances by over 100%, so it has sufficient funds to cover all client withdrawals. Two-factor authentication and address whitelists keep accounts safe while AI technology actively scans the ecosystem for potential threats.

Despite offering complex bot strategies and derivative products, Pionex’s target market is beginners. The platform offers a smooth user experience on both web browsers and iOS/Android apps.

➕ What We Like: Retail clients can trade top cryptocurrencies with 100x leverage.

➖ What to Consider: The platform offers just 46 trading markets.

Exchange Overview

Margex is a safe trading platform that specializes in perpetual futures — these contracts support leverage of up to 100x. The exchange supports long and short positions, making it a great choice for active traders looking to profit from bullish and bearish markets.

The platform offers many features, including advanced charting tools, copy trading, and competitive staking rewards. Users can also access a free demo trading platform with risk-free virtual funds.

Margex supports 46 trading markets — large-cap cryptocurrencies like Bitcoin, Ethereum, BNB, and TRON offer 100x leverage. Other cryptocurrencies come with lower leverage limits of 25x or 50x. This small selection of digital assets is much lower than most Japanese Bitcoin exchanges, so it’s not the best option for diversification.

Margex is a low-fee crypto exchange with flat commissions. Market makers and takers pay 0.019% and 0.06% per slide, respectively, charged on the full leveraged amount. Users pay funding fees every 8 hours, with exact rates depending on order sizes, market exposure, and the ratio of longs and shorts. An effective strategy to avoid funding rates is to close positions before the next 8-hour period.

Margex offers fully-fledged copy trading services, a great option for beginners who want to automate leveraged positions. Users select their preferred trader based on historical performance, risk profile, and average trade duration. Positions match the user’s investment size proportionally, which ensures affordability. Copy trading portfolios can be tracked on a dedicated mobile app for iOS and Android.

Margex has a solid reputation for account security and customer fund protection. The exchange’s security framework has never been breached — this record dates back to Margex’s inception in 2019. 100% of client-owned assets are held in cold storage wallets, with no exposure to remote internet threats.

Margex provides account security tools like two-factor authentication and email notifications. The security team processes withdrawals once per day, which gives users enough time to block unauthorized transactions.

Margex’s user experience is suitable for beginners and experienced pros. Its advanced analysis tools and technical indicators are ideal for skilled traders, while newbies will like the copy trading feature and instant token swaps. Accounts can be opened in seconds — only an email address is needed to get started.

5. Binance

Exchange Overview

Margex is a safe trading platform that specializes in perpetual futures — these contracts support leverage of up to 100x. The exchange supports long and short positions, making it a great choice for active traders looking to profit from bullish and bearish markets.

The platform offers many features, including advanced charting tools, copy trading, and competitive staking rewards. Users can also access a free demo trading platform with risk-free virtual funds.

Margex supports 46 trading markets — large-cap cryptocurrencies like Bitcoin, Ethereum, BNB, and TRON offer 100x leverage. Other cryptocurrencies come with lower leverage limits of 25x or 50x. This small selection of digital assets is much lower than most Japanese Bitcoin exchanges, so it’s not the best option for diversification.

Margex is a low-fee crypto exchange with flat commissions. Market makers and takers pay 0.019% and 0.06% per slide, respectively, charged on the full leveraged amount. Users pay funding fees every 8 hours, with exact rates depending on order sizes, market exposure, and the ratio of longs and shorts. An effective strategy to avoid funding rates is to close positions before the next 8-hour period.

Margex offers fully-fledged copy trading services, a great option for beginners who want to automate leveraged positions. Users select their preferred trader based on historical performance, risk profile, and average trade duration. Positions match the user’s investment size proportionally, which ensures affordability. Copy trading portfolios can be tracked on a dedicated mobile app for iOS and Android.

Margex has a solid reputation for account security and customer fund protection. The exchange’s security framework has never been breached — this record dates back to Margex’s inception in 2019. 100% of client-owned assets are held in cold storage wallets, with no exposure to remote internet threats.

Margex provides account security tools like two-factor authentication and email notifications. The security team processes withdrawals once per day, which gives users enough time to block unauthorized transactions.

Margex’s user experience is suitable for beginners and experienced pros. Its advanced analysis tools and technical indicators are ideal for skilled traders, while newbies will like the copy trading feature and instant token swaps. Accounts can be opened in seconds — only an email address is needed to get started.

➕ What We Like: The largest exchange platform for active traders, volume, and liquidity.

➖ What to Consider: Binance was fined $4 billion in 2023 for money laundering failures.

Exchange Overview

Binance needs no introduction in the global exchange market — the platform serves almost 270 million users and consistently records the most daily trading volume. It’s one of the best crypto exchanges in the Japanese market for bank transfer deposits, with JPY payments often credited the same day without fees.

Binance Japan lists about 50 cryptocurrencies, and only the spot trading markets are available. It offers staking rewards on multiple coins, although APYs are generally higher on other platforms.

The exchange offers unprecedented liquidity levels, so it’s suitable for the industry’s biggest institutions and crypto whales.

While Binance’s global exchange lists over 600 cryptocurrencies, its Japanese wing supports just 50. Established projects with proven use cases are the focus, such as XRP, BNB, and Ethereum. Japanese users are also prohibited from accessing Binance’s derivative products, including crypto options and futures.

Binance users never pay more than 0.1% per slide on spot trading positions. Those holding BNB (Binance’s native coin) receive a 25% fee reduction. Lower commissions are also available when meeting monthly trading milestones.

While premium liquidity and tight spreads are worth mentioning, Binance’s top feature is its fee-free JPY deposits. Most bank account payments are credited within one hour on weekdays, so Japanese users can get started without long payment delays.

Hackers breached the Binance exchange in 2019, stealing $40 million worth of cryptocurrencies. Binance’s native blockchain, BNB Chain, was also breached in 2022 — the hack was worth over $570 million. No Binance users lost money in either security incident, and the exchange has since created the SAFU (Safe Asset Fund for Users).

That said, Binance is regarded as the go-to exchange for millions of traders globally, including institutional players. It’s considered safe by most industry stakeholders, with rising financial interests from the Trump family.

Binance Japan has restricted most features for retail clients, including leverage, short-selling, and dual investments. The platform is primarily aimed at entry-level investors who wish to deposit JPY. As such, the user experience is suitable for most skill sets, unlike the main Binance exchange (which is more advanced-centric).

➕ What We Like: Full-service crypto exchange with Japan Virtual Currency Exchange Association (JVCEA) membership

➖ What to Consider: Users have access to just 44 crypto trading pairs

Exchange Overview

OKJ (formerly OKCoinJapan) is a trusted crypto exchange for Japanese residents. It’s fully regulated and a member of the JVCEA, providing local users with consumer protections and a safe trading environment. The platform, which is owned by OKX, supports fast JPY deposits with recurring buy features and dollar-cost averaging. It was designed for retail clients with limited trading experience, and accessibility extends to web browsers and an iOS/Android app.

One of OKJ’s key drawbacks is its trading marketplace, which supports just 44 crypto pairs. Top markets include Bitcoin, Cardano, Bitcoin Cash, Solana, and Sui. Users can also access selected meme coins like Pepe, Dogecoin, and Shiba Inu. Users can make instant purchases, allowing beginners to avoid traditional exchange orders.

OKJ commissions start from 0.07% and 0.14% per slide for makers and takers. Fees are reduced when trading at least 1 million JPY within a 30-day period. Negotiable commissions are available for corporate clients. Deposit fees are limited to banking charges incurred by OKJ, and withdrawals range from 400 JPY to 1,320 JPY, depending on the amount.

OKJ is the best crypto exchange in Japan for long-term investors. Its recurring buy feature enables users to purchase cryptocurrencies at fixed amounts and intervals — timeframes include daily, weekly, bi-weekly, and monthly. Investment minimums and maximums are 1,000 JPY and 200,000 JPY when using this feature.

As a JVCEA member, OKJ is legally required to follow institutional-grade security practices. It stores 100% of user funds in cold wallets, and safety controls include two-factor authentication and audited financial statements.

OKJ is a beginner-friendly platform that’s suitable for first-time investors. It accepts traditional payment methods for a seamless investment experience. However, the onboarding process can be cumbersome — accounts are only activated after completing the KYC verification steps.

➕ What We Like: Beginner-friendly trading app that allows users to buy crypto from just 1 JPY

➖ What to Consider: Users must trade at least 100,000 JPY for reduced commissions

Exchange Overview

bitFlyer is a global crypto trading platform with licensing in Japan, the US, and Europe. It allows Japanese retail clients to buy cryptocurrencies from just 1 JPY. Users can make bank account deposits and withdrawals, although fees depend on the financial institution. bitFlyer lists spot markets and contracts-for-differences (CFDs), and key features include recurring orders and crypto-backed credit cards.

The platform lists just 38 cryptocurrencies, including Bitcoin, Dogecoin, Pepe, Axie Infinity, and Shiba Inu. Beginners can buy and sell coins via spot markets. CFD products, which are crypto derivatives with 2x leverage, are also available. These leverage limits are significantly lower than those offered by other crypto exchanges.

Users pay commissions between 0.01% and 0.15%, depending on monthly volumes. The highest rate is paid unless you trade over 100,000 JPY monthly. Deposits from some bank account providers are free, while others charge a flat fee of 330 JPY per transaction. Variable margin fees apply when users trade CFD products.

The exchange’s best feature is its ability to support trades from just 1 JPY. This small amount is ideal for first-time buyers who want risk-averse exposure to the crypto market.

bitFlyer’s security systems align with other regulated exchanges located in Japan. It uses cold storage wallets to store 100% of client-owned cryptocurrencies, and 24-hour monitoring systems ensure complete protection. Two-factor authentication and anti-phishing controls are also in place.

Despite its beginner-friendly market, some aspects of bitFlyer result in a poor user experience. Users can only deposit funds and trade after a sluggish KYC process, with ID verification often needing several upload attempts. The browser-based trading dashboard is highly outdated, too, which can be distracting for newbies.

➕ What We Like: Traders can go long or short on cryptocurrencies with an upfront margin of just 0.5%

➖ What to Consider: Just 35 futures markets are listed, which limits users from broader diversification

Exchange Overview

Launched in 2018, PrimeXBT is a derivative platform that offers crypto futures. While just 35 markets are supported, traders can speculate on crypto prices with an upfront margin requirement of just 0.5%. A $100 account balance would provide market exposure of $20,000, with both long and short positions available.

PrimeXBT, which has an excellent reputation and serves over 1 million clients, is also one of the best crypto exchanges in Japan for anonymity. It allows traders to withdraw up to $20,000 in cryptocurrencies daily without providing personal information or ID documents. Instant fiat payments, such as Visa and MasterCard, are also anonymous, but the limits are smaller at $2,000.

PrimeXBT offers 35 crypto futures markets, a much lower range than most derivative platforms. It focuses on the most liquid crypto assets, including Bitcoin, XRP, Solana, and Dogecoin, due to its high leverage framework. PrimeXBT also enables users to purchase four cryptocurrencies with bank cards, namely Bitcoin, Ethereum, Tether, and USD Coin.

Users can also access non-crypto markets via CFDs. This includes forex pairs like GBP/USD and EUR/USD, commodities, indices, and individual stocks from the top US exchanges.

PrimeXBT charges market makers 0.01% on crypto futures positions. Market takers pay between 0.02% and 0.045%, depending on monthly trading volumes. Leverage and funding rates are based on several factors, including the position direction and broader market conditions.

Investors who buy cryptocurrencies instantly with Visa or MasterCard pay variable fees, which are built into the quoted exchange rate. For instance, a 40,000 JPY buy order on Bitcoin converts to 0.00299322 BTC.

PrimeXBT’s best feature is its low margin requirements, which enable traders to access significantly more capital than is available in the exchange account. Just 0.5% of the total position size needs to be paid upfront, converting to 200x the trader’s stake. Margin traders have access to many tools, such as high-level pricing charts, customizable trading screens, technical indicators, and advanced orders.

PrimeXBT is licensed by four regulatory bodies, which include the FSA (Seychelles), FSCA (South Africa), FSC (Mauritius), and BCR (El Salvador).

Although these regulatory bodies provide little protection for Japanese clients, PrimeXBT offers robust security systems to ensure a safe trading experience. It leverages cold storage wallets with multisig technology and distributes data centres in multiple global locations. Users can create whitelisted withdrawal addresses, and account access is protected by two-factor authentication.

PrimeXBT offers a consumer-friendly user experience on desktop browsers and mobile devices. The mobile app for iOS and Android is fully optimized, which enables users to buy and sell crypto futures effortlessly. Users can navigate charts and other analytical tools seamlessly, although these features are best suited for intermediate-to-advanced traders. Complete beginners can use PrimeXBT to purchase cryptocurrencies with bank cards — no prior experience is needed.

Opening an account with PrimeXBT is also fast and hassle-free, as no KYC documents are required if daily withdrawals don’t exceed $20,000.

➕ What We Like: Access millions of Ethereum-based cryptocurrencies in a decentralized and secure environment

➖ What to Consider: Traders must cover Ethereum network fees, which can be high during bullish cycles

Exchange Overview

Uniswap is one of the best decentralized crypto exchanges for Japanese traders. It operates on the Ethereum network and supports millions of ERC20 tokens, including brand-new launches with small-cap valuations. This market diversity makes Uniswap a great option for discovering the next crypto to explode.

Uniswap uses decentralized liquidity pools rather than traditional order books, so it executes trades without market participants. Users must connect a non-custodial wallet to the Uniswap platform to swap tokens, so there’s no account opening or KYC processes involved.

Uniswap, as a decentralized exchange, doesn’t list cryptocurrencies like traditional platforms. Any Ethereum-based project can launch on Uniswap by adding some liquidity, so by extension, the exchange supports millions of ERC20 tokens. Some of the most successful ERC20 tokens, including Shiba Inu and Pepe, started their journeys on Uniswap, so it’s popular with Japanese investors hunting the next big project.

Uniswap also supports cryptocurrencies from layer-2 ecosystems like Base, Polygon, and Arbitrum. The exchange supports cross-chain swaps, but additional fees are charged.

Uniswap charges a 0.25% commission on all token swaps, which is higher than traditional exchanges in Japan. Traders must also cover Ethereum network fees, known as “gas”. These fees are quoted directly by Ethereum, so Uniswap doesn’t add a markup.

Uniswap offers a completely different way to buy and sell cryptocurrencies in Japan. Its decentralized framework removes market participants, order books, and centralized intermediaries. Traders buy and sell tokens via liquidity pools, and prices are determined by the automated market maker model. Uniswap never holds client cryptocurrencies, even when swaps are conducted — smart contracts transfer tokens for a secure and non-custodial experience.

Uniswap doesn’t rely on centralized servers like traditional exchanges, so users can eliminate counterparty risks. The exchange’s entire ecosystem functions on smart contracts, which remove intermediaries when swapping cryptocurrencies. Smart contracts aren’t 100% immune to security breaches, but wallets only connect to Uniswap briefly — they’re disconnected once the token swap is complete.

Users should remember that anyone can add cryptocurrencies to Uniswap, including scammers. You should always paste the token’s contract address manually rather than searching by the project name. Scammers have been known to add imitation tokens to trick unsuspecting investors.

Uniswap has designed its decentralized exchange with retail clients in mind, so the desktop and mobile interface is clean and minimalistic. There are no pricing charts or technical indicators like on centralized exchanges, as the core function is trading one token for another. To place a trade, users enter the required cryptocurrencies and amount, then confirm. Uniswap smart contracts then transfer the purchased tokens to the connected wallet. A basic understanding of wallet best practices is a must to ensure costly mistakes are avoided.

➕ What We Like: Established non-custodial exchange that sources the best market rates from 20+ platforms

➖ What to Consider: Token swaps can take up to 40 minutes to arrive in the user’s wallet

Exchange Overview

Changelly is a non-custodial crypto exchange that launched in 2015. It operates differently from both centralized and decentralized exchanges, as users don’t interact with order books or smart contracts directly. Instead, users create a swap order form by entering the cryptocurrencies they want to exchange — which includes cross-chain trades like Bitcoin for Ethereum. Changelly sources the best market price from 20+ partnered liquidity providers, and users transfer their cryptocurrencies to the provided wallet address. Users also need to enter their own wallet address so Changelly can complete the transfer.

Changelly supports over 1,000 cryptocurrencies from multiple network standards. Popular markets include Bitcoin, XRP, Litecoin, Ethereum, and TRON. Users can also buy cryptocurrencies instantly with the Japanese Yen — accepted payment methods include Visa, MasterCard, Google Pay, and bank transfers. Fiat payments are processed by third parties, so fees and KYC requirements vary.

Changelly offers an all-in-one exchange rate, which includes its 0.25% commission. While it selects the most competitive liquidity provider available, better rates could be available elsewhere, so users are advised to verify prices before proceeding. Changelly users must also cover network fees, as swaps are facilitated by wallet transfers.

Users like Changelly for its cross-network swaps without needing to directly engage with smart contracts and bridging tools. Bitcoin can be traded for Ethereum in minutes, even though both cryptocurrencies have a unique network standard.

Chalgelly offers two-factor authentication via code-generating apps like Google Authenticator. Users can also reduce counterparty risks when they use Changelly, as the exchange doesn’t directly hold client funds. It passes orders to partnered liquidity providers, who directly transfer cryptocurrencies to the user’s wallet address.

Changelly is a user-friendly exchange with an easy-to-navigate layout, although being comfortable with wallet basics is crucial. This step is also required when buying cryptocurrencies with fiat money, as the user’s wallet address must be provided at the point of purchase.

Japanese cryptocurrency exchanges are online platforms that facilitate digital asset trading. Traders can buy and sell popular cryptocurrencies like Bitcoin, Dogecoin, XRP, and Litecoin — exchanges make money from trading commissions, similar to traditional stock brokers.

Most exchanges require users to open an account before they can trade. Some support fiat payments, which means you can purchase cryptocurrencies in JPY with local bank transfers, credit cards, and even e-wallets like PayPal. Other exchange types only support crypto-to-crypto swaps, so users must already own digital assets to trade.

Crypto exchanges are aimed at a wide range of Japanese clients. Some are ideal for beginners who simply wish to invest in digital assets via a long-term strategy. There are also exchanges for day traders who actively buy and sell cryptocurrencies for short-term gains.

Exchanges can also specialize in derivative products like crypto futures and options. These complex financial instruments offer high leverage and short-selling capabilities, so they’re aimed at more experienced traders.

Crypto investors have several different exchange types to choose from. The best option depends on the objective, such as preferred markets, account minimums, and KYC requirements. Let’s explore the most common crypto exchanges available in 2025.

Note: The best crypto exchanges in Japan cover multiple platform types and product offerings.

Centralized exchanges (CEXs) are the most common option when trading cryptocurrencies online. These platforms are run by companies like Binance and OKJ, with user experiences reflecting traditional brokerages.

Major CEXs require users to register an account, provide personal information, and upload some KYC documents, such as a government-issued ID. Verified users can then deposit funds in JPY or purchase cryptocurrencies instantly with credit cards and other convenient methods.

CEXs, which rely on the order book system, typically have in-built trading tools like real-time charts, indicators, and custom order types. They sometimes offer staking, crypto loans, and research materials, too.

Most CEXs offer spot trading markets, so users buy and sell cryptocurrencies “on the spot” — this is unlike derivatives, which simply track market prices.

Despite their popularity with Japanese retail clients, CEXs also have drawbacks. They rely on centralized servers, which expose client-owned funds to external hacks and fraud. Internal malpractice is also a major risk — as seen with the FTX collapse in 2022, where billions of dollars in customer cryptocurrencies were “misplaced”.

Decentralized exchanges (DEXs) offer an alternative way to trade cryptocurrencies. There are no centralized servers or custodians, which allows users to buy and sell crypto assets with limited counterparty risk.

Most DEXs use the automated market maker (AMM) mechanism. This replaces traditional order books with decentralized liquidity pools, which investors fund to earn passive yields. One example is the ETH/WBTC pool, which contains equal amounts of Ethereum and Wrapped Bitcoin. Someone holding ETH can instantly swap their coins for WBTC (and vice versa) without needing another market participant. That ETH is deposited into the liquidity pool while WBTC is transferred to the user’s wallet.

The DEX and AMM systems rely on smart contracts, which execute transactions automatically. This decentralized framework ensures that DEXs never hold client-owned funds, unlike CEXs.

DEXs are also ideal for finding the next 1000x cryptocurrencies, as they’re often used by brand-new projects that haven’t secured CEX listings. Uniswap, for instance, offers access to millions of tokens from Ethereum, Base, Polygon, and other EVM-compatible networks. Those interested in new Solana tokens can use Raydium, Jupiter, or Orca.

Investors with a higher risk appetite might like Japanese crypto exchanges that specialize in derivative products.

The most common crypto derivative is perpetual futures or “perps”, which track market prices rather than settling trades on the spot. Perps come without settlement dates, unlike delivery futures, so positions remain open until they’re closed by the trader. The key benefit of perps is that they invite leverage. MEXC offers 400x leverage on major cryptocurrencies, which amplifies market exposure from 20,000 JPY to 8 million JPY. This makes derivative exchanges attractive to high-risk, high-return crypto traders.

Another benefit of derivatives, which also includes options contracts, is that they facilitate long and short trading. Users speculate on rising and falling crypto prices, making them suitable for all market cycles.

A drawback to consider is that derivatives come with liquidation risk — losing positions can be closed automatically by the exchange. This outcome means the upfront margin paid to enter the trade is kept by the platform. Long-term investors and those with a lower risk tolerance are better suited for traditional spot trading markets.

Experts suggest that exchange aggregators are a great option for traders who prioritize decentralization, non-custodianship, and market-leading prices. Offered by non-custodial wallets like Best Wallet, these tools extract prices from external liquidity pools — giving users access to hundreds of DEXs in one safe and convenient place.

Aggregators compare all available prices based on the user’s required cryptocurrencies and amount, which results in the most competitive exchange rates. Smart contracts execute swaps almost instantly once the user confirms the trade, with the tokens deposited into their wallet balance. The key benefit is that users never lose control of their private keys, eliminating custodian risks.

Swap routers sit somewhere between CEXs and DEXs. They offer user-friendly dashboards like centralized platforms while allowing users to trade cryptocurrencies without accounts or KYC documents.

Changelly is one example of a swap router — it compares prices from 20+ partnered liquidity providers based on the trade requirements, such as the cryptocurrencies being swapped and the order amount. The next step involves transferring cryptocurrencies to the provided public address, and after a certain number of blockchain confirmations, the liquidity provider sends the purchased tokens to the client’s wallet.

Peer-to-peer (P2P ) exchanges connect buyers and sellers directly, but unlike DEXs, trades are completed off-chain. Buyers start by entering their purchase requirements, including the digital asset, payment method, and amount.

A list of suitable sellers is then shown, sorted by the exchange rate offered. Once the buyer accepts an offer, sellers transfer the exact crypto amount into the P2P platform’s escrow wallet. The buyer makes payment and, once verified by the seller, receives the purchased tokens.

P2P exchanges attract limited users, translating to weak liquidity and unfavorable prices. Crypto scammers also exploit P2P platforms to launder stolen cryptocurrencies, so users should avoid them.

These factors should be considered when choosing the best crypto exchange in Japan.

Not all crypto exchanges are safe, so users should evaluate the security and regulatory framework before opening an account. Licensed exchanges offer a safe place to trade cryptocurrencies, especially when regulated by Japanese authorities. Account safeguards like two-factor authentication, withdrawal whitelisting, and biometrics prevent unauthorized access. It’s best to use exchanges that have verified Proof of Reserves, which ensures platforms have sufficient reserves to cover client withdrawals.

Millions of digital assets exist, although CEXs often only support selected cryptocurrencies, as listing applications must be manually vetted and approved. MEXC supports over 4,000 tokens, but only 50 are available on Binance, highlighting the disparity in asset diversification. DEXs and exchange aggregators often support all cryptocurrencies on specific networks like Ethereum, Solana, and BNB Chain, giving users access to a much wider range of markets.

Long-term investors use spot trading exchanges, which enable them to buy and own cryptocurrencies outright. Crypto assets can then be withdrawn from the exchange to a private wallet for safe storage. Traders using short-term strategies like short-selling or scalping prefer derivative products — futures, options, and CFDs allow market speculation and leverage without direct ownership.

Exchanges earn money through commissions, which buyers and sellers pay when trading cryptocurrencies. MEXC is one of the cheapest exchanges — commissions start from 0% and are capped at 0.05%. At most, a 10,000 JPY trade incurs a 5 JPY fee. Other fees to explore include deposits, withdrawals, spreads, and funding rates.

The best Bitcoin exchanges in Japan provide users with tools and features for better decision-making. Insights like top-performing and most traded cryptocurrencies, and market sentiment indexes like Fear and Greed and Altcoin Season are ideal for making smart investments.

Passive or inexperienced investors will like copy trading tools, while active traders need customizable charts, technical indicators, and advanced order types.

Japanese retail clients typically buy cryptocurrencies with convenient payments like credit cards and local bank transfers, so ensure the platform accepts JPY to avoid foreign exchange fees. Decentralized platforms don’t handle client funds, so swaps are executed via wallet transfers — this requires users to hold some digital assets before trading.

Online exchanges often have a global audience, so customer service should be offered 24/7 via live chat. Avoid exchanges that offer assistance solely through support tickets or email, as replies can take several days.

Top exchanges have clean and intuitive interfaces, which result in a user-friendly experience, especially for beginners. Account opening and payment timeframes should be fast, and setting up and placing orders should be seamless. User experiences can differ on different device types, such as desktop browsers or mobile apps.

Japanese crypto exchanges charge fees on various account functions, including trades, leverage funding, and payments. These are the fees that investors should look for when choosing a platform.

Exchange users pay commissions when spot trading digital assets — this is often charged “per slide”, so fees are paid when buying and selling. Most exchanges charge commissions as a percentage of the total order size. Pionex, for instance, charges 0.05%, so a 100,000 JPY buy order costs just 50 JPY. A 0.05% commission also applies when closing that position, based on the total amount being cashed out.

Platforms sometimes offer lower commissions for market makers, as limit orders provide exchanges with liquidity. Meeting monthly trading minimums can also result in competitive fees, as can holding the exchange’s native token. Binance users, for instance, receive a 25% discount when paying fees in BNB.

Commissions on derivative products like perpetual futures are often lower than spot trading, at least in percentage terms. However, the commission is charged on the total leveraged value, not the upfront margin.

MEXC charges market makers 0.04% on perps, so a position leveraged to 10 million JPY would mean a 4,000 JPY commission. An additional commission is charged when closing the derivative trade.

Derivatives also attract funding rates — these are usually charged every 8 hours and specific fees depend on the trade direction (e.g., long or short) and market exposure. This additional fee should be a reminder that derivative trading is only suitable for short-term strategies.

Spreads are considered a hidden fee in trading — even the best crypto exchanges in Japan typically don’t display them. The spread is the difference between the buy (ask) and sell (bid) prices for a specific trading market.

Here’s a simplified example of how the spread works when using crypto exchanges:

In this example, the spread is 12.5% — the position value would need to rise by that amount just to break even.

Crypto traders in Japan often face payment fees when using online exchanges. JPY payment fees depend on the funding method and platform. Some offer free domestic bank account transfers, while credit card payments could exceed 3-5%.

Digital asset deposits, transferred from the user’s wallet, are often credited without fees. Withdrawals often incur a flat fee that typically exceeds the real-time network charge, so these variables should be assessed when choosing a Japan crypto exchange.

To operate legally, crypto exchanges in Japan must be regulated by the Financial Services Agency (FSA), the financial watchdog overseeing the domestic banking and securities markets. Local exchanges must also register with the Japan Virtual Currency Exchange Association (JVCEA), a self-regulated body created to enhance consumer protections and safeguards.

However, many Japanese traders use offshore exchanges, as most offer accounts without KYC requirements — so nationalities aren’t collected. These platforms generally offer a wider range of markets, competitive fees, and deeper liquidity, making them an attractive alternative to domestic exchanges.

Here are the general requirements when using Japanese crypto exchanges — guidelines are provided for both CEXs and DEXs.

Selecting the best crypto exchanges in Japan requires due diligence and research — key factors include safety and licensing, KYC requirements, available markets, and trading fees.

All metrics considered, Best Wallet is a top choice in 2025. Best Wallet is a non-custodial exchange and wallet app that aggregates prices from hundreds of liquidity pools. Users receive the most competitive fees without giving up control of private keys, ensuring complete control and ownership of their digital assets.

Yes, crypto trading is legal in Japan. Crypto exchanges located in the country must be regulated by the Financial Services Agency (FSA).

The Japanese crypto exchange list approved by the FSA includes Binance, OKJ, GMO Japan, and BitFlyer. Some traders use offshore exchanges to access a wider range of markets and lower fees.

Best Wallet is a good option for Japanese users who want to trade and store cryptocurrencies via a non-custodial wallet. OKJ is suitable for traders who seek a traditional interface and don’t mind KYC verification.

Yes, Binance has a dedicated exchange for Japanese users with full FSA approval. It offers fewer markets and services than Binance’s global platform.

MEXC is the cheapest place to trade cryptocurrencies in Japan. Makers and takers pay commissions of 0% and 0.05% respectively.

Cryptocurrencies can be sold for JPY on Binance Japan, OKJ, and bitFlyer. The process can then be withdrawn to a Japanese bank account.

Yes, there are anonymous crypto exchanges available to Japanese traders, but they’re located offshore. These platforms generally have millions of active traders from around the world.

Yes, some Japanese crypto exchanges offer leverage, but it’s capped at 2x due to regulatory restrictions. Offshore exchanges often offer leverage 400x or more.

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

Monthly readers

Expert contributors

Crypto Projects Reviewed

Jose Rafael Aquino is a Filipino writer and entrepreneur that specializes in finance, technology, cryptocurrency, and sports. Versed in the startup tech space, he has written for websites such as The GUIDON, TradingPlatforms, StockApps, and BuyShares. Read More

Maximize Your Trading With Margex’s 20% Deposit Bonus

Hottest Meme Coins to Buy in April? Retail Target Latest Crypto For Mega Gains

AR.IO Brings The Permanent Cloud to AI Storage Crisis

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

4 Days Left For Early Investors in World’s First Meme Coin Index: Meme Coin Mcap Hits $56Bn

Best Crypto Exchanges in Hong Kong for 2025

Best Fiat-to-Crypto Exchanges 2025

Best Crypto Exchanges in Japan for 2025

Best Canadian Crypto Exchange in April 2025

CoinEx Review 2025: Earn More from 1,400+ Altcoins

7 Best No-Fee Crypto Exchanges in April 2025

Let’s get social

© 2025 99bitcoins LTD, All rights reserved

Stay ahead with the latest updates, exclusive offers, and expert insights! Sign up for our newsletter today and never miss a beat.