By Tyler Grant

Binance and Bybit are crypto exchanges that offer trading features such as instant buy/sell crypto, leverage trading, and staking services.

Binance is the best exchange for high-volume traders, boasting the highest global trading volume at around $50 billion daily and supporting over 400 cryptocurrencies with a maximum leverage of 125x. Bybit is best for derivatives traders, mainly focusing on crypto derivatives with a maximum leverage of 100x, supporting over 1,600 cryptocurrencies, and offering advanced trading tools best for futures and options markets.

The key features of Binance are spot trading, futures trading, options trading, staking, NFTs, margin trading, and the SAFU fund. The key features of Bybit are spot trading, an advanced derivatives market, trading bots, staking services, and no-KYC withdrawal.

In this Binance vs. Bybit comparison, we will compare both crypto exchanges based on their best features, trading fee structures, security and regulatory levels, and customer support quality. At last, we will also decide which exchange you should use.

Binance is best for high-volume traders, while Bybit mainly focuses on crypto derivatives trading. Binance provides a higher maximum leverage of 125x compared to Bybit’s 100x, whereas Bybit currently offers trading for over 1600 coins compared to Binance’s 400 only.

Binance enforces mandatory KYC for all users and increases security with its SAFU insurance fund, which is worth over $1 billion. On the other hand, Bybit offers more flexibility with optional KYC for withdrawals.

The best features of Binance are high trading volume, fiat deposit and withdrawal support (40+ currencies), advanced trading tools (125x leverage futures), a built-in NFT marketplace, staking and earning options, a P2P trading platform, and robust security measures (SAFU fund).

The best features of Bybit are derivatives trading, vast coin variety (1600+ coins), no-KYC crypto withdrawals (up to 20,000 USDT daily), copy trading with 800,000+ master traders, fast execution speeds, user-friendly interface, and advanced order types.

The fee structures of Bybit and Binance are that both charge 0.1% for maker and taker spot fees, with tiered discounts available based on your trading volume. Both exchanges have variable futures fees, zero deposit fees, and variable withdrawal fees.

Let’s compare in detail:

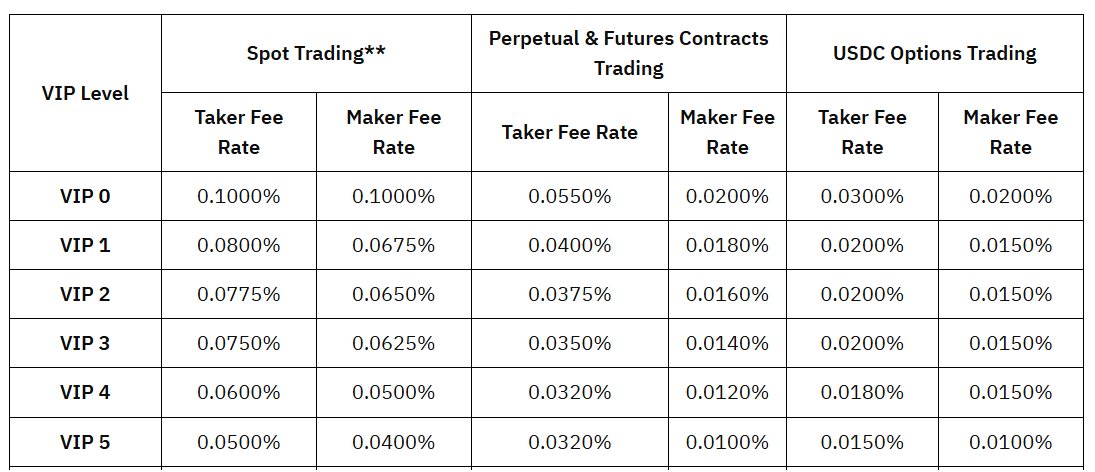

Bybit’s futures trading fees will depend on whether you’re a maker or a taker. The exchange sets a maker fee of 0.02% and a taker fee of 0.055% for regular new users trading both perpetual and futures contracts.

A maker means it will add liquidity by placing a limit order that doesn’t fill immediately, while a taker generally removes liquidity by filling an existing order. Bybit’s fees also drop as your trading volume increases – like VIP 5 users, who pay only around 0.01% maker fees and 0.032% taker fees if they trade over $250 million in the last 30 days.

The platform also includes a funding fee for your perpetual contract trades, which you pay or receive every 8 hours to keep the prices close to the spot market.

Here are the full Bybit trading fees:

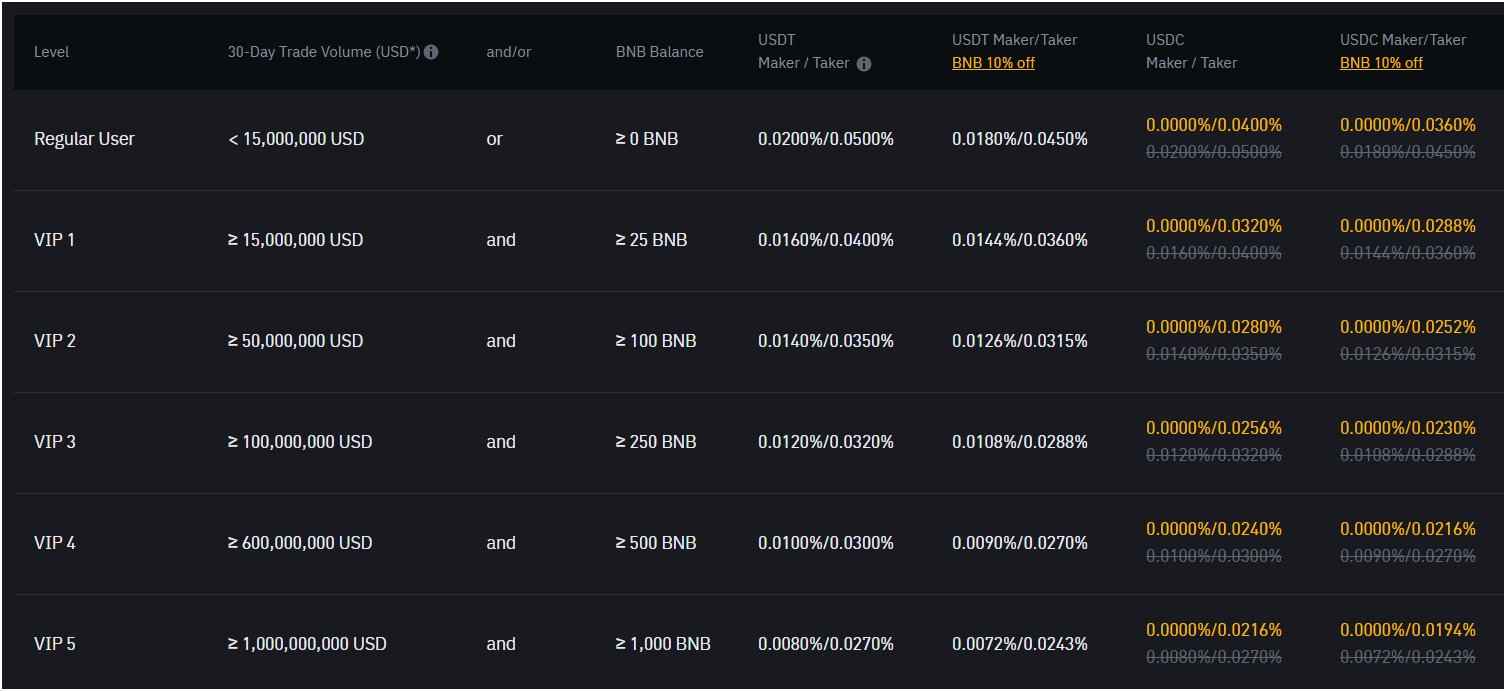

Binance has lower futures trading taker fees compared to Bybit. The exchange will charge you a maker fee of 0.02% and a taker fee of 0.05% for new users on both your USDT-M and Coin-M futures contracts. Similar to Bybit, Binance also offers fee discounts based on trading volume.

You can also pay Binance trading fees with its native token, BNB, and easily get a 10% discount, which will reduce the maker fee to 0.018% and the taker fee to 0.045%.

Bybit maintains deposit charges that are minimal and appealing to users. The exchange does not incur any charges for cryptocurrency deposits such as BTC, ETH, or USDT. You can transfer crypto to your Bybit wallet without additional charges from the platform, although blockchain network charges (such as gas fees for Ethereum) still exist and are based on the coin and network traffic.

Bybit also accepts fiat deposits via third-party suppliers such as Banxa or MoonPay, though with fees charged by the providers – usually 1% to 3% – and not Bybit.

Binance also uses the same approach for crypto deposits. It does not charge any fees for depositing cryptocurrencies like BTC, ETH, or USDT, though network fees do apply depending on the blockchain.

Binance is unique in that it provides free bank deposits for fiat currencies like USD, EUR, and AUD in most scenarios. But, there are certain fiat methods – such as credit card deposits – that can charge up to 1.8% or higher in fees based on the payment provider and location.

Bybit applies dynamic withdrawal fees for your cryptocurrencies, meaning that they may change over time based on network conditions. The exchange doesn’t set a fixed fee by itself but passes on the network cost to users. F

For example, your BTC withdrawal on the Bitcoin network will cost you around 0.0002 BTC, and the same ETH could be around 0.0015 ETH. And, Bybit also doesn’t add extra platform fees on top of this. Fiat withdrawals aren’t directly supported on Bybit, as you’d need to convert your fiat to crypto first or use a third-party service, which will, of course, add costs.

Binance also ties its withdrawal fees to network costs, but we noticed that it tends to offer lower rates. The exchange charges 0.0001 BTC for Bitcoin withdrawals and 0.001 ETH for Ethereum. These are much cheaper than Bybit’s rates.

Also, Binance adjusts these fees regularly to match blockchain conditions, and similar to Bybit, it doesn’t add extra platform fees. It also supports bank transfers with withdrawal fees as low as $0 for some currencies (like AUD), or you need to pay up to $15 for others (like USD), but it also depends on the method and region.

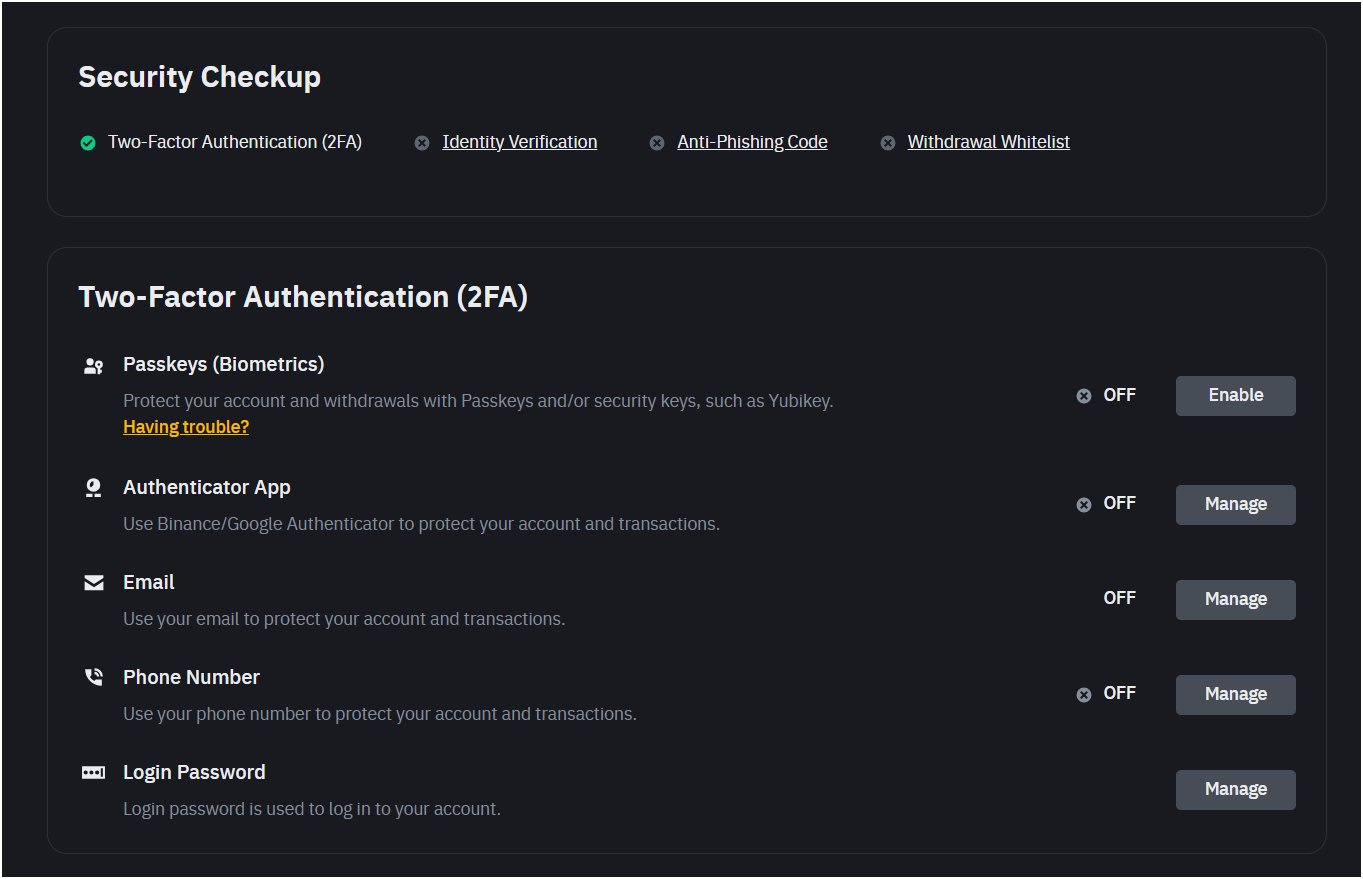

Binance and Bybit are highly secure exchanges with measures such as anti-phishing code, withdrawal address whitelisting, PoR data, 2FA, and cold storage.

Binance SAFU Fund

Binance launched its Secure Asset Fund for Users (SAFU) in July 2018. The exchange generally sets aside 10% of trading fees, and now, this fund has grown to $1 billion.

Bybit $1.4B Hack

Recently, Bybit experienced a massive $1.4 billion hack on February 21, 2025. The hackers, identified as a North Korean group, stole over 400,000 ETH from a multi-sig cold wallet by manipulating user interaction code. Bybit took out $1.12 billion in bridge loans to cover 80% of the loss funds, but it doesn’t have a fund such as SAFU, so you’re less covered.

Regulatory Levels in Different Countries

Binance secures licenses in 22 jurisdictions globally. The exchange currently operates legally in countries like France, Dubai, Lithuania, Australia, and Ukraine.

Bybit also holds some regulatory approvals, but very few. The exchange is registered as a Virtual Asset Service Provider in Dubai and is also registered with FIU in India. France removed Bybit from its blacklist in February 2025 after talks with the AMF, hinting at a future MiCA license in the EU, but we can say it still lags way behind Binance.

Binance provides you with some solid customer support. It comprises 24/7 live chat, email assistance, and a comprehensive help center with tutorials for you to assist in any difficult situations. You can also contact them either using the Binance website or app, and they generally respond within hours; of course, some complicated situations may take longer.

Bybit also offers you the same 24/7 support arrangement. It has live chat, email, and a help center, along with active social media accounts such as Twitter and Telegram.

Binance gets mixed feedback from you on platforms like Reddit and Quora. A Reddit user said, “I’ve no problems with Binance. Mainly, the other exchanges are not great.”

Another user quoted, “My withdrawals have been disabled for over 30 days, and despite multiple attempts to contact support, I keep getting generic responses with no real solution.”

Bybit receives varied reviews, too. A Quora user said, “Avoid Bybit P2P at all cost! Their support is zero! They don’t care about their customers.”

Note: Both Binance and Bybit are good at customer assistance, with some positive and negative user reviews.

Binance is best suited for users:

Bybit is best suited for users:

Binance Pros

The pros of Binance are a wide range of supported cryptocurrencies, low trading fees, high volume and liquidity, advanced trading features, and strong security.

Binance Cons

The Cons of Binance are regulatory issues in the United States, and mandatory KYC measures may be restrictive for privacy-focused users.

Bybit Pros

The pros of Bybit are high-leverage derivative trading, simple interface, no-KYC crypto withdrawals, fast order matching engine, and copy trading.

Bybit Cons

The cons of Bybit are hacking issues, with a recent $1.4B hack and high crypto withdrawal fees.

Tags

Tyler Grant

Editor-in-Chief

Tyler Grant is the Editor-in-Chief of CryptoNinjas.net, bringing years of expertise in cryptocurrency trading, blockchain technology, and financial analysis. A former investment strategist, Tyler transitioned to the crypto world early, quickly establishing himself as a trusted voice in the industry. His sharp insights and in-depth reviews have helped countless readers navigate the complex world of digital assets. Specializing in crypto exchanges, Tyler has extensively analyzed and reviewed platforms like Binance, BingX, and Bybit, offering detailed evaluations based on fees, security, and user experience. His comprehensive rankings of crypto exchanges have become a trusted resource for traders seeking unbiased, actionable advice. With a passion for innovation and education, he leads CryptoNinjas.net as a reliable source for crypto news and resources.

The latest news, articles, and resources, sent to your inbox weekly.

CryptoNinjas is a global news and research portal that supplies market and industry information on the cryptocurrency space, bitcoin, blockchains. CryptoNinjas aims to expand knowledge and understanding of the cryptocurrency and blockchain space.

The latest news, articles, and resources, sent to your inbox weekly.

Binance vs. Bybit Comparison (2025): Fees, Features, and Security – CryptoNinjas